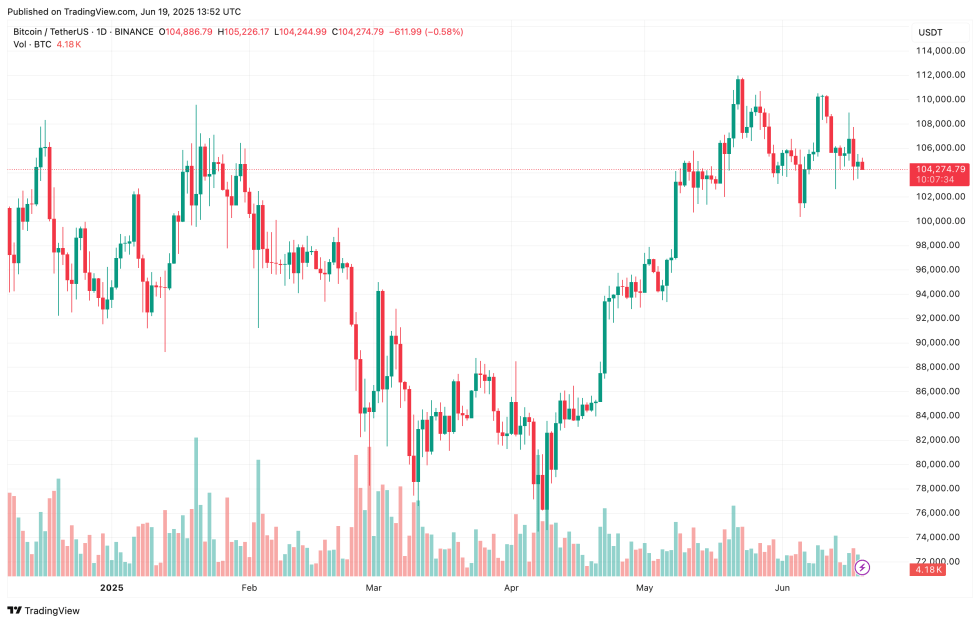

Yesterday, the US Federal Reserve (Fed) held rates of interest regular for the fourth consecutive time, dampening hopes for a big rally in risk-on belongings like Bitcoin (BTC). Nonetheless, on-chain indicators recommend that BTC is experiencing robust demand – doubtlessly laying the groundwork for its subsequent transfer upward.

Bitcoin Sees Robust Demand Regardless of Regular Curiosity Charges

Based on a latest CryptoQuant Quicktake put up by contributor Amr Taha, Bitcoin has established a strong demand zone within the mid-$100,000 vary. The analyst suggests this might sign BTC’s readiness for an additional upward rally.

The next chart – titled Binance BTC Value and Open Curiosity Change – illustrates how this value space has repeatedly absorbed robust promoting strain, leading to BTC forming constant equal lows simply above $104,000.

In distinction, open curiosity on Binance has shaped a sequence of decrease lows, indicating progressive deleveraging within the derivatives market. Deleveraging usually reduces extra threat and might help construct a extra steady basis for sustainable value development.

Moreover, the $104,000 degree has acted as a “liquidation magnet” for late lengthy positions. The next BTC: Binance Liquidation Delta chart exhibits a pointy focus of liquidations round this value degree.

Inexperienced delta spikes within the chart symbolize the compelled closure of lengthy positions, suggesting a cleanup of merchants who joined the rally late. Minimal brief liquidations verify that the market was dominated by lengthy squeezes.

To elucidate, a protracted squeeze happens when the worth of an asset drops sharply, forcing merchants holding lengthy positions to promote or get liquidated. This promoting strain pushes the worth down even additional, typically accelerating the decline.

Curiously, the timing of this market cleanup coincides with the Fed’s resolution to pause rate of interest hikes. Such a growth has usually labored out as a internet constructive for risk-on belongings like BTC. Taha concluded:

Traditionally, BTC has proven bullish tendencies following fee stabilization, particularly when paired with indicators of liquidation exhaustion and fading open curiosity.

BTC Uptrend To Resume Quickly?

A number of on-chain indicators recommend the present BTC pullback could also be nearing its finish. For instance, latest evaluation by crypto analyst CryptoGoos factors to short-term BTC sellers working out of momentum.

Furthermore, indicators of retail euphoria stay absent, hinting that the market should be in an early or mid-stage rally. The Puell A number of additionally suggests that BTC has additional room to develop.

That mentioned, some cautionary indicators stay. Notably, BTC buying and selling volumes throughout main world exchanges have dropped to multi-year lows, elevating issues that bullish momentum could also be weakening. At press time, BTC trades at $104,274, up 0.3% previously 24 hours.

Featured Picture from Unsplash.com, charts from CryptoQuant and TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our staff of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.