Key Takeaways

- Bitcoin onchain exercise has dropped to its lowest level since October 2023.

- Giant transactions now dominate onchain quantity, with whales accounting for 89%.

- Off-chain buying and selling, particularly in futures, has surged and dwarfs onchain quantity by as much as 16 occasions.

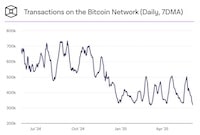

Bitcoin’s onchain transaction exercise has fallen to its lowest ranges since October 2023, with day by day transactions lately starting from 320,000 to 500,000—down from a peak of 734,000 per day in 2024.

Analysts at Glassnode attribute a lot of the decline to a drop in non-monetary actions like Inscriptions and Runes, which beforehand inflated utilization metrics.

Transaction tendencies

Regardless of the slowdown in total onchain transactions, the typical transaction measurement has elevated considerably.

Glassnode studies a mean quantity per transaction of $36,200, with transactions over $100,000 now accounting for 89% of complete quantity, in comparison with 66% in late 2022.

Every day settlement on the Bitcoin blockchain is averaging $7.5 billion, with a peak of $16 billion seen through the preliminary $100,000 value break in November.

Charge stress

Charge stress has additionally eased.

Miner income from transaction charges has fallen to about $500,000 per day, with common charges at their lowest in 18 months.

This contrasts with prior bull markets, the place elevated costs led to community congestion and charge spikes. For additional particulars, the bitcoin miner income chart offers extra context.

Off-chain volumes surge

In the meantime, off-chain exercise is booming. Centralized exchanges, particularly in futures markets, now deal with many of the buying and selling quantity. Bitcoin futures averaged $57 billion day by day over the previous yr, peaking at $122 billion, whereas spot buying and selling peaked at $23 billion. Mixed, off-chain quantity now exceeds onchain exercise by 7 to 16 occasions.

The launch of U.S. spot Bitcoin ETFs in January 2024 has furthered this transition, contributing to a derivatives-led market construction.

“This transition can considerably affect how we interpret community metrics, as conventional indicators could not seize the complete scope of market exercise,” Glassnode analysts famous.