Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

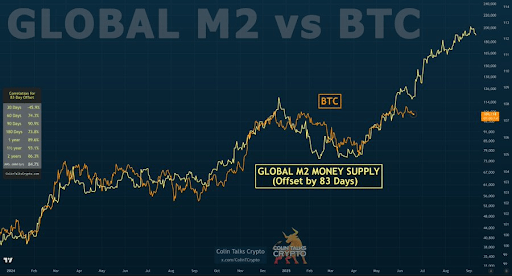

Crypto analyst Colin has highlighted the Bitcoin worth’s deviation from the International M2 cash provide, elevating issues that the bull run could also be over. The analyst rapidly addressed issues, noting how such deviations often occur in some unspecified time in the future however don’t invalidate the macro pattern.

Analyst Highlights Bitcoin Value’s Deviation From International M2 Cash Provide

In an X put up, Colin revealed that the Bitcoin worth has deviated from the worldwide M2 cash provide. He famous that this deviation was short-term in an in any other case broad correlation. The analyst added that this present deviation is just like the place that BTC was in February 2025.

Associated Studying

Colin remarked that this improvement doesn’t imply the M2 is damaged, simply because it wasn’t damaged again in February. As an alternative, he claimed that it simply implies that market individuals haven’t zoomed out sufficient and are permitting for the non-correlated durations. The analyst added that non-correlation between the Bitcoin worth and international M2 cash provide occurs 20% of the time.

He then alluded to the common chart, which exhibits the sturdy correlation between the Bitcoin worth and the worldwide M2 cash provide. Colin defined that the M2 is “directionally predictive” for BTC and that it’s not 1:1 price-related. The analyst additional remarked that the M2 doesn’t predict a particular BTC worth.

As an alternative, the worldwide M2 cash provide solely predicts the market path, with about 80% accuracy. Colin added that the Bitcoin worth has its y-axis whereas the M2 is on a distinct y-axis. He additionally opined that the M2 could decouple from BTC close to the cycle prime. Though the analyst didn’t present a timeline for when the cycle prime might be, his evaluation signifies that the cycle prime shouldn’t be but in and the bull run isn’t over.

Cash Provide Reveals No Want To Fear About BTC Value

In an X put up, market professional Raoul Pal advised that the Bitcoin worth’s correlation with the cash provide exhibits that there is no such thing as a want to fret about the present worth motion. He remarked that if 89% of BTC’s worth motion is defined by international liquidity, then by definition, virtually all “information” and “narrative” is noise.

Associated Studying

This means that the present geopolitical dangers, heightened by the Israel-Iran battle, are unlikely to affect the Bitcoin worth as a lot as anticipated. Buying and selling agency QCP Capital lately famous that the flagship crypto has but to indicate full-blown panic, which exhibits how a lot the asset has matured.

The agency remarked that BTC’s resilient worth motion seems underpinned by continued institutional accumulation, with firms like Technique and Metaplanet shopping for the dip. The Bitcoin ETFs additionally proceed to file constructive flows.

On the time of writing, the Bitcoin worth is buying and selling at round $104,700, down within the final 24 hours, in keeping with knowledge from CoinMarketCap.

Featured picture from Getty Pictures, chart from Tradingview.com