Common altcoin Solana is up 2% over the previous 24 hours, because the broader crypto market reveals indicators of resilience.

Nevertheless, past the overall market restoration, SOL’s upward transfer is pushed by a touch at renewed institutional curiosity within the coin and its ecosystem.

Solana Primed for Rally? Nasdaq Submitting Gasoline Momentum

In response to a Type 40-F submitting dated June 18, Canadian asset supervisor Sol Methods, a agency targeted completely on the Solana ecosystem, filed compliance paperwork with the US Securities and Trade Fee (SEC), signaling its intent to listing on the Nasdaq.

Whereas nonetheless awaiting approval, the submitting represents a daring step towards providing institutional traders direct publicity to Solana-based property by way of conventional markets. This growth has triggered a renewed wave of cautious optimism amongst SOL hodlers, driving up its worth right now.

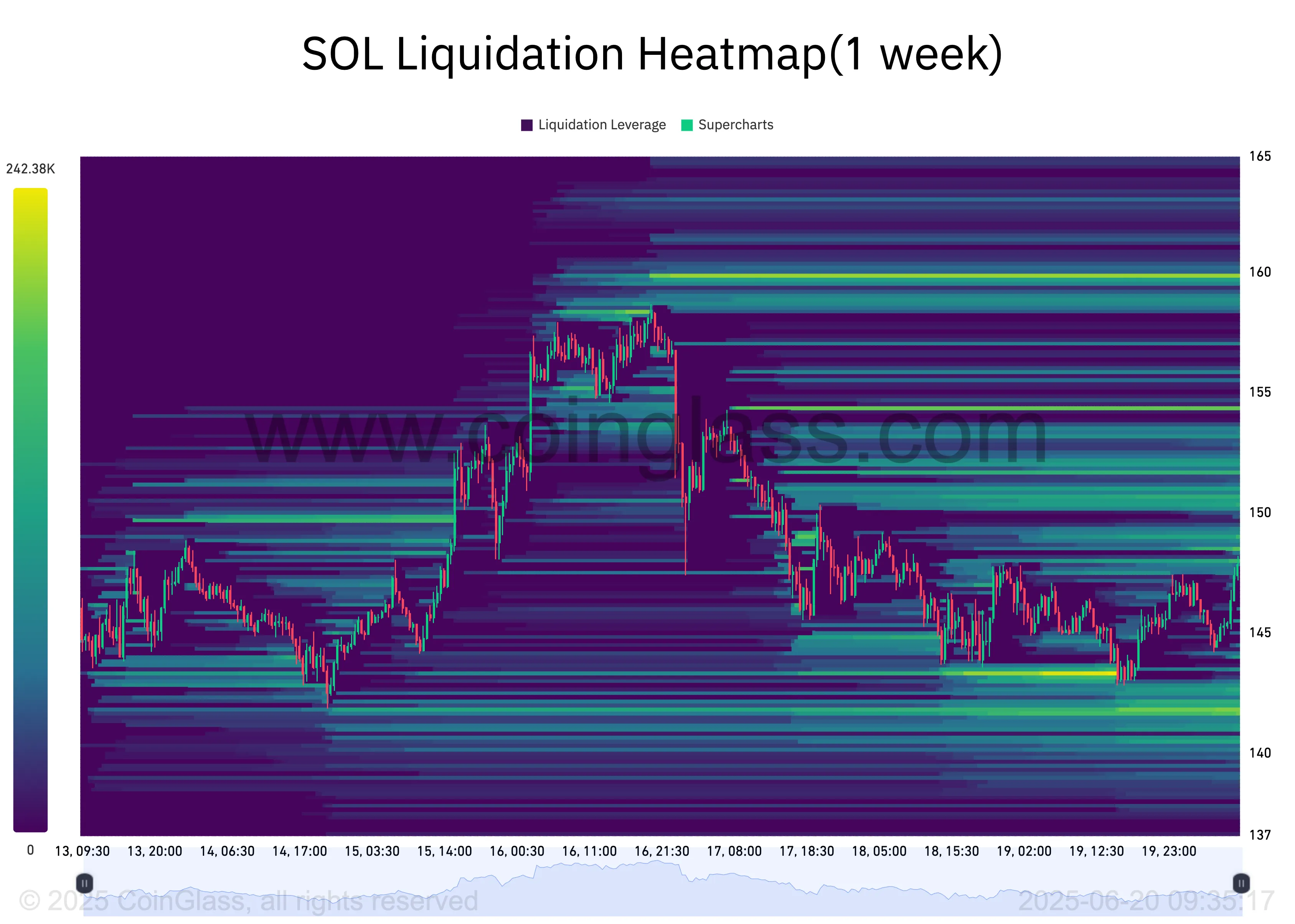

Additionally, the timing of this submitting aligns with more and more bullish on-chain indicators such because the coin’s Liquidation Heatmaps, which present a dense cluster of liquidity has shaped across the $160 stage.

Liquidation heatmaps are visible instruments merchants use to establish worth ranges the place massive clusters of leveraged positions are more likely to be liquidated. These maps spotlight areas of excessive liquidity, usually color-coded to indicate depth, with brighter zones representing bigger liquidation potential.

Normally, these worth zones are magnets for worth motion, because the market strikes towards these areas to set off liquidations and open recent positions.

Due to this fact, for SOL, the dense liquidity cluster across the $160 stage suggests sturdy dealer curiosity in shopping for or protecting quick positions at that worth. This units the stage for a near-term rally towards that zone.

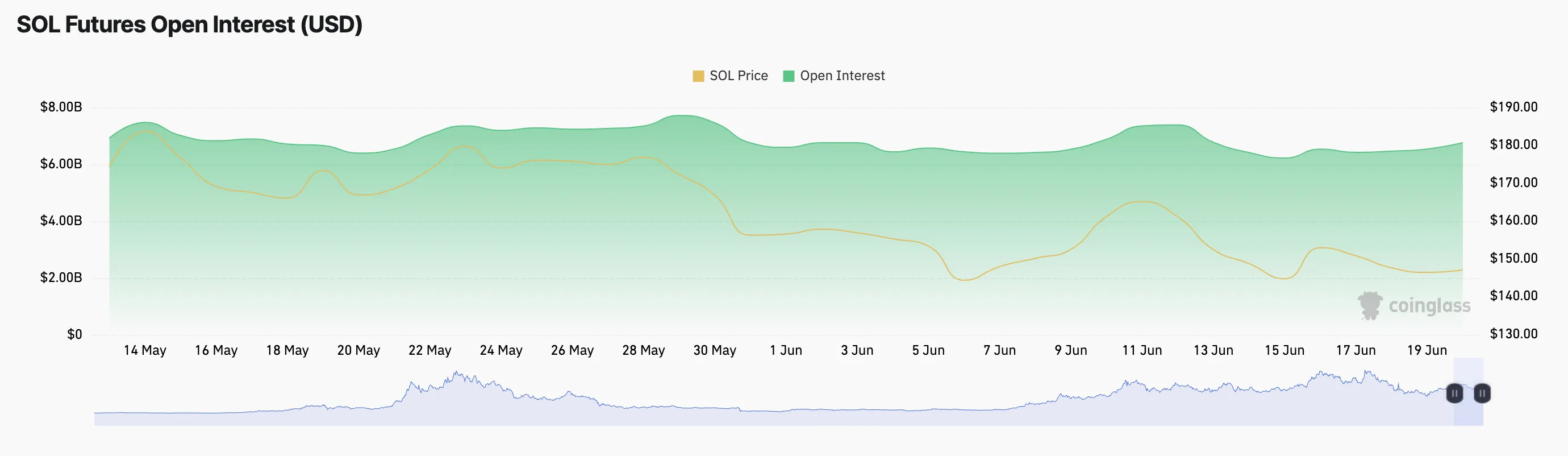

Moreover, SOL’s open curiosity (OI) has climbed 3% over the previous day, indicating elevated leveraged participation in SOL futures.

A rising OI means that extra capital is flowing into the coin’s derivatives markets, reflecting rising conviction amongst merchants about SOL’s potential upward worth motion.

Can Contemporary Demand Spark a Breakout Above $160?

Since early June, SOL has traded inside a good vary, going through resistance at $153.59 and discovering help at $142.59. A possible push towards $160 would require a decisive breakout above this resistance, which may solely occur if recent demand enters the market.

With out renewed shopping for strain, present momentum could stall. If consumers start to indicate indicators of exhaustion, SOL dangers reversing its current features and retesting help at $142.59.

A breakdown under this stage may open the door for a deeper correction within the SOL coin’s worth towards $134.68 as Q2 attracts to a detailed.

Disclaimer

According to the Belief Undertaking pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. All the time conduct your personal analysis and seek the advice of with an expert earlier than making any monetary selections. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.