Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

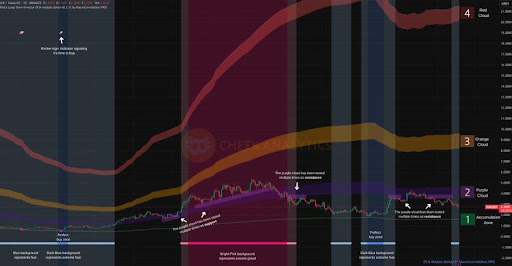

SUI’s worth chart, marked by increasing cloud zones, displays shifting sentiment and market construction. These zones have tracked main strikes from fear-based accumulation to key resistance factors. With new formations creating, a doubtlessly parabolic transfer may very well be on the horizon.

Excellent Setups For SUI That Paid Off Large

Cheek Analytics, in a current X put up, recognized $1.57 as SUI’s basic worth and a really perfect purchase zone, particularly during times of worry. Historic knowledge present that coming into at this stage on August 3, 2024, may have yielded as much as a 957% acquire, whereas an analogous setup on April 7, 2025, has already returned as much as a 134% acquire at its peak.

Associated Studying

Cheek Analytics additionally pointed to the Purple Cloud round $4 as the primary important resistance SUI must clear. This zone has been examined a number of instances, with one transient breakthrough, just for the value to fall again and validate it as resistance. Cheek views this stage as a key barrier: breaking above it might shift the momentum decisively and set the stage for additional good points.

Wanting additional forward, Cheek Analytics highlighted the Orange Cloud at $9 as SUI’s main resistance zone. Traditionally, as soon as the purple zone is damaged, worth usually accelerates towards this stage. Nonetheless, throughout a previous try, rising cloud zones stalled the transfer, and sentiment shifted to excessive greed, triggering profit-taking. SUI later retraced by -52% and nonetheless trades -28% under its peak.

To spherical out the roadmap, Cheek Analytics launched the Crimson Cloud at $20 because the long-term goal zone, a area that would come into play if the orange cloud flips to help. Nonetheless, Cheek notes that on bigger altcoins like SUI, the crimson cloud is never touched. It’s because all cloud zones broaden or contract with market motion.

Larger Highs Wanted: The Path To Breaking Resistance

Cheek Analytics concluded that SUI reveals robust long-term potential, as seen in its increasing cloud zones. Nonetheless, for additional upside, the value should type increased lows and better highs; in any other case, a breakout above the purple cloud could fail and appeal to renewed promoting stress.

Associated Studying

If the bullish construction fails to materialize, the analyst warns of a possible retracement again towards the basic inexperienced line at $1.57, a stage described as a really perfect accumulation level for long-term believers, or as they put it, “buttlievers.”

At present, the sentiment indicator is already displaying worry, marked by a lightweight blue background. Ought to worth revisit the inexperienced line, Cheek Analytics expects sentiment to shift into excessive worry, setting the stage for optimum dollar-cost averaging (DCA) circumstances for dedicated holders aiming to experience the subsequent main wave.

Featured picture from Shutterstock, chart from Tradingview.com