The crypto market will witness $4.11 billion in Bitcoin (BTC) and Ethereum (ETH) choices contracts expire immediately. This large expiration might affect short-term worth motion, particularly as each belongings have just lately declined.

With Bitcoin choices valued at $3.5 billion and Ethereum at $565.13 million, merchants are bracing for potential volatility.

Excessive-Stakes Crypto Choices Expirations: What Merchants Ought to Watch Right this moment

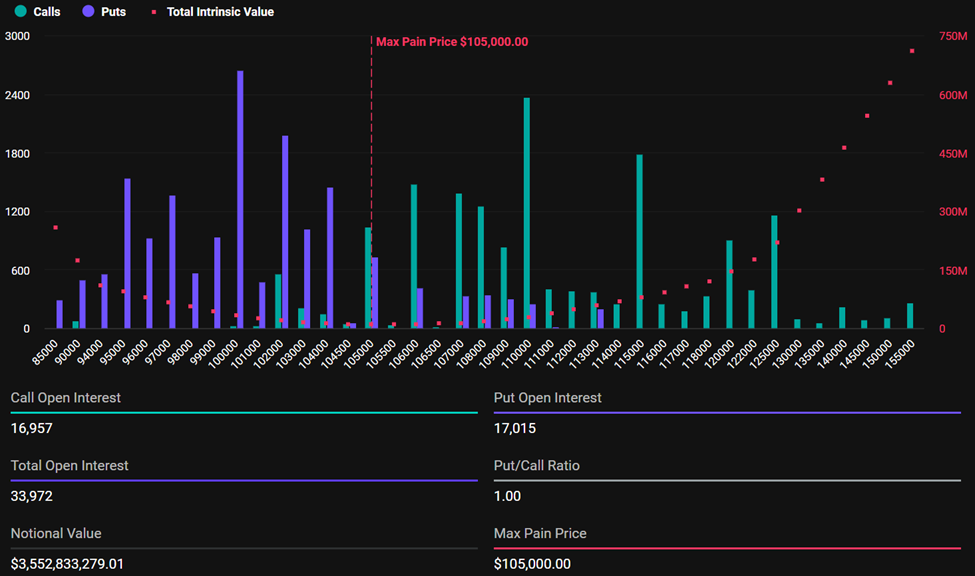

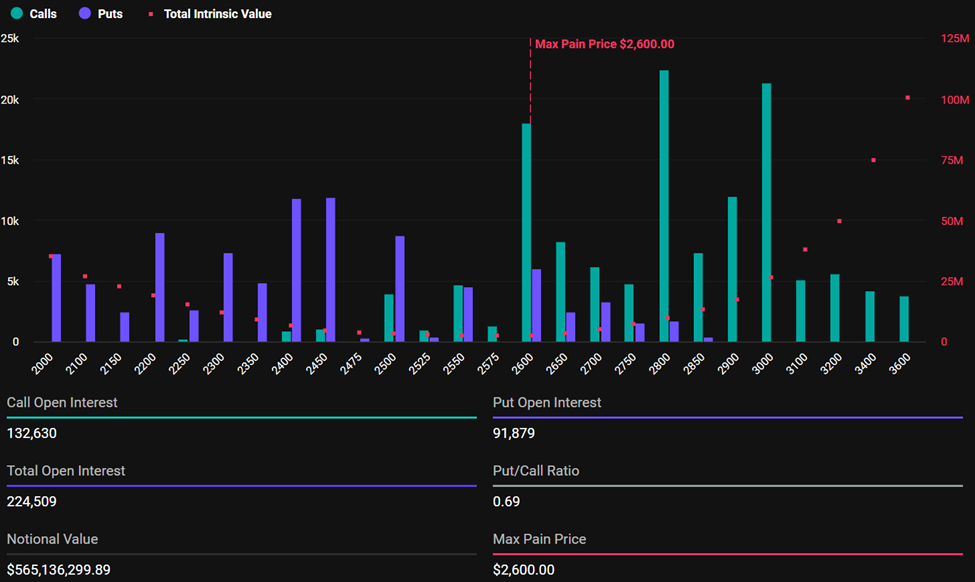

In line with Deribit knowledge, Bitcoin choices expiration includes 33,972 contracts, in comparison with 27,959 contracts final week. Equally, Ethereum’s expiring choices whole 224,509 contracts, down from 246,849 contracts the earlier week.

For Bitcoin, the expiring choices have a most ache worth of $105,000 and a put-to-call ratio of 1.00. This means merchants is perhaps equally divided between bearish (shopping for places) and bullish (shopping for calls) outlooks.

It displays uncertainty or a consolidation section available in the market, aligning with BeInCrypto’s latest report on Bitcoin’s resilience amid geopolitical stress. The pioneer crypto stays range-bound, with institutional assist and low volatility bolstering its place.

However, the decision and put open pursuits point out a slight lean towards places, hinting at gentle bearish sentiment or hedging.

As compared, their Ethereum counterparts lean bullish with a put-to-call ratio of 0.69 and a most ache worth of $2,600.

The utmost ache level is an important metric that always guides market habits. It represents the worth degree at which most choices expire nugatory, inflicting most monetary “ache” on merchants.

Merchants and buyers ought to brace for volatility, as choices expirations usually trigger short-term worth fluctuations, which create market uncertainty. Primarily based on the Max Ache Concept, asset costs are likely to gravitate towards their respective max ache or strike costs.

Ethereum, buying and selling beneath its max ache degree at $2,506 as of this writing, means a bullish outlook and explains the decision choices as merchants wager on worth will increase. Alternatively, although additionally beneath its max ache degree, Bitcoin exhibits extra balanced positioning with a put-to-call ratio of 1.0.

“BTC exhibits extra balanced positioning close to max ache, whereas ETH flows tilt bullish with calls dominating up the curve. How will the market reply this time?” analysts at Deribit posed.

Nonetheless, markets often stabilize quickly after merchants adapt to the brand new worth setting. With immediately’s high-volume expiration, merchants and buyers can count on an analogous consequence, probably influencing crypto market developments into the weekend.

Geopolitical Dangers and Fed Outlook Weigh on Sentiment

Elsewhere, analysts at Greeks.dwell be aware that market sentiment amongst crypto derivatives merchants has turned notably bearish within the quick time period. This comes after the Federal Reserve Chair Jerome Powell’s newest FOMC assertion.

The buying and selling group is broadly positioning for draw back threat by means of July, whereas sustaining long-term optimism into the fourth quarter (This fall).

“Merchants are operating detrimental delta for July positions whereas planning so as to add optimistic deltas for This fall,” Greeks.dwell wrote in a put up.

Geopolitical tensions, notably the rising threat of US involvement within the Center East, are rising because the dominant short-term catalyst. A number of merchants are reportedly positioning lengthy places forward of potential US involvement and Iran tensions, hedging towards an additional market downturn.

Disclaimer

In adherence to the Belief Challenge tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nonetheless, readers are suggested to confirm details independently and seek the advice of with knowledgeable earlier than making any choices primarily based on this content material. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.