Current bulletins in quantum computing have introduced renewed consideration to the query of how these advances might impression Bitcoin. In a newly printed report, we offer an summary of the present state of quantum computing, the risk mannequin for Bitcoin, and the following steps being thought of. This publish provides a abstract of our key findings and suggestions. See the complete report right here.

Timeline for Bitcoin Preparation to Quantum Computing

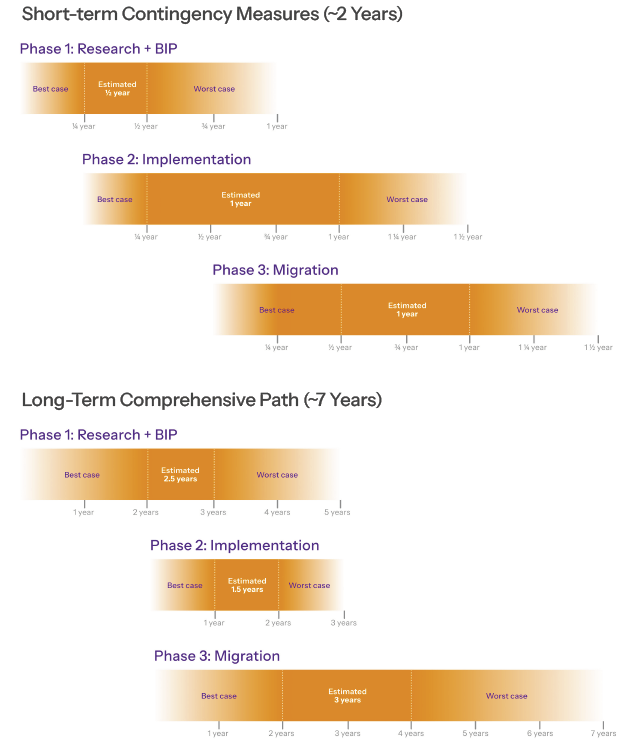

We define a dual-track migration technique for Bitcoin in response to the potential emergence of quantum computing.

- Lengthy-Time period Path: This complete method assumes that there’s nonetheless a considerable window of time earlier than quantum computing poses a sensible risk. Drawing on the timelines of prior protocol upgrades comparable to SegWit and Taproot, we estimate that implementing a full quantum-safe transition might take roughly 7 years.

- Brief-Time period Contingency Path: This monitor serves as an emergency response within the occasion of a sudden breakthrough in quantum computing. It prioritizes a fast deployment of protecting measures to safe the Bitcoin community and may very well be executed in roughly 2 years.

In each situations, funds which can be rigorously managed, i.e., saved in hashed tackle sorts like P2PKH or P2WPKH with out tackle reuse, are already protected against quantum assaults. Nonetheless, spending these funds in a post-quantum safe approach would require extra infrastructure, which is anticipated to be developed through the second part of both timeline

Quantum Computer systems: When Are They Coming, and What Will They Be Succesful Of?

If realized at scale, quantum computing might provide vital speed-ups for particular lessons of issues by harnessing the rules of quantum mechanics. Of specific concern are cryptographically related quantum computer systems (CRQCs), machines able to breaking the mathematical assumptions underlying fashionable cryptography. This consists of algorithms like Elliptic Curve Cryptography (ECC), which is key to Bitcoin’s safety.

Whereas quantum computing has been an energetic space of theoretical analysis for many years, vital engineering challenges stay in constructing large-scale quantum machines, particularly CRQCs. So far, no quantum pc has surpassed classical supercomputers in fixing commercially related issues, nor demonstrated the capabilities wanted to threaten fashionable cryptography.

Estimated timelines for CRQCs

Technological progress is notoriously onerous to foretell, it not often follows a linear path, and historical past provides many examples of sudden breakthroughs. In anticipation of potential shifts within the cryptographic panorama, a number of organizations have proposed timelines for transitioning cryptographic signatures.

One of the vital distinguished efforts comes from the U.S. Nationwide Institute of Requirements and Expertise (NIST), which has been main the event of cryptographic requirements. Their printed suggestions spotlight two key dates:

- By 2030, conventional encryption strategies, comparable to ECDSA and RSA, needs to be phased out.

- By 2035, all cryptographic techniques ought to transition totally to post-quantum algorithms.

The UK’s Nationwide Cyber Safety Centre follows a comparable method with a three-phase migration framework that goals to finish the transition to post-quantum cryptography by 2035. Different entities, such because the EU and China, are additionally actively engaged on post-quantum cryptography methods, although they haven’t but printed formal timelines.

On the business stage, a number of main firms, together with Cloudflare, Sign, and Google, have begun adopting post-quantum cryptography. They’re implementing hybrid signature schemes that mix conventional encryption strategies with post-quantum algorithms, requiring an attacker to interrupt each in an effort to compromise the system. Apple has additionally introduced plans to transition to post-quantum cryptography. As PQC turns into an rising business normal, extra firms are anticipated to observe go well with.

What’s at Stake?

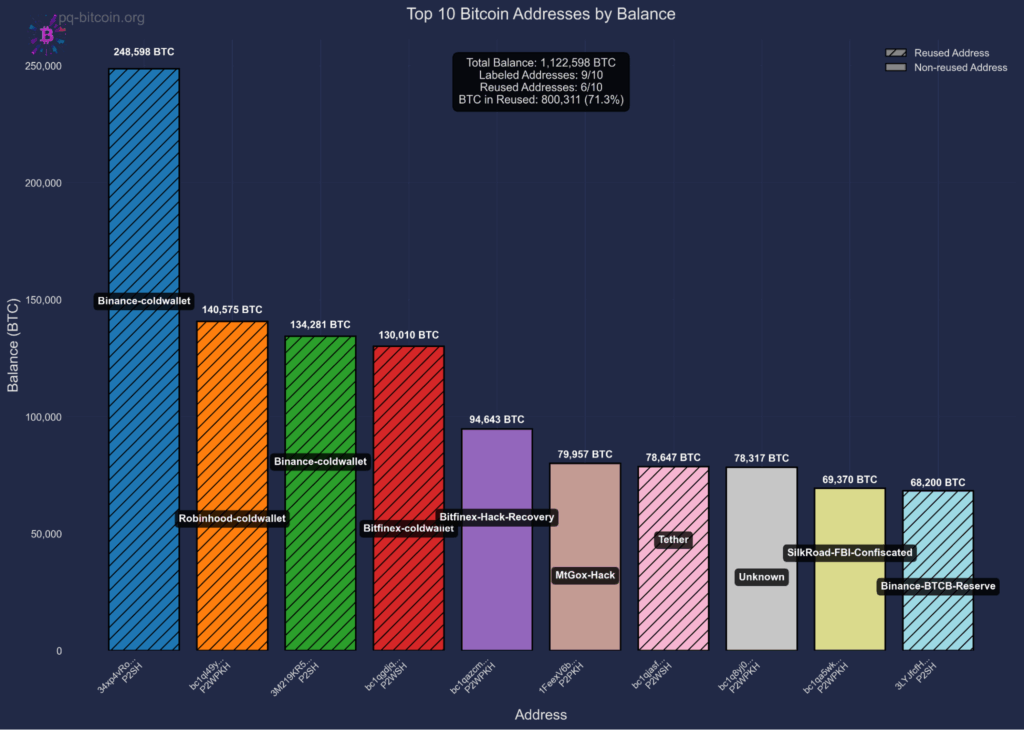

The monetary stakes of the risk to Bitcoin are substantial. Fig 2 illustrates evaluation revealing that roughly ~6.51 million bitcoin, value over $700 billion at present valuations, and representing 32.7% of present provide, is quantum susceptible. This consists of funds held in addresses which have practiced tackle reuse, funds secured by inherently quantum-vulnerable script sorts, and funds which can be susceptible by way of public key publicity on forks of Bitcoin, comparable to Bitcoin Money.

Bitcoin Risk Mannequin: What Ought to We Be Fearful About?

Quantum computing is anticipated to impression two key areas of Bitcoin: mining and transaction signatures. In quantum mining, the issue of mixing the facility of a number of machines offers a disproportionate benefit to massive quantum miners, threatening decentralization. For transaction signatures, the danger is extra direct, a CRQC might derive non-public keys from public keys, enabling theft of funds.

Importantly, the timelines for these two threats differ considerably. Constructing a quantum pc that may outperform fashionable ASIC miners presents a far higher engineering problem than setting up one able to breaking digital signatures. That is due, partly, to the low clock speeds of quantum processors, that are a lot slower than the extremely optimized and specialised {hardware} utilized in Bitcoin mining and the dearth of parallelization.

Signatures

A CRQC might break the belief that it’s infeasible to derive a non-public key from its corresponding public key underneath ECC primarily based schemes, probably permitting attackers to steal funds. In Bitcoin, possession of a UTXO is confirmed by signing a transaction with the non-public key comparable to a given public key. If a CRQC can derive that personal key from the general public key, it will possibly falsely declare possession and spend the funds.

This results in two distinct quantum assault situations. When spending from hashed addresses, public keys are revealed quickly, giving attackers a quick window, sometimes minutes to hours, to derive non-public keys and steal funds, probably by chain reorganization. In distinction, sure output sorts (P2PK, P2MS, P2TR) expose public keys completely on-chain from the second funds are acquired, giving attackers limitless time to mount quantum assaults. Deal with reuse converts the momentary vulnerability of hashed addresses into everlasting publicity, as public keys stay seen on-chain after the primary spend. As proven in Fig 3, probably the most susceptible targets are addresses that maintain vital funds with uncovered public keys comparable to institutional holdings that practiced tackle reuse.

Mining

Bitcoin mining relies on the precept that the likelihood of discovering a sound block scales linearly with the quantity of computational effort expended. Grover’s algorithm, a quantum search approach, provides a quadratic speedup for brute-force search. Nonetheless, not like classical mining, Grover’s algorithm isn’t simply parallelizable. This limitation might give a disproportionate benefit to entities with entry to large-scale, centralized quantum {hardware}, probably rising mining centralization somewhat than broadening participation.

Along with issues about centralization, quantum mining might alter miners’ optimum methods, probably degrading chain high quality, for instance, by rising the speed of stale blocks. A better stale block fee could make sure assaults (comparable to egocentric mining or double-spends) more cost effective and extra possible.

As famous earlier, constructing a quantum pc able to outperforming fashionable ASIC miners is believed to be a lot farther off than growing CRQCs. As such, quantum mining isn’t a right away concern and is unlikely to be a sensible risk within the coming many years. However, exploring Proof-of-Work mechanisms in a future quantum context stays a worthwhile analysis route. Creating a greater understanding of the potential dangers and mitigation methods would assist the ecosystem put together for a world the place quantum mining turns into possible.

Migration to Quantum Safety: What are the principle challenges?

Quantum-Safe Signatures

Quantum-secure cryptographic signatures have been studied for many years, however curiosity and progress have accelerated lately. This has led to the event of candidate protocols comparable to SPHINCS+, FALCON, and others. Nonetheless, as a comparatively younger area, it has seen a number of proposed schemes initially believed to be safe however had been later damaged (e.g. SIKE), even by classical computer systems. Whereas belief within the present candidates is rising over time, the sphere stays energetic and evolving.

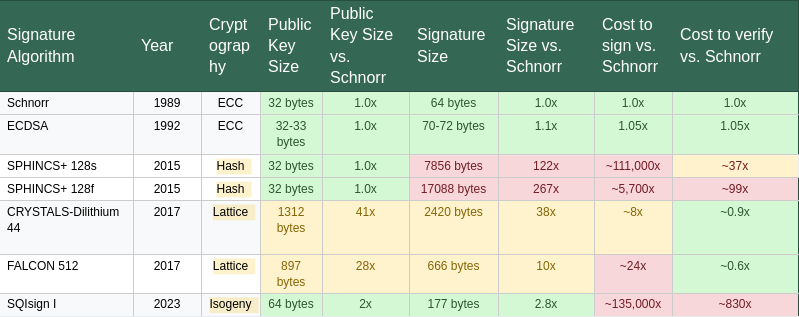

As detailed in Desk 1, a major limitation of post-quantum signature schemes is their considerably bigger key and signature sizes, together with elevated verification occasions, relative to classical algorithms comparable to ECDSA and Schnorr which can be at the moment utilized in Bitcoin. To deal with this, some proposals recommend leveraging SegWit’s witness low cost mechanism to scale back on-chain footprint. Nonetheless, one of the best method for integrating quantum-secure signatures into the protocol stays an open query. Along with efficiency trade-offs, quantum-secure schemes don’t but assist the complete vary of performance supplied by classical signatures, comparable to these relied upon within the Lightning Community and different purposes. This space continues to be an energetic focus of analysis throughout the cryptography group, and additional enhancements are anticipated within the coming years.

Migration Pathways

If the Bitcoin group chooses emigrate susceptible funds to quantum-resistant codecs, numerous UTXOs will must be moved. A number of approaches are into consideration, every making totally different tradeoffs. Some deal with enabling safe spending of hashed-address outputs with out exposing the general public key prematurely. Others suggest mechanisms to restrict or regulate the spending of UTXOs which can be straight susceptible to quantum theft. These methods typically require adjustments to consensus guidelines, comparable to mushy forks, and should additionally account for the sensible problem of transferring a big quantity of UTXOs, probably taking 4 to 18 months even with sustained allocation of block house.

Philosophical Dilemma: Will we permit funds to be stolen?

The Bitcoin group faces a elementary philosophical query: ought to quantum-vulnerable funds be made completely unspendable (“burned”) or stay accessible to quantum computer systems (“stolen”)? This determination touches Bitcoin’s core rules of property rights, censorship resistance, and immutability. The burn method treats quantum vulnerability as a protocol bug requiring a conservative repair, stopping wealth redistribution to those that win the CRQC race. The steal method maintains that burning funds violates the property rights of their homeowners, successfully confiscating belongings from those that could merely be unaware of the risk or unable emigrate in time.

The implications prolong past philosophy to market dynamics. A coordinated burn would completely take away hundreds of thousands of bitcoins from circulation, probably rising the worth of remaining cash whereas offering market certainty. Permitting quantum theft allows large wealth switch to entities with quantum capabilities, probably creating extended market uncertainty and volatility as funds are regularly drained. A call on this matter is a defining second for Bitcoin’s governance mannequin, requiring the group to stability safety imperatives towards foundational rules of person sovereignty and non-intervention.

So, what’s subsequent?

The arrival of CRQCs would mark a significant shift throughout the digital panorama, inserting a lot of right this moment’s safe communication, authentication, and digital infrastructure in danger. Whereas quantum computing isn’t but a sensible actuality, preparations are underway to assist guarantee Bitcoin’s resilience towards future developments. Analysis continues throughout each the cryptographic and Bitcoin communities to evaluate potential dangers and discover sensible responses. Our report highlights two areas that will warrant near-term consideration: stopping tackle reuse and evaluating the trade-offs within the Burn vs. Steal dialogue round uncovered funds.

The window for proactive motion is open now, although it could not stay open indefinitely. Staying knowledgeable about advances in quantum computing and cryptography is crucial, as is learning potential mitigation methods and their broader implications for the Bitcoin ecosystem. Guaranteeing Bitcoin’s long-term safety in a post-quantum world requires considerate, deliberate work, beginning now, so we are able to make well-informed choices whereas time continues to be on our aspect.

This can be a visitor publish by Clara Shikhelman and Anthony Milton. Opinions expressed are solely their very own and don’t essentially replicate these of BTC Inc or Bitcoin Journal.