- BTC futures premium fell beneath 4%, signaling dealer anxiousness regardless of sturdy costs.

- Choices skew hit 5%, indicating a shift towards bearish sentiment.

- Institutional consumers stay sturdy, however confidence within the $100K assist is clearly shaky.

So, Bitcoin’s hovering simply 8% beneath its all-time excessive, sitting at about $103,450. Sounds good, proper? Properly, perhaps not. Derivatives metrics—these deeper, behind-the-scenes alerts—are exhibiting indicators of weak point. Like, weirdly bearish. And it’s not simply the same old futures jitters both. One thing else feels off.

Yeah, crypto merchants will be twitchy, particularly with leverage within the combine. However this—this feels totally different. The optimism simply isn’t there. And with BTC dropping briefly to $102,400, individuals are asking: is that this about Bitcoin itself… or the broader economic system falling aside on the seams?

Futures Premiums Sign Warning

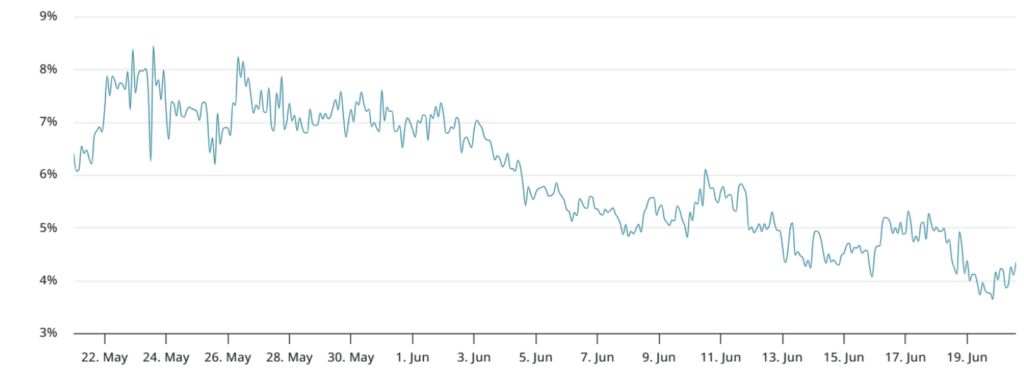

Let’s speak about these month-to-month futures. Usually, BTC futures commerce a couple of factors above spot—between 5% to fifteen%—to account for time till settlement. Fundamental stuff. However since June 12, that hole has dipped beneath 5%, following a rejection at $110K. That’s not an incredible signal. Truly, it’s the bottom premium we’ve seen in like, three months.

What’s much more weird? The metric was stronger again on June 5, despite the fact that BTC was buying and selling at simply $100,450 then. On Thursday, the premium dropped beneath 4%. That’s decrease than April’s ranges—do not forget that day Bitcoin nose-dived to $74,440? This present quantity’s decrease than that.

Choices Market Echoes the Sentiment

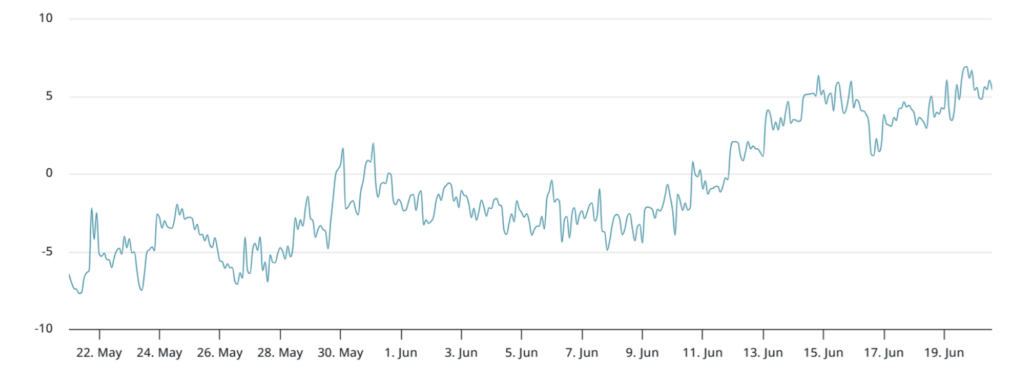

To examine if it’s only a futures factor, we peek into choices. Particularly, put-call skew. When merchants begin sweating, they pile into places, which pushes the skew above 5%. If everybody’s feeling bullish, the skew often slides below -5%.

Proper now? We’re sitting at 5% on the dot. Proper on the border of “ehh” and “yikes.” Not horrible, however not encouraging both. Again on June 9, that skew was a snug -5% after BTC surged previous $110K. However that optimism? It’s gone. Quick.

Macro Mess and Market Malaise

Zooming out, macro stuff isn’t serving to. The Russell 2000 index—U.S. small-caps—held assist at 2,100, which is… one thing. However struggle tensions, sticky inflation, and rates of interest hanging above 4.25%? Yeah, not nice. Recession talks are again. And crypto merchants—like most merchants—don’t love uncertainty.

Humorous sufficient, institutional gamers don’t appear scared. Over the previous 30 days ending June 18, U.S.-listed BTC ETFs raked in over $5.1 billion. That’s big. Corporations like Technique, H100 Group, and even Metaplanet went buying—shopping for tons of Bitcoin.

The place’s the Confidence Gone?

The large query: why does the market really feel bearish, even when value motion appears steady? Confidence is simply… skinny. Merchants aren’t certain the $100K assist will stick. And that nervous power is exhibiting throughout derivatives. Places are up, premiums are down, and volatility’s not precisely fading.

So, what’s it gonna take to flip the vibe? Actually—who is aware of. Perhaps a Fed charge reduce, or some constructive ETF-related shock. However till then, the longer BTC chills across the $100K degree, the extra it begins to really feel like bears are sharpening their claws once more.