Circle’s public debut has drawn criticism from high-profile buyers, particularly over how early workers could have missed out on practically $3 billion in unrealized positive aspects.

Billionaire enterprise capitalist Chamath Palihapitiya famous that Circle insiders bought 14.4 million shares on the Preliminary Public Providing (IPO) worth of $31 every, securing roughly $446 million. Nevertheless, with the inventory now buying and selling above $240, the identical shares would at present be price round $3.45 billion.

Circle IPO Leaves Billions on the Desk for Early Staff

The distinction marks an almost $3 billion hole, which Palihapitiya described as a pricey misstep brought on by the selection of a standard IPO route.

He famous that underwriters bought the insider shares and redistributed them to pick out shoppers, leaving unique shareholders with restricted upside.

In his view, the workers primarily handed over billions in worth to outdoors buyers who had no position in Circle’s success.

“On this case, it was a $3 billion present from the workers and buyers of Circle to folks they don’t know, won’t ever know and don’t have anything to do with their journey,” Palihapitiya mentioned.

Palihapitiya argued that the state of affairs may need performed out in another way if Circle had chosen a particular function acquisition firm (SPAC) merger or a direct itemizing.

These various routes usually give insiders extra management over pricing, timing, and disclosures, serving to them retain extra worth throughout a public transition.

He added that SPACs and direct listings disclose valuation dynamics extra clearly and may be structured to profit each sellers and consumers.

“To be clear, this technique of worth switch doesn’t occur by way of a direct itemizing or SPAC – the advantages in SPACs and DLs are disclosed very explicitly up entrance. They are often negotiated, minimized and many others to the good thing about promoting shareholders and shopping for shareholders,” he added.

Circle had beforehand deliberate to go public by way of a SPAC merger with Harmony Acquisition Corp, however canceled the deal in 2022. The corporate later pursued a standard IPO, which, whereas profitable, seems to have left early stakeholders with regrets.

CRCL Surges as Stablecoin Confidence Grows

Regardless of the controversy, Circle’s efficiency in public markets has been outstanding.

Its inventory, now buying and selling underneath the ticker CRCL, has surged greater than 675% since its $31 debut, reaching a peak of $248 per share on June 20. That places the corporate’s market capitalization at round $58 billion, signaling sturdy investor confidence within the agency’s future.

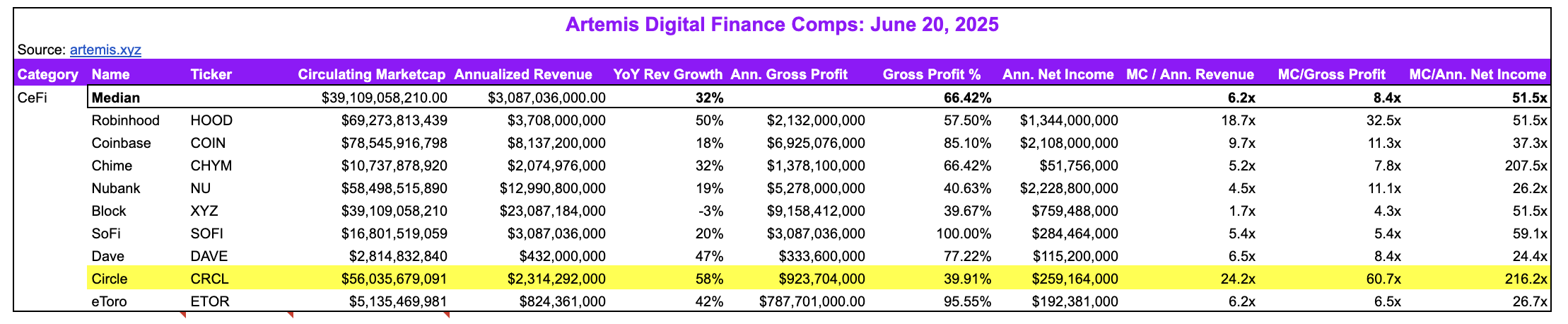

Jon Ma, CEO of blockchain analytics agency Artemis, famous that Circle is buying and selling at valuation multiples properly above these of Coinbase and Robinhood, regardless of these corporations reporting increased internet revenue.

“Circle now trades for: 24.2x [its] Q1’25 income run fee, 60.7x Q1’25 gross revenue run fee [and] 216x Q1’25 internet revenue run fee,” Ma identified.

Based on him, the premium probably displays investor perception in Circle’s future development and potential regulatory benefit.

A key issue behind that optimism is the current passage of the GENIUS Act within the Senate—a bipartisan invoice designed to carry stablecoin readability to the US market. The laws, backed by President Donald Trump, nonetheless wants approval from the Home and a last signature.

If handed, it may solidify Circle’s regulatory footing, reinforcing its dominance within the stablecoin sector and serving to justify its hovering inventory worth.

Disclaimer

In adherence to the Belief Mission tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nevertheless, readers are suggested to confirm information independently and seek the advice of with an expert earlier than making any choices primarily based on this content material. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.