Crypto and blockchain shares are placing altcoins to disgrace.

The Circle ($CRCL) inventory worth has appreciated by one other 20% on Friday, closing the week at $240. Since its June 5 debut, $CRCL has now surged 677%, benefiting considerably from pro-stablecoin laws in the USA and robust institutional demand.

In the meantime, Coinbase (COIN) can also be exhibiting appreciable bullish power, up by practically 28% this week and 116% since its April backside.

The COIN inventory worth surged by 4.43% on Friday on the information that Coinbase has acquired the MiCA license from Luxembourg to offer crypto providers within the European Union.

Apart from COIN and CRCL, crypto treasury shares have emerged as enticing bets. Wall Road big Cantor Fitzgerald has recognized Solana treasury agency Sol Methods (CYFRF) as an “chubby” inventory.

The Canadian agency is trying to enter the US markets with a Nasdaq itemizing, which might make it probably the greatest blockchain shares to purchase.

Are COIN And CRCL Nonetheless Engaging Buys or Ought to Sidelined Traders Wait For A Higher Entry?

The continued crypto bull market, stablecoin laws within the US and the robust institutional demand have established Coinbase and Circle as two wonderful bets in a boring inventory market.

TradFi buyers seem like viewing $COIN, $CRCL, and crypto treasury performs as higher investments than large-cap altcoins, a lot of which proceed to undershoot expectations.

Notably, the GENIUS Act’s bipartisan development by means of the Senate has offered added tailwinds to the crypto inventory rally.

Pending passage within the Home of Representatives and remaining approval by the President, the Act would set up a regulatory framework for stablecoins and open the door for his or her adoption by banks, monetary establishments, and even consumer-facing firms.

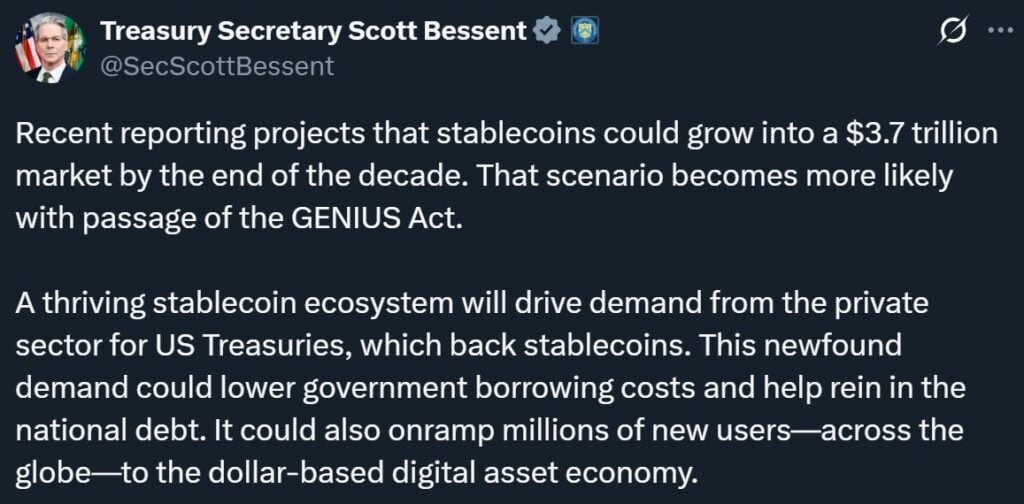

US President Donald Trump has already signalled his intent to signal the invoice. “Get it to my desk, ASAP — NO DELAYS, NO ADD ONS”. In the meantime, US Treasury Secretary Scott Bessent claims that the stablecoin market capitalization might attain $3.7 trillion by the tip of the last decade following the passage of the GENIUS Act, which is 15x bigger than the sector’s present valuation.

Circle, which is the issuer of the second-largest stablecoin, USDC, has emerged as a wonderful stablecoin play.

Nonetheless, sidelined buyers ought to keep away from FOMO shopping for at present ranges. The inventory’s explosive rally has been fueled largely by speculative 0DTE flows and sky-high implied volatility, reasonably than fundamentals.

With profit-taking dangers elevated and bearish bets rising, a pointy pullback stays an actual chance.

In the meantime, $COIN is one other wonderful stablecoin play, particularly contemplating Coinbase has a minority stake within the firm. Along with that fairness publicity, Coinbase earns 50% of the curiosity revenue generated from USDC reserves, making it a direct beneficiary of USDC’s development.

Coinbase’s development additionally isn’t totally depending on the stablecoin sector. Already the biggest crypto alternate within the US, it has now acquired the MiCA license from Luxembourg to offer crypto providers within the EU.

Nonetheless, $COIN can also be nearing key resistance ranges at $312 and $350, the latter of which is a multi-year resistance.

Sidelined buyers ought to due to this fact await a greater entry level at decrease costs or purchase at a transparent breakout above these ranges.

Greatest Blockchain Shares To Purchase Now

Whereas stablecoin performs could also be working out of steam, crypto treasury performs are simply getting began.

Wall Road big Cantor Fitzgerald means that Solana treasury firms might outpace Bitcoin and Ethereum treasuries in asset-per-share development, owing to SOL’s staking capabilities, which may compound returns with out counting on exterior capital.

Cantor has recognized Sol Methods (CYFRF) as probably the greatest blockchain shares, initiating protection and labelling it “chubby”. Their analysts have initiated protection and anticipate a 65% rally in CYFRF within the coming weeks, which has already rallied 15x over the previous 12 months.

Sol Methods is also known as the MicroStrategy of Solana, owing to its rising SOL holdings, staking technique and validator development to spice up long-term returns.

It not too long ago secured a $500 million convertible be aware facility and filed a $1 billion shelf prospectus to assist its ongoing SOL accumulation and validator enlargement.

Extra importantly, Sol Methods is now eyeing a US market entry, submitting for a Nasdaq itemizing with the SEC, which might make it one of many high blockchain shares to spend money on.

New Solana utility cash are additionally in excessive demand. As an illustration, a outstanding SOL Layer-2 coin, Solaxy (SOLX), is being seen as the subsequent 10x crypto.

Apart from its cutting-edge layer-2 structure, Solaxy can also be constructing a full-stack ecosystem inside Solana, together with a meme coin launchpad and its personal decentralized alternate.

Whales proceed to pour six-figure investments into SOLX simply days forward of its June twenty third launch. It has now raised over $56 million in its presale.

Go to Solaxy Presale

This text has been offered by considered one of our industrial companions and doesn’t replicate Cryptonomist’s opinion. Please bear in mind our industrial companions could use affiliate packages to generate revenues by means of the hyperlinks on this text.