As geopolitical tensions intensify and investor sentiment deteriorates, bearish strain has continued spreading throughout Bitcoin’s spot and derivatives markets.

The uncertainty surrounding international macroeconomic stability has led many market members to take a risk-off strategy, with the coin displaying indicators of vulnerability because the second quarter attracts to an in depth.

Bitcoin Futures Flip Bearish

With the coin struggling to rally momentum across the $103,000 worth mark, Bitcoin futures merchants have more and more positioned towards the coin.

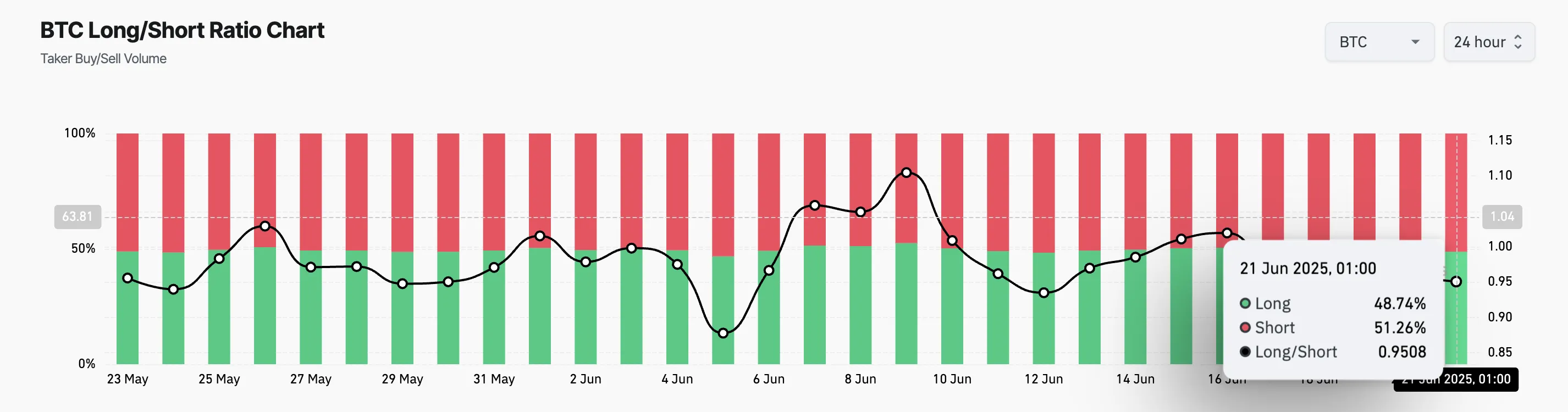

In keeping with Coinglass, the coin’s lengthy/quick ratio — a key measure of dealer sentiment — has tilted closely towards shorts since June 17, indicating a rising perception that BTC’s latest rally could also be dropping momentum. At press time, the ratio is 0.95, indicating extra merchants are betting towards the altcoin.

This ratio compares the variety of lengthy and quick positions in a market. When an asset’s lengthy/quick ratio is above 1, there are extra lengthy than quick positions, indicating that merchants are predominantly betting on a worth improve.

Conversely, as seen with BTC, a ratio beneath one signifies that the majority merchants are positioning for a worth drop. This displays heightened bearish sentiment and rising expectations of continued draw back actions within the quick time period.

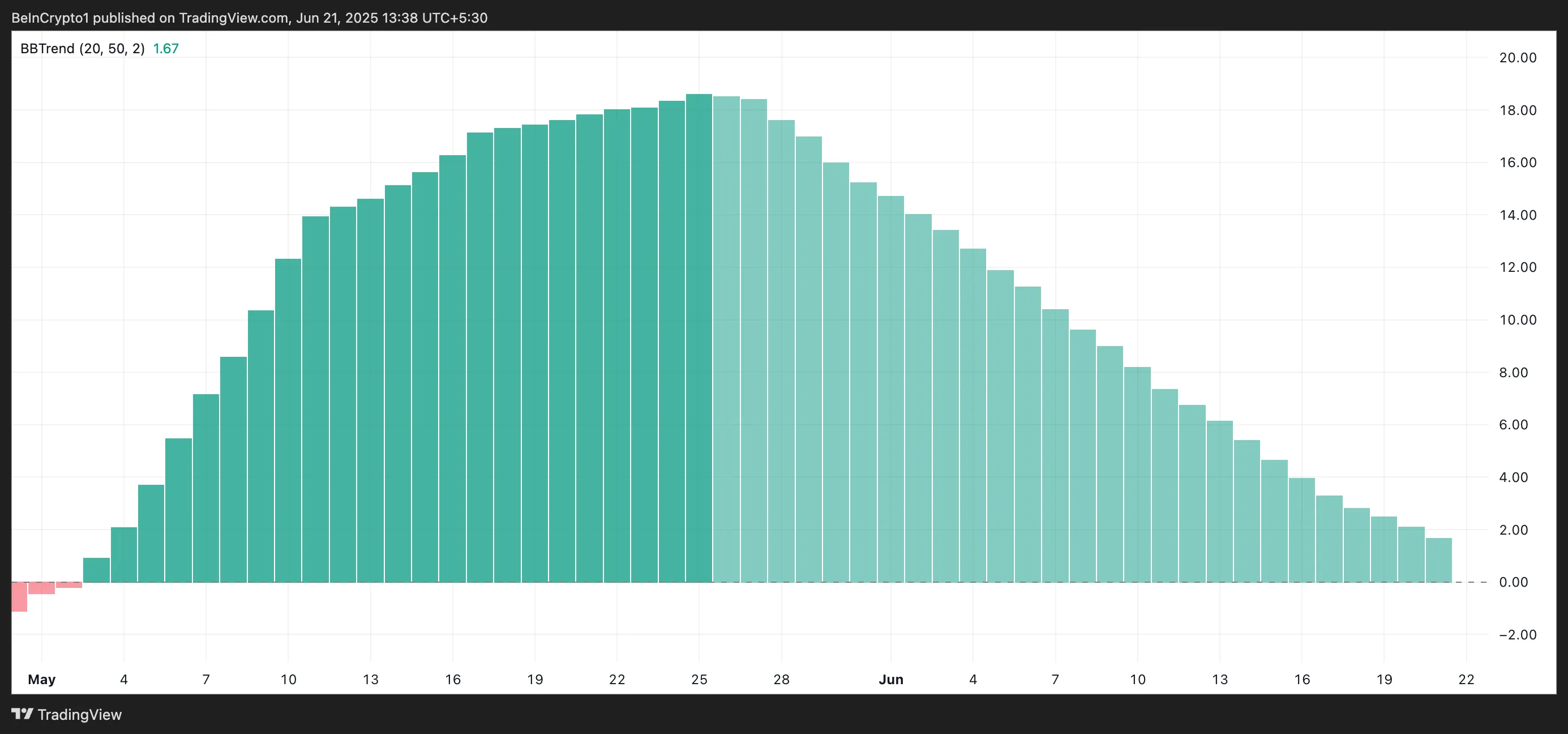

Furthermore, every day chart readings from BTC’s BBTrend indicator reinforce the bearish outlook. As BTC’s worth momentum weakens, the inexperienced histogram bars on the indicator have steadily fallen in measurement, signaling a decline in shopping for strain and a lack of bullish power.

The BBTrend is used to gauge the power and route of worth traits. It seems as histogram bars — inexperienced when the pattern is bullish and pink when bearish.

When the BBTrend turns detrimental or the inexperienced bars shrink, upward momentum is fading, and the asset could also be coming into a consolidation part or dealing with a reversal.

A persistently detrimental BBTrend means that promoting strain is dominating, rising the probability of an prolonged worth correction for BTC.

BTC Slips to Two-Week Low: Will Assist at $102,000 Maintain?

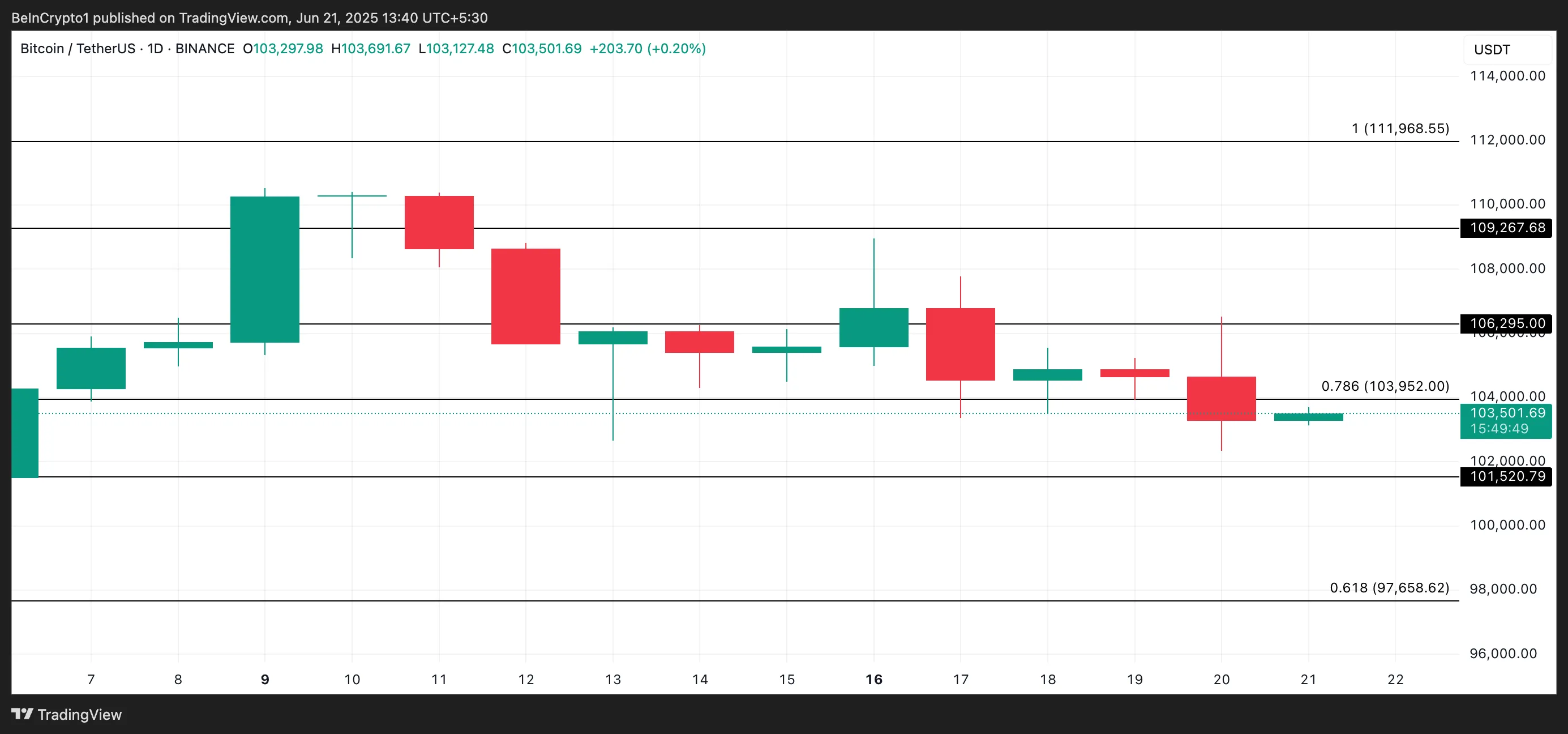

Yesterday, BTC’s worth fell to a 15-day low of $102,345. Though it rebounded and closed at $103,297, bearish strain stays, with the coin nonetheless down 2% over the previous 24 hours.

If new demand continues to be restricted, BTC’s worth may lengthen its dip towards $101,520. Ought to the bulls fail to defend this essential assist degree, the asset may plunge additional to $97,658.

Then again, if shopping for strain strengthens, BTC may rebound and try a break above $103,952. A profitable transfer previous this degree might open the door for a rally towards $106,295.

Disclaimer

In step with the Belief Venture pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. At all times conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.