Prime Tales of The Week

US crypto ETF approval odds surge to ‘90% or increased’ — Bloomberg analysts

The probability of US regulators approving a wave of crypto exchange-traded funds (ETFs) is now a close to certainty, signaling a continued pro-crypto shift on the Securities and Trade Fee (SEC), in accordance with Bloomberg analysts Erich Balchunas and James Seyffart.

In a social media put up on Friday, Seffart mentioned he and Balchunas have raised their odds for the overwhelming majority of crypto ETF approvals to “90% or increased,” citing “very optimistic” engagement from the SEC.

The analysts additionally advised that the SEC “possible” views cryptocurrencies reminiscent of Litecoin, Solana, XRP and Dogecoin as commodities — a designation that will place them outdoors of its speedy jurisdiction.

Coinbase secures MiCA license, names Luxembourg as EU headquarters

Coinbase has secured a Markets in Crypto-Belongings (MiCA) license from the Luxembourg Fee de Surveillance du Secteur Financier, which permits the change to supply crypto merchandise throughout European Union nations.

The transfer indicators mounting competitors within the European crypto market, the place different exchanges have additionally been pursuing registrations. OKX and Crypto.com secured MiCA licenses in January, adopted by Bybit in Could. Gemini can also be on observe to acquire a license within the area, in accordance with a Reuters report.

Coinbase has named Luxembourg as its new European headquarters, citing the nation’s repute as a progressive monetary middle in Western Europe. Bordered by Belgium, France and Germany, the nation has been progressively advancing crypto rules since 2019.

Semler Scientific plans Bitcoin holdings of 105,000 BTC by 2027

Healthcare tech agency Semler Scientific, Inc. says it plans to spice up its Bitcoin stack by almost 28 instances within the subsequent two-and-a-half years, rising its holdings from 3,808 Bitcoin to 105,000 Bitcoin.

Semler is aiming to carry a complete of 10,000 BTC by the tip of this yr, then 42,000 BTC by the tip of 2026, earlier than going for its closing goal of 105,000 BTC by 2027, the corporate mentioned on Thursday.

It plans to make use of fairness, debt financing and operational money circulate to succeed in its goal, and has appointed a brand new director to guide the plan.

Semler first bought Bitcoin in Could 2024 and mentioned it will proceed to purchase and maintain Bitcoin for the long run.

Bitcoin sentiment at ‘peak FUD’ with divide between bears and bulls — Santiment

Retail merchants are virtually evenly cut up on Bitcoin’s outlook, with sentiment at its lowest degree since April when Donald Trump’s international tariff announcement rattled markets.

Crypto analysis platform Santiment advertising and marketing director Brian Quinlivan mentioned on Thursday that with “crypto in a little bit of a lull, merchants are exhibiting indicators of impatience & bearish sentiment.”

He added the agency’s social media evaluation discovered that “there are simply 1.03 bullish feedback for each 1 bearish remark, which hasn’t occurred since peak FUD [fear, uncertainty and doubt] throughout preliminary tariff reactions on April 6.”

Telegram’s Pavel Durov accredited to depart France briefly

Telegram founder Pavel Durov gained courtroom approval to depart France for as much as 14 days to journey to Dubai, United Arab Emirates, the place the corporate is headquartered.

Durov shall be allowed to depart France on July 10 after having a journey request denied by French officers in Could, in accordance with French information outlet Le Monde.

The manager had requested permission to journey to Oslo, Norway, to ship a keynote handle on the Human Rights Basis’s Oslo Freedom Discussion board, which was introduced remotely after French officers rejected his journey utility.

Winners and Losers

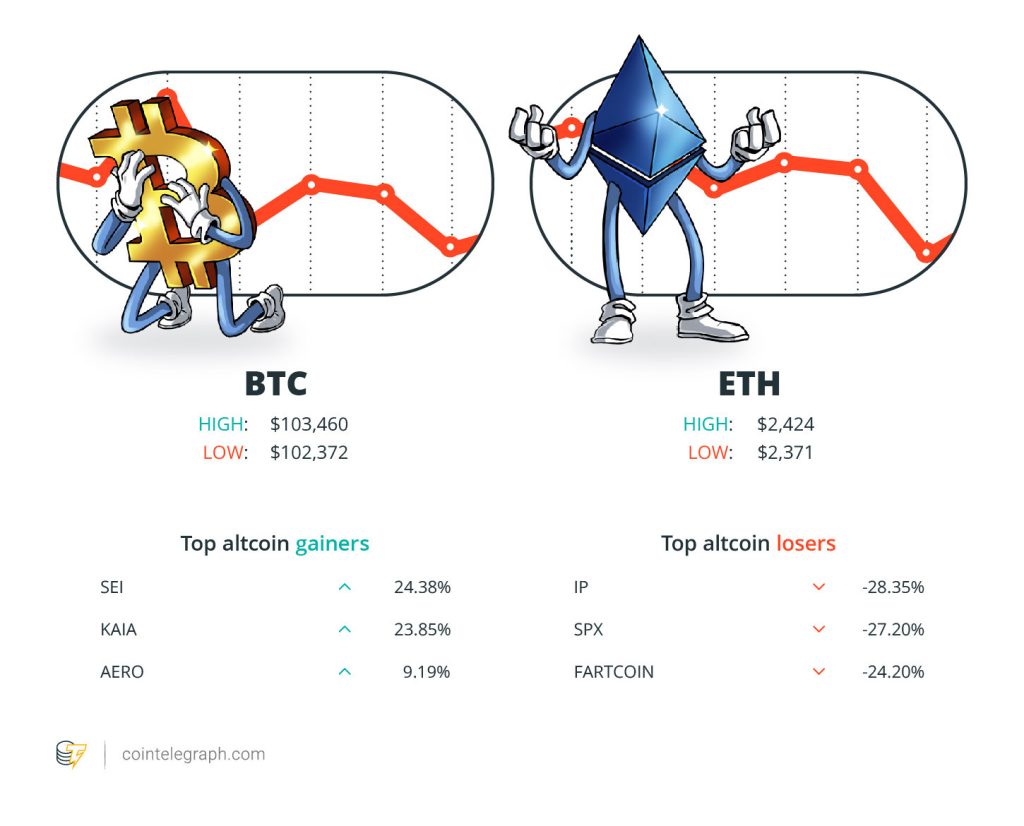

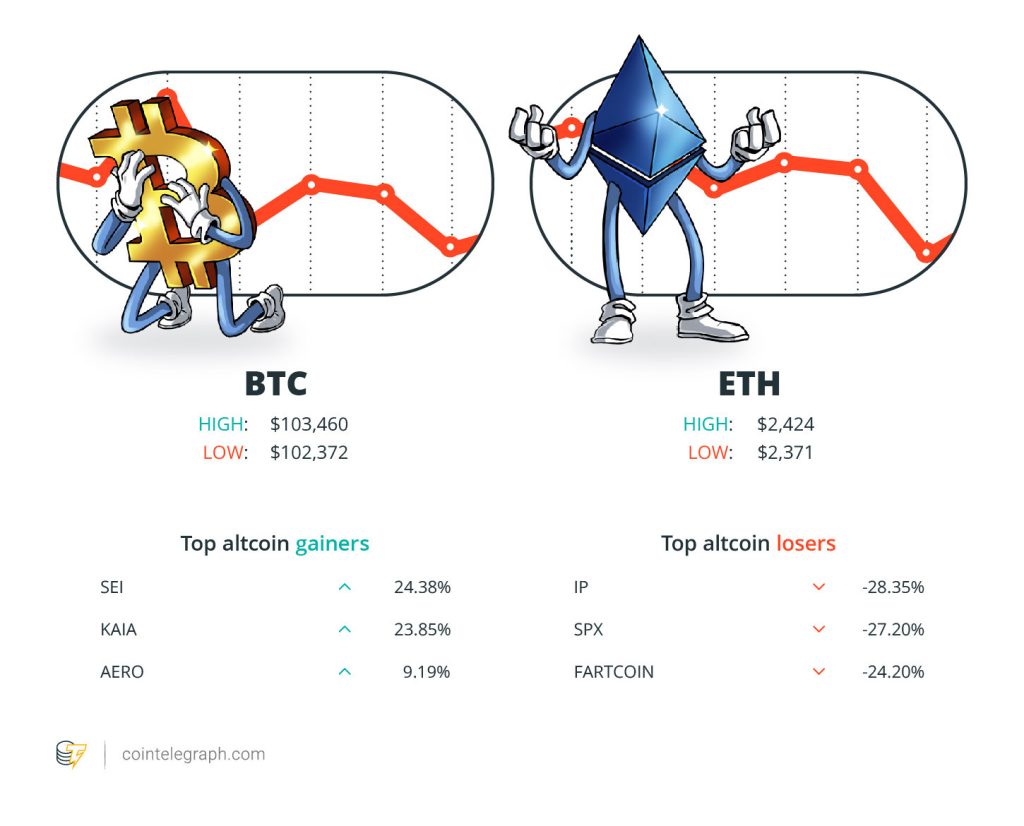

On the finish of the week, Bitcoin (BTC) is at $103,460, Ether (ETH) at $2,424 and XRP at $2.12. The whole market cap is at $3.20 trillion, in accordance with CoinMarketCap.

Among the many largest 100 cryptocurrencies, the highest three altcoin gainers of the week are Sei (SEI) at 24.38%, Kaia (KAIA) at 23.85% and Aerodrome Finance (AERO) at 9.19%.

The highest three altcoin losers of the week are Story (IP) at 28.35%, SPX6900 (SPX) at 27.20% and Fartcoin (FARTCOIN) at 24.20%. For more information on crypto costs, ensure that to learn Cointelegraph’s market evaluation.

Most Memorable Quotations

“Each platform ought to have a ‘will perform’ in order that when somebody is not round, their property may be distributed to designated accounts in accordance with specified proportions.”

Changpeng “CZ” Zhao, founder and former CEO of Binance

“Wall Road needs Bitcoin and crypto property.”

Anthony Pompliano, crypto entrepreneur

“The itemizing marks the start, not the tip of this cycle’s stablecoin mania.”

Arthur Hayes, co-founder and former CEO of BitMEX

“A powerful stability sheet constructed on Bitcoin permits us to considerably enhance our brokerage operation whereas sustaining full publicity to Bitcoin’s upside potential.”

Torbjørn Bull Jenssen, CEO of K33

“Conventional cross-border cost infrastructures may be simply politicized and weaponized, and used as a software for unilateral sanctions, damaging international financial and monetary order.”

Pan Gongsheng, governor of the Individuals’s Financial institution of China

“The markets aren’t totally Bitcoin targeted; as a matter of truth, it’s shifting towards Ethereum.”

Michaël van de Poppe, founding father of MN Capital

Prime Prediction of The Week

Historic Bitcoin development requires $330K BTC value earlier than bull market ends

Bitcoin’s value has had a rocky month, however current evaluation signifies that BTC may surge one other 300% this cycle. Technical analyst Gert van Lagen’sX posthighlights the AVIV Ratio, a metric that compares Bitcoin’s energetic capitalization (cash in movement) to its complete invested capitalization (realized capital, excluding miner rewards).

Traditionally, when the AVIV Ratio crosses its +3σ imply deviation, it has signaled a cycle high. For instance, BTC was $1,200 in 2013, close to $20,000 in 2017, and round $69,000 in 2021.

At the moment, the AVIV Ratio’s degree stays under these previous peaks, suggesting Bitcoin may climb to at the very least $330,000 this cycle, earlier than the +3σ imply deviation situation is met.

FUD of The Week

Norway’s authorities explores crypto mining ban amid vitality provide considerations

The federal government of Norway is contemplating a short lived ban on crypto mining within the nation in an effort to “liberate energy, community capability and space for different functions.”

In a Friday discover, the Norwegian authorities mentioned it will be conducting an investigation in autumn that would end in a short lived ban on crypto mining information facilities. Officers mentioned they’d the authority to implement such a ban below Norway’s Planning and Constructing Act, which incorporates provisions on allocating vitality.

“It’s unsure how large an issue crypto mining will turn out to be in Norway sooner or later,” the discover reads. “The registration requirement within the new information middle rules will present elevated data concerning the scope of knowledge facilities that mine cryptocurrency.”

Learn additionally

Options

You don’t have to be indignant about NFTs

Options

May a monetary disaster finish crypto’s bull run?

Crypto person attacked in France over Ledger {hardware} pockets — Report

France has reportedly seen one other incident concentrating on cryptocurrency customers, this time involving the kidnapping of a 23-year-old man in a Paris suburb.

In keeping with a Thursday report from French information outlet Le Parisien, the sufferer was kidnapped in Maisons-Alfort and held captive for a number of hours whereas the perpetrators demanded his companion to show over 5,000 euros ($5,764) in money, together with the important thing to a Ledger {hardware} pockets containing an unreported quantity of crypto.

The report advised that the criminals used violence to extract data concerning his digital property.

The unnamed man was reportedly held captive on Tuesday earlier than being launched within the city of Créteil.

Politicians’ memecoins, dropped courtroom circumstances gasoline crypto ‘crime supercycle’

Memecoins promoted by political figures like Donald Trump, lax rules, and crypto courtroom circumstances deserted by US regulators have kicked off a crypto “crime supercycle,” say a pair of blockchain crime investigators.

Learn additionally

Options

What do crypto market makers truly do? Liquidity, or manipulation

Options

Easy methods to stop AI from ‘annihilating humanity’ utilizing blockchain

Pseudonymous blockchain investigator ZachXBT posted to X on Thursday that crypto has traditionally been ripe for abuse, however that has “noticeably elevated since politicians launched memecoins and quite a few courtroom circumstances have been dropped, additional enabling the conduct.”

He claimed crypto influencers and key thought leaders face “zero repercussions” for scamming their followers.

“That mentioned, there’s by no means been a worse time to be doing black hat, phishing, social engineering, robberies, vs. grey hat exercise when the present atmosphere is favorable,” ZachXBT added.

Prime Journal Tales of The Week

New York’s PubKey Bitcoin bar will orange-pill Washington DC subsequent

For a group that’s primarily on-line, the brick-and-mortar bar PubKey provides Bitcoiners the possibility to drink, fellowship and orange-pill the neighborhood.

WeChat associates assist crypto thieves, Korbit denies hack: Asia Specific

Scammers are exploiting WeChat’s safety function to steal crypto, South Korean change goes darkish for 12 hours however denies hack, and extra.

Bitcoin’s invisible tug-of-war between fits and cypherpunks

Bitcoin’s complete schtick was about sticking it to the large banks and governments, not becoming a member of them.

Subscribe

Essentially the most participating reads in blockchain. Delivered as soon as a

week.

Editorial Workers

Cointelegraph Journal writers and reporters contributed to this text.

Learn additionally

Hodler’s Digest

Bitcoin plunges, Ethereum suffers, Musk loses billions: Hodler’s Digest, Feb. 21–27

Editorial Workers

10 min

February 27, 2021

The perfect (and worst) quotes, adoption and regulation highlights, main cash, predictions and far more — one week on Cointelegraph in a single hyperlink!

Learn extra

Hodler’s Digest

2020 particular! New information, mega weirdness, the predictions that got here true: Hodler’s Digest, Dec. 20–26

Editorial Workers

9 min

December 26, 2020

The perfect (and worst) quotes, adoption and regulation highlights, main cash, predictions and far more — one week on Cointelegraph in a single hyperlink!

Learn extra