- SUI has accomplished a bearish head and shoulders sample, with value now trending decrease.

- Token is buying and selling beneath key transferring averages, reinforcing short-term weak spot.

- Retests of damaged assist may set off extra promoting if bulls fail to regain momentum.

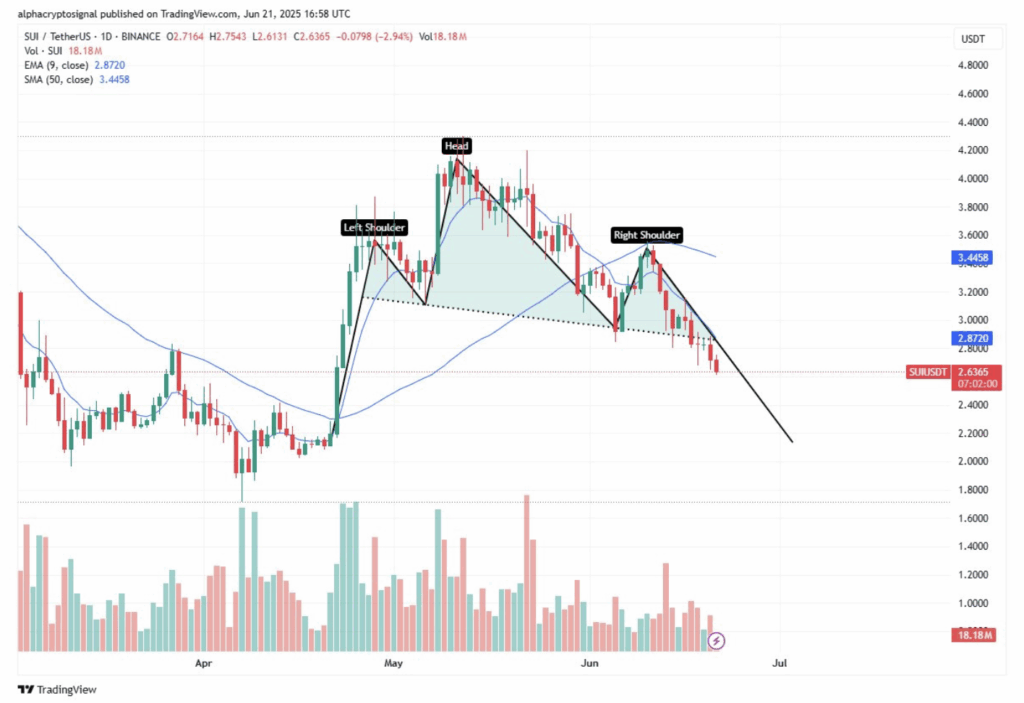

Issues aren’t wanting nice for SUI proper now. The governance token of the Sui blockchain simply accomplished a textbook head and shoulders sample, and if you already know your charts, that’s often a nasty omen. In accordance with a latest publish by Alpha Crypto Sign, the sample has already damaged down—and sellers are beginning to step in laborious.

A Bearish Sample That’s Arduous to Ignore

So what’s the cope with the top and shoulders factor? Mainly, it’s a construction the place value makes one excessive, dips, then shoots larger (the “head”), dips once more, and at last makes a decrease excessive earlier than giving up and sliding down. SUI’s chart? It’s bought all of the elements.

The “left shoulder” confirmed up again in April. The large peak (aka the “head”) got here in Might, and the “proper shoulder” wrapped up earlier this month. After that, the neckline assist—which held up throughout earlier dips—simply gave out. And that break? It’s a sign. One which often screams: be careful beneath.

Since then, SUI has began printing decrease highs and decrease lows, a basic signal of a downtrend in movement. Translation? The token isn’t simply struggling to recuperate—it’s steadily shedding worth.

Worth Slips Under Key Transferring Averages

On the time of writing, SUI’s buying and selling round $2.63, down almost 3% up to now day. It’s now sitting below each the 9-day EMA and the 50-day SMA, which mainly confirms what we’re seeing on the chart: weak spot. Not short-term weak spot, both—one thing extra sustained.

Alpha Crypto Sign notes that until SUI reclaims the neckline quickly, the downtrend most likely sticks round. Proper now, the bias is firmly bearish. Any short-term bounce? May simply be one other setup for extra promoting.

Retest Incoming? Sellers Might Be Ready

Merchants who’re watching this carefully would possibly search for a weak retest of that neckline—the one which simply broke. If value makes it again up there and stalls out, anticipate extra promote strain to point out up quick. Every mini pump may grow to be a contemporary excuse to dump extra tokens.

Except one thing modifications quick, this setup doesn’t favor the bulls.