- XRP is seeing explosive development in lively wallets, new partnerships, and upcoming good contract help.

- Institutional cash is flowing in, because of native compliance options.

- Ethereum nonetheless owns DeFi, nevertheless it’s caught ready on upgrades and regulatory readability.

Alright—image this: somebody fingers you $5,000 and says, “Decide one crypto. Just one.” Do you go together with XRP, the chain that’s slowly successful over Wall Avenue with its regulatory-friendly rails? Or do you wager on Ethereum, the OG platform nonetheless powering half the decentralized finance universe? It’s not a easy alternative. These two play very totally different video games—however each have a shot at severe long-term returns.

That mentioned… one among them appears to be like like the higher transfer proper now. Let’s unpack it.

XRP: Actual-World Momentum Is Arduous to Ignore

XRP’s been heating up in methods which are actually arduous to brush off. In accordance with Ripple’s newest knowledge, the variety of lively wallets on the XRP Ledger jumped 142% quarter over quarter, hitting a two-year excessive of 134,600. That type of development doesn’t occur except there’s actual curiosity—and clearly, persons are exhibiting up to make use of the chain.

The massive distinction right here? XRP’s consumer base leans closely institutional. We’re speaking about entities with precise capital to maneuver, not simply retail FOMO. Ripple’s been lining up partnerships that matter—like its new cross-border cost hall within the UAE with Zand Financial institution and Mamo, embedding XRP into one of many busiest remittance networks on the planet.

And it’s not stopping there. Extra stablecoins are launching on XRP Ledger, and even perhaps extra vital, there’s an EVM-compatible sidechain rolling out this quarter. That’ll open up the chain to good contract performance—the identical type Ethereum is thought for. Consider it as pulling a few of ETH’s dev vitality proper into the XRP ecosystem.

Even in case you don’t know what an EVM or sidechain is, right here’s the takeaway: XRP’s about to get much more versatile, and which means extra devs, extra apps, and probably extra worth.

Institutional Cash’s Taking Discover

In accordance with Ripple’s markets report, XRP-based funding merchandise pulled in $37.7 million in web inflows in Q1—nearly rivaling Ethereum, regardless of ETH having a market cap greater than double XRP’s. That type of momentum says one thing.

And right here’s what XRP’s doing that Ethereum isn’t: it’s baking KYC and AML compliance straight into its protocol. No third-party widgets, no messy good contracts. For establishments? That’s an enormous win. And as extra money goes on-chain, this sort of baked-in compliance is gonna matter. Lots.

If Ripple delivers on its roadmap—sidechain, new corridors, extra adoption—then XRP’s setup appears to be like downright bullish proper now.

Ethereum: Nonetheless a Big, However Slower to Transfer

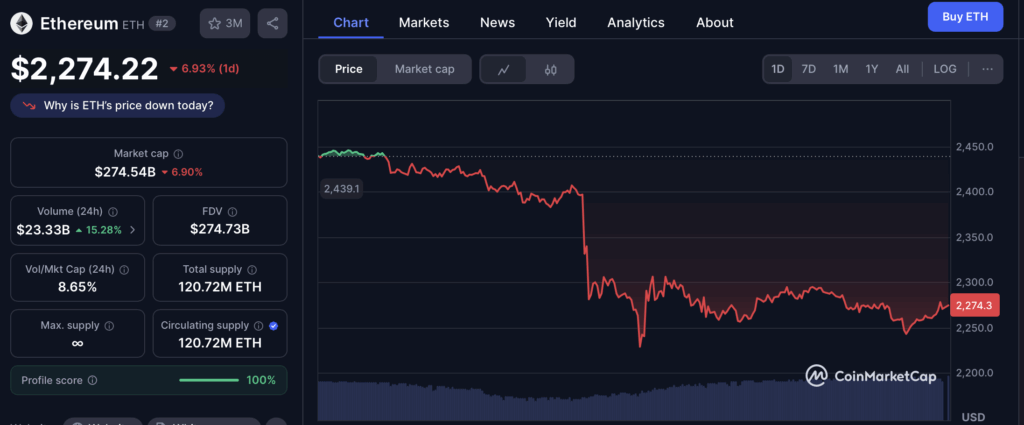

Let’s be clear—Ethereum’s not out of the race. Not by a protracted shot. Nevertheless it’s been in type of a funk. Worth-wise, it’s down 29% over the past 12 months. Developer and consumer curiosity has waned. The vibes? Meh.

Nonetheless, there are indicators of life. The latest Pectra improve, which went stay in early Might, added smoother identification options, decrease gasoline charges, and a bit extra scalability. It’s a stable step ahead. And regardless of the hunch, Ethereum nonetheless instructions 55% of all worth locked in DeFi. That’s not nothing.

What’s holding it again? Regulation. Ethereum’s compliance framework is fragmented. KYC? Is dependent upon the dApp. Token requirements? All over. If Ethereum needs severe institutional capital, it wants extra consistency. And quick.

The bull case for ETH hinges on two huge “ifs”:

- If upgrades like Pectra result in a smoother, cheaper, sooner ecosystem…

- And if it nails standardized, regulation-friendly tooling…

If each hit, ETH may simply 2x or extra in just a few years. Nevertheless it’s not assured. And it’s positively not quick.

Verdict: XRP Will get the Edge (For Now)

For those who’re having a bet in the present day, with $5,000 on the road, XRP appears to be like just like the stronger play. Actual-world utilization? ✅ Rising institutional traction? ✅ Regulatory alignment? ✅ It’s all lining up—and quick.

Ethereum nonetheless issues. It’s the spine of DeFi. However proper now, it’s transferring slower. And on this market, pace issues.