- Ethereum dropped 2% in 24 hours however noticed $274M in whale accumulation

- Stablecoin deposits rose almost $30M, hinting at rising consumer and investor exercise

- ETH nonetheless trails far behind Bitcoin and the S&P 500 in year-to-date returns, elevating issues for broader enchantment

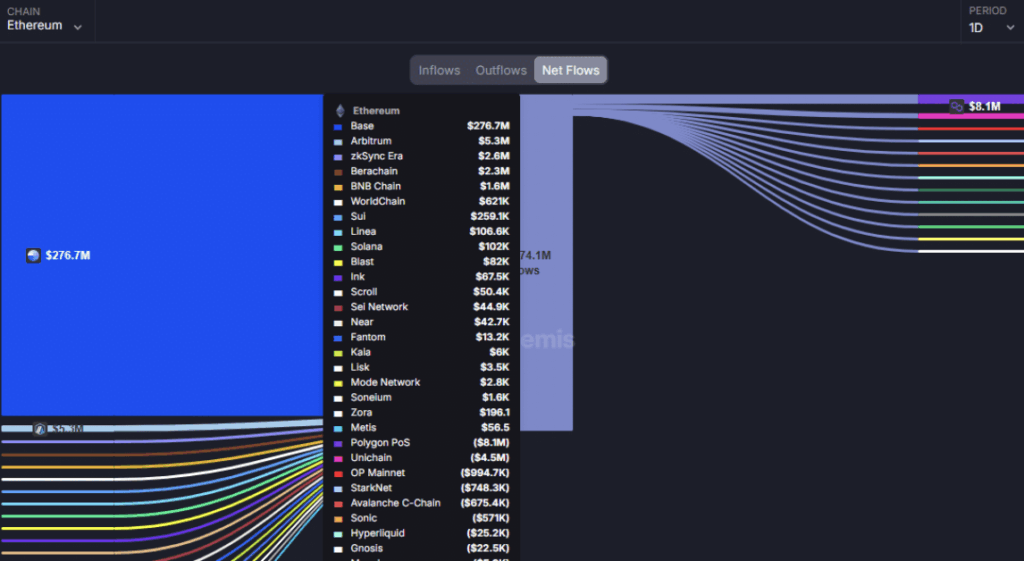

Ethereum didn’t precisely have an amazing day — it dropped round 2% within the final 24 hours, caught up within the broader market tumble. Nonetheless, there’s a twist within the story. Regardless of the worth dip, whales have been quietly scooping up ETH. In truth, greater than $274 million flowed into Ethereum only in the near past, principally by way of cross-chain purchases. That’s a hefty quantity, and it’s elevating eyebrows.

Layer 2s like Base and Arbitrum have been buzzing, contributing huge chunks of the liquidity inflow. And that wasn’t the one bullish signal — stablecoin provide on Ethereum jumped by almost $30 million in the identical timeframe. These sorts of strikes normally level to rising consumer engagement and anticipation of larger performs forward.

Weekend Strikes, Monday Momentum?

It’s fascinating timing. These sorts of weekend strikes — particularly huge netflows and stablecoin exercise — usually come simply earlier than a powerful Monday open. May whales be front-running some institutional performs? Probably. There’s been chatter about spot Ethereum ETFs influencing market sentiment on Mondays earlier than. So if this weekend’s rhythm follows previous patterns, we may be in for a shock bounce when the brand new week kicks in.

However in fact, nothing’s assured in crypto. The market’s moody, and optimism alone doesn’t all the time transfer value. Nonetheless, this type of capital rotation means that sensible cash isn’t operating away from ETH — if something, it’s organising store early.

Ethereum vs. the Massive Canines: A Robust Comparability

Now, zooming out a bit — Ethereum’s efficiency doesn’t look so scorching subsequent to its rivals. In comparison with Bitcoin and the S&P 500, ETH is kinda lagging behind. Bitcoin’s up over 58% this 12 months, the S&P’s gained a modest 10%, and Ethereum? Down 35%. That’s not an amazing search for anybody making an attempt to pitch ETH as a number one funding proper now.

The underperformance may spook some buyers, particularly these searching for safer performs. With Bitcoin now being talked about extra like gold — a digital retailer of worth — ETH begins to look a bit extra speculative by comparability. It’s nonetheless a tech play, not but a protected haven.

The place Does ETH Go From Right here?

It’s a combined bag for Ethereum. Value is down, however on-chain habits and whale exercise are displaying confidence. When you’re bullish, you may argue that that is simply accumulation earlier than the following leg up. When you’re extra cautious, the underperformance in comparison with BTC and legacy markets might need you pondering twice.