Pi Community’s extended decline has prolonged into one other week, with the token shedding almost 16% of its worth amid a broader market lull.

As macro uncertainty intensifies and Pi’s scheduled each day token unlocks proceed to weigh closely on sentiment, the downward stress seems removed from over.

Sellers Dominate as PI Falls Beneath Key Thresholds

Since reaching an all-time excessive of $3 on February 25, PI has recorded constant weekly losses, with no vital demand inflows to halt the slide.

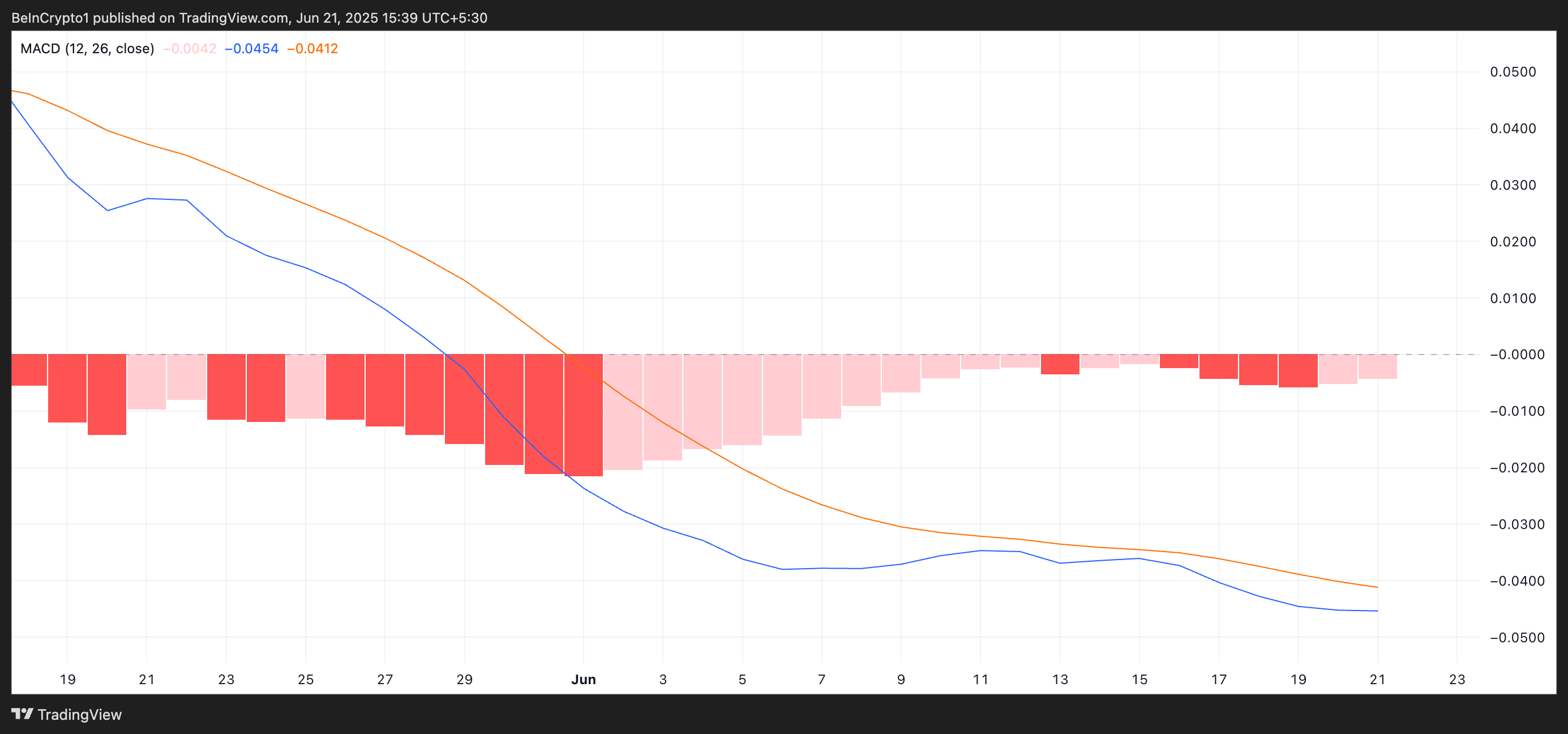

On the each day chart, the readings from the token’s Shifting Common Convergence Divergence (MACD) indicator replicate the deepening bearish momentum. At press time, PI’s MACD line (blue) rests under the sign line (orange).

The MACD indicator identifies tendencies and momentum in its worth motion. It helps merchants spot potential purchase or promote indicators by means of crossovers between the MACD and sign strains.

As with PI, when the MACD line rests under the sign line, it signifies waning shopping for exercise. Merchants see this setup as a promote sign. Therefore, it may exacerbate the downward stress on PI’s worth.

Furthermore, PI’s detrimental Steadiness of Energy (BoP) reveals that sellers stay firmly in management. As of this writing, the indicator is at -0.12.

The BoP indicator measures the power of consumers versus sellers out there, serving to to establish momentum shifts. When its worth is optimistic, consumers dominate the market over sellers and drive newer worth features.

Conversely, detrimental BoP readings sign that sellers are dominating the market, with little to no resistance from consumers. This factors to sustained downward stress and weakening investor confidence.

For PI, the detrimental BoP readings reinforce the bearish outlook. It means that promoting momentum might persist until new demand emerges.

Pi Community Struggles Beneath Key EMA Degree

At the moment, PI trades at $0.53, exchanging arms under its 20-day exponential transferring common (EMA), which kinds dynamic resistance above its worth at $0.56.

The 20-day EMA measures an asset’s common worth over the previous 20 buying and selling days, giving extra weight to current costs. When an asset’s worth trades under its 20-day EMA, it indicators short-term bearish momentum and potential continued draw back. If the bears retain management, they might drive PI’s worth to revisit its all-time low at $0.40.

Nonetheless, a rebound may push the Pi Community’s token above the 20-day EMA and towards $0.79.

Disclaimer

In keeping with the Belief Mission pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. All the time conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.