This week, a number of crypto information tales are within the pipeline, with excessive potential to maneuver the market. For some, nevertheless, the affect might be ecosystem-specific, with associated tokens sure to exhibit volatility.

Merchants seeking to capitalize on the anticipated volatility ought to monitor this week’s crypto information and headlines.

Potential Iran Retaliation Towards the US

Following US President Donald Trump’s directive attacking Iran’s nuclear websites, the market anticipates a retaliation. Already, Iran has taken a daring stance following the assault, closing the Strait of Hormuz, successfully constraining a key oil gateway.

A retaliation could be unsurprising, given Iran’s latest transfer hitting the Israeli Inventory Trade constructing in Tel Aviv. The assault was retaliatory, after Israeli-linked cyberattacks affected Iran’s banking system and destroyed tens of thousands and thousands of {dollars} in digital belongings.

Iran’s retaliation might ship threat belongings into freefall, with analysts speculating a 20% drop within the Bitcoin worth. The implications for the Bitcoin worth could possibly be excessive as international locations rally assist amid escalating pressure.

Injective Summit

One other crypto information occasion to observe this week is the Injective Summit, which kicks off June 26, 2025, in New York. The occasion is pivotal for the blockchain finance ecosystem.

Injective, a high-performance Layer 1 (L1) blockchain, is predicted to unveil a significant announcement, doubtlessly associated to its Injective EVM or Actual-World Asset (RWA) Module, which can improve institutional adoption.

“Get able to witness game-changing bulletins, main reveals and the following evolution of finance,” the community stated lately.

With a deal with decentralized derivatives and interoperability, the summit could spotlight new dApps or partnerships, constructing on its $137 million day by day buying and selling quantity.

Attendees anticipate updates on protocol governance or burn auctions, reinforcing INJ’s deflationary mannequin. The occasion will unite builders, buyers, and Web3 innovators, amplifying Injective’s function in borderless DeFi.

The attendees embody Thomas Cowan, the pinnacle of tokenization at Galaxy Digital; Kyle DaCruz, the director of digital belongings product at VanEck; and Josh Olszewicz, the pinnacle of buying and selling at Canary Capital. Federico Brokate, the pinnacle of US Enterprise at 21 Shares, can even attend.

Infinex Large Announcement

The Infinex ecosystem can be among the many crypto information headlines this week. It’s a DeFi protocol constructed on Synthetix and Base chain.

Infinex is predicted to make a major announcement on Tuesday, June 24, possible unveiling Infinex Join.

This function might streamline cross-chain interactions throughout EVM chains and Solana, enhancing the consumer expertise of its non-custodial pockets. Infinex Join could combine protocols like Synthetix Perps V3 or Aave, providing seamless buying and selling, staking, or lending.

Following its $67.7 million NFT sale, Infinex goals to rival centralized exchanges with a Web2-like UX. The announcement might additionally make clear governance level conversions, regardless of Kain Warwick’s anti-airdrop stance.

Synthetix DEX Launch

Synthetix, a derivatives liquidity protocol, is about to launch its decentralized perpetual futures change on Ethereum Mainnet quickly, marking a return from Optimism rollups.

This transfer goals to consolidate liquidity and cut back fragmentation points confronted on Layer-2 networks. The change will leverage Synthetix’s Perps V3, providing low-slippage buying and selling with sUSD and SNX collateral.

A proposed acquisition of Derive’s off-chain matching engine (SIP-415, later withdrawn) hints at ambitions for high-speed derivatives.

With 170 million SNX staked and 19.83% APY yields, the launch might appeal to important TVL.

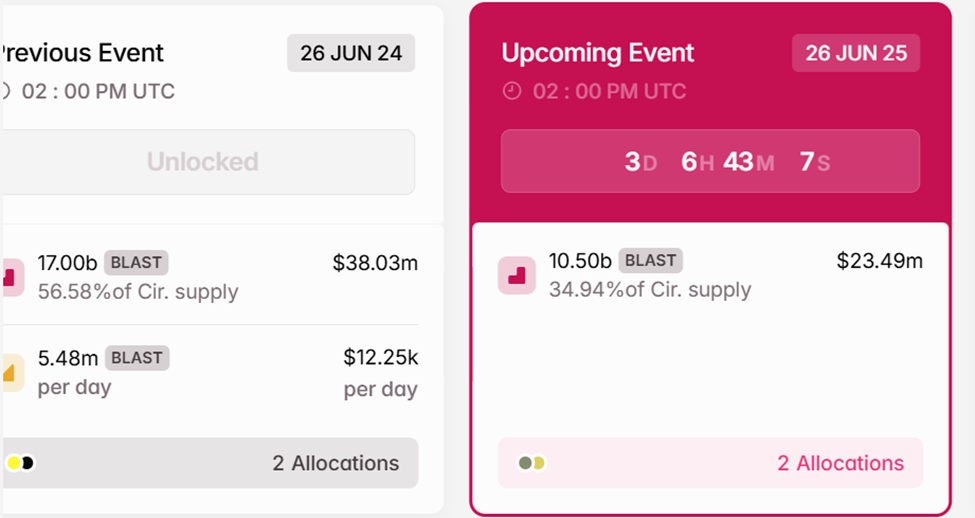

$23 Million BLAST Token Unlock

One other spotlight of this week’s crypto information is that on June 26, $23.49 million value of BLAST tokens, representing 34.94% of its circulating provide, will unlock. This high-volume unlock, constituting 10.5 billion BLAST tokens, might introduce market volatility.

BLAST, related to Ethereum L2 scaling options, follows a development of great unlocks, as seen with Taiko’s $46 million occasion.

Historic information suggests giant unlocks usually set off sell-offs, particularly if early recipients money out for early features. Information on Tokenomist.ai reveals the tokens might be allotted to core contributors and buyers.

The unlock might affect BLAST’s worth, which was buying and selling for $0.00223 as of this writing, up by over 3% within the final 24 hours.

Disclaimer

In adherence to the Belief Venture pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nevertheless, readers are suggested to confirm information independently and seek the advice of with an expert earlier than making any choices based mostly on this content material. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.