- Sensible cash is sitting on huge AVAX earnings however hasn’t bought—but.

- Retail sentiment is bearish, with elevated promoting and quick positions stacking up.

- AVAX wants to interrupt $19.81 to spark severe upside—however resistance and weak momentum would possibly get in the way in which.

After weeks of crimson candles, Avalanche (AVAX) lastly caught a break—climbing 2.62% within the final 24 hours. It’s the primary inexperienced day after a reasonably brutal 26% drop over the previous month. Not precisely celebration time, however hey, it’s one thing.

What’s attention-grabbing although? The rally appears to be using on the again of some severe good cash performs. These early buyers? They’re sitting on some juicy earnings, however they haven’t dumped but. That’s acquired some people considering this would possibly simply be the beginning of a pattern reversal. Or… is it simply the calm earlier than retail panic?

Massive Positive aspects for Sensible Cash—However They’re Not Promoting… But

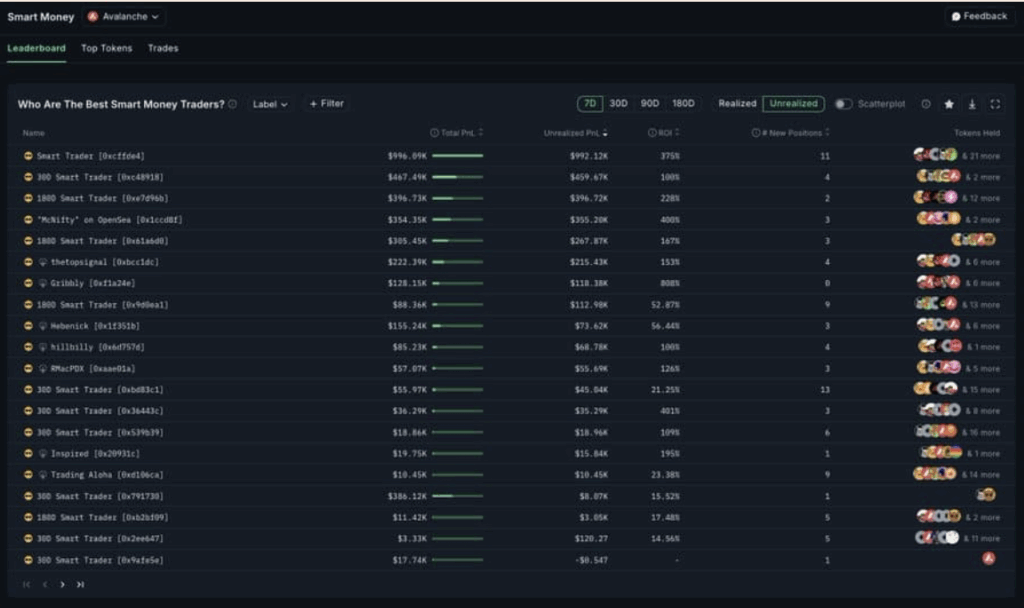

In keeping with Nansen, a bunch of AVAX’s so-called “good cash” gamers—y’know, the parents who time their buys higher than most—are up big. Like, 375% sort of big. Throughout 11 tracked wallets, they’re sitting on almost $1M in unrealized positive aspects, though AVAX continues to be down round 13% total.

Now usually, when good cash sees this sort of run, the playbook says they hit promote. Money out, transfer on. However… not this time. They’re holding. Which is odd. In the meantime, retail people? They’re working for the exits.

Retail Pulls Again, Shorts Stack Up

CoinGlass information paints a not-so-cheery image on the retail facet. Only a week in the past, retail buyers scooped up nearly $12M in AVAX. Now? They’re dumping. Within the final 24 hours alone, about $821K in promote stress got here from retail wallets.

On the derivatives facet, the temper’s souring too. Shorts are stacking up as small merchants wager AVAX is gonna fall once more. One key sign? The Open Curiosity Weighted Funding Fee—it simply dipped beneath zero to -0.0022%, a bearish inform if there ever was one.

So, you’ve acquired retail bailing out whereas the whales are oddly quiet. Bizarre setup, proper?

AVAX Chart Tries to Break Free—However Resistance Is Lurking

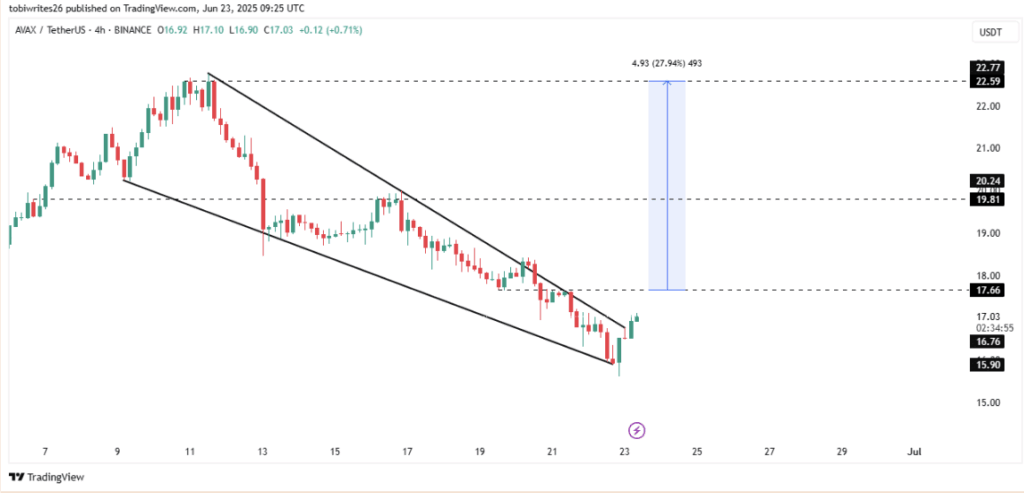

On the technical facet, issues aren’t all doom and gloom. AVAX broke out of its descending channel, which—usually—can sign the beginning of a run again to earlier highs. However… it’s not a clean path up.

First, there’s a key resistance zone straight forward. If AVAX can punch by that, perhaps bulls stick round. However then comes the true take a look at: $19.81. If it breaks that? There’s room to run to $22. That’s a 27% soar from the present zone. Not dangerous—if it will get there.

But when promoting stress builds once more, this entire breakout might fizzle out simply as quick because it began.

Market Temper? Form of Meh.

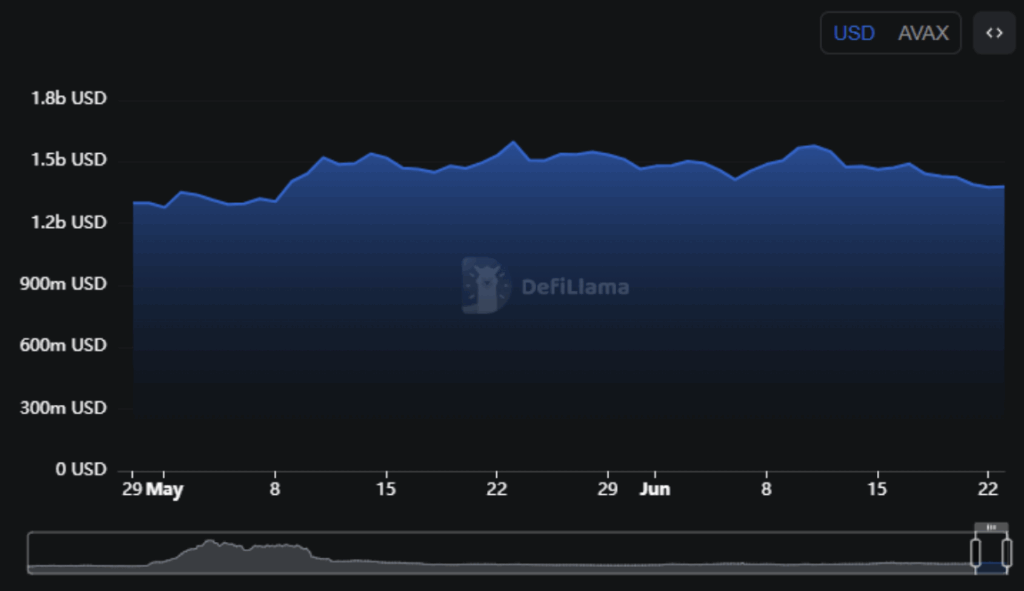

Taking a look at AVAX’s Complete Worth Locked (TVL), nothing’s actually modified. No huge spikes. No huge drains. It’s flat. Which kinda sums up the temper—buyers are watching, however nobody’s diving in headfirst.

With retail fleeing and sentiment turning shaky, this bounce may not have the gas to go the gap. If issues cool off much more, a pullback might be across the nook.