Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

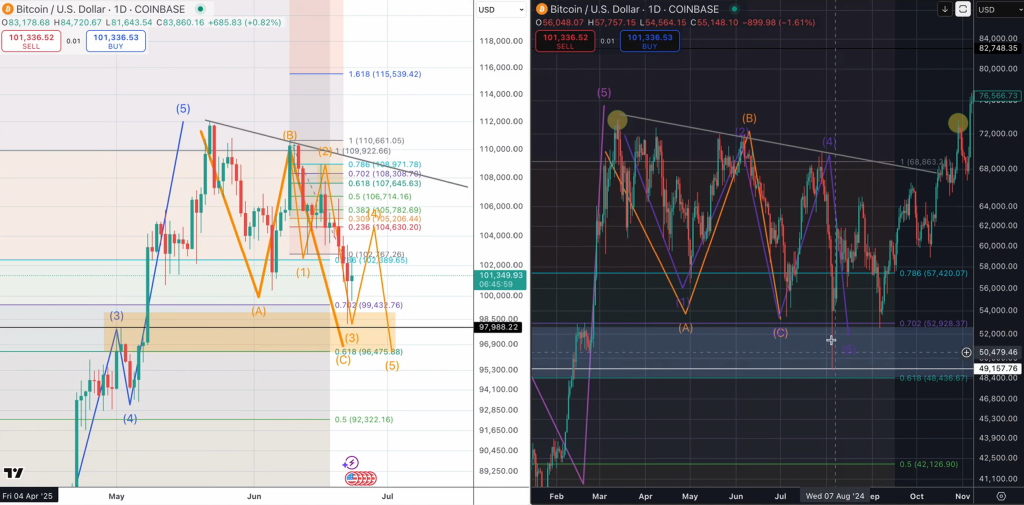

Bitcoin rallied above $105,000 in mid-morning European buying and selling on Tuesday, clawing again losses sustained over the weekend after dipping under six figures for the primary time since Could. But the respite might show fleeting, says veteran technician Quantum Ascend (@quantum_ascend).

Bitcoin Worth Mirrors 2021

On side-by-side charts of the present cycle and the 2021-to-2024 arc, the analyst argued that Bitcoin is “the identical actual sample—run-up, one excessive, again down, second excessive,” adopted by an ABC corrective sequence that in 2021 bottomed solely after a second, deeper flush. “Intestine says no,” he instructed viewers when requested whether or not final Friday’s sell-off had already marked capitulation. “We’ve been speaking about this ABC since March… folks had been calling for brand new lows; I stated nope, we obtained 5 waves on the high, we obtained an ABC after which we go— and that’s when the alts take off.”

His base case now envisions a reduction rally towards the $107,000–$108,000 band—the extent the place a trend-line projected from the 2 post-halving peaks intersects—earlier than a closing leg decrease drives value into what he calls the “ache field” sandwiched between the 0.702 and 0.618 Fibonacci retracements of your entire rally from final October’s $58,000 breakout. In 2021 that zone in the end depraved to the precise 0.618, a transfer he believes might repeat, implying spot ranges between roughly $96,500 and $92,000. “This measurement suits the parameter now… if it desires to show round and rip, nice,” he conceded, “however there’s nonetheless an excellent likelihood that was not the tip.”

Associated Studying

Internally, the analyst parses the present drop because the growing C-wave of a bigger flat, subdividing right into a basic five-wave impulse. Wave three, he notes, seems full; wave 4 “might come up excessive,” granting altcoins a short-lived pop, “however hopefully, once more, ahead of later, we roll over.” He cites 2021’s July fractal, when Bitcoin bounced 20% earlier than sliding a closing time, as a psychological template. “When there’s a giant information narrative occasion,” he noticed, “we’ll get just a little reduction—folks suppose it’s performed—then wham, another factor to scare retail.”

Macro sentiment, he argues, stays fragile. The Chicago Mercantile Alternate hole at $92,000 is drawing “average-retail” bids, a setup he characterises as a “washer” during which skilled cash fronts liquidity solely to fade it. “Retail is only a washer, man… that purchase isn’t going to get stuffed,” he warned. Nonetheless, he reiterated long-term optimism, revealing he “hammered some buys” throughout Monday’s dip and advising his followers to dollar-cost common—“not monetary recommendation”—by the turbulence.

Associated Studying

Quantum Ascend’s upside goal for the following impulsive advance is relatively restrained: $132,000, a stage he says enjoys “two items of confluence” and would coincide with “the alts second” when Bitcoin dominance lastly cracks. “We’ll ultimately work our means again up close to the highest of this B-wave… flag just a little, after which increase,” he predicted, referencing November 2021’s so-called “Trump pump” that ignited a multisector altcoin surge.

For now, merchants watch the 0.702–0.618 pocket and the mooted reduction ceiling at $108,000. Ought to Bitcoin slice by assist with out that interim bounce, the analyst says, the flush might conclude “ahead of later,” clearing the runway for what he calls “the following few months—our second.” In his sign-off he urged viewers to “be an grownup, dwell by it,” but additionally confessed palpable pleasure: “I really feel actually good about the place we’re at.” Whether or not the market shares his confidence will possible change into clear as soon as the ultimate C-wave verdict arrives—maybe, he hopes, inside the week.

At press time, BTC traded at $105,077.

Featured picture created with DALL.E, chart from TradingView.com