As volatility engulfs the cryptocurrency market amid warfare tensions, on-chain knowledge reveals that the Bitcoin short-term holders are promoting at a loss.

Bitcoin Brief-Time period Holders Simply Made Massive Alternate Inflows At A Loss

In a brand new submit on X, CryptoQuant writer Axel Adler Jr has talked about how the Bitcoin short-term holders have reacted to the worth volatility that has come alongside rising tensions within the Center East following US strikes on three nuclear services in Iran.

The short-term holders (STHs) seek advice from the BTC buyers who bought their cash throughout the previous 155 days. The opposite facet of the community, the holders with a holding time higher than 155 days, are termed because the long-term holders (LTHs). The previous group accommodates the brand new entrants and low conviction holders, who typically panic simply at any time when some change happens available in the market. Alternatively, the latter cohort consists of the veterans of the market, who have a tendency to sit down tight by means of crashes and rallies alike.

As such, given the latest sharp worth motion that has occurred within the sector, the STHs are prone to have made some strikes. And certainly, on-chain knowledge would verify so.

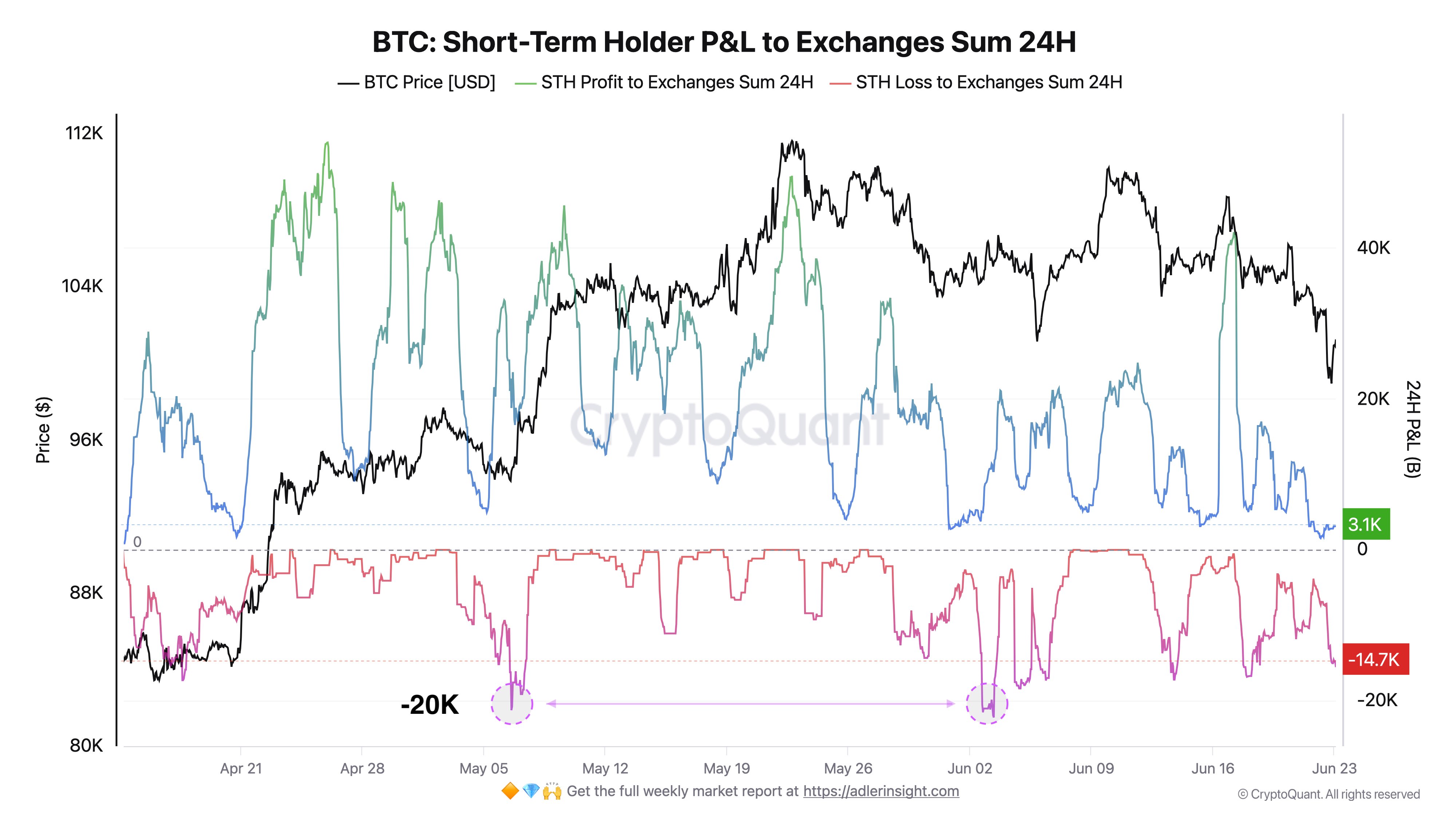

The above chart, shared by the analyst, reveals the info for the revenue and loss alternate deposit transactions that the STHs as an entire are making. Buyers normally switch to those centralized platforms after they wish to promote, so inflows going to them can present hints about whether or not promoting is elevated or not.

From the graph, it’s seen that the loss transactions going to the exchanges from this cohort have amounted to 14,700 BTC, which, though decrease than the 2 main capitulation occasions from the previous couple of months, is important. Thus, it could seem that a number of the STHs have reacted to the information by exiting the market, even when it means taking a loss.

It’s additionally obvious from the chart that the worthwhile transfers have remained comparatively low at 3,100 BTC. That is probably all the way down to the truth that the STHs are left with little revenue following the worth decline, because the on-chain analytics agency Glassnode has identified in an X submit.

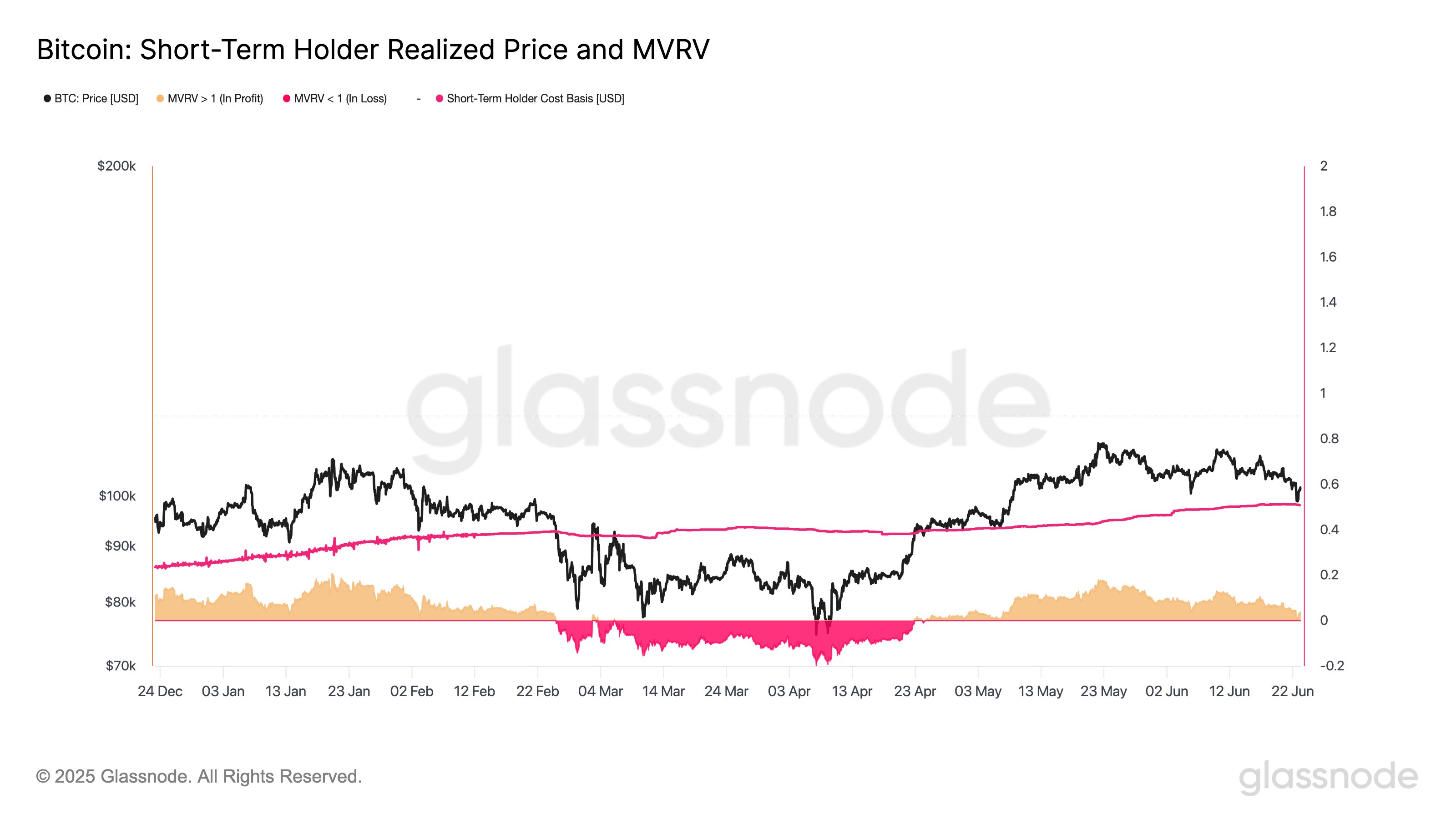

Within the chart, the pattern of the STH Realized Worth is displayed. This indicator retains observe of the Bitcoin price foundation or acquisition stage of the typical STH. Throughout the crash, the worth nearly retested the road, and even after the rebound, it stays near it, that means the revenue margin for the cohort remains to be tight.

BTC Worth

On the time of writing, Bitcoin is buying and selling round $101,300, down over 5% within the final week.