Crypto asset funding merchandise have continued to draw institutional capital for a tenth consecutive week, with CoinShares reporting $1.24 billion in web inflows throughout the latest seven-day interval.

This sustained development has now pushed whole year-to-date (YTD) inflows to $15.1 billion, marking a big milestone for the sector amid fluctuating market circumstances.

The weekly CoinShares report, launched earlier right now, famous that the robust influx momentum earlier within the week started to taper towards the tip, a growth attributed to the US Juneteenth vacation and geopolitical considerations involving US tensions with Iran.

Regardless of the slight cooldown, the information exhibits a broad sample of ongoing institutional engagement in digital asset markets, led by continued curiosity in Bitcoin and Ethereum-related merchandise.

Bitcoin and Ethereum Proceed to Lead Institutional Demand

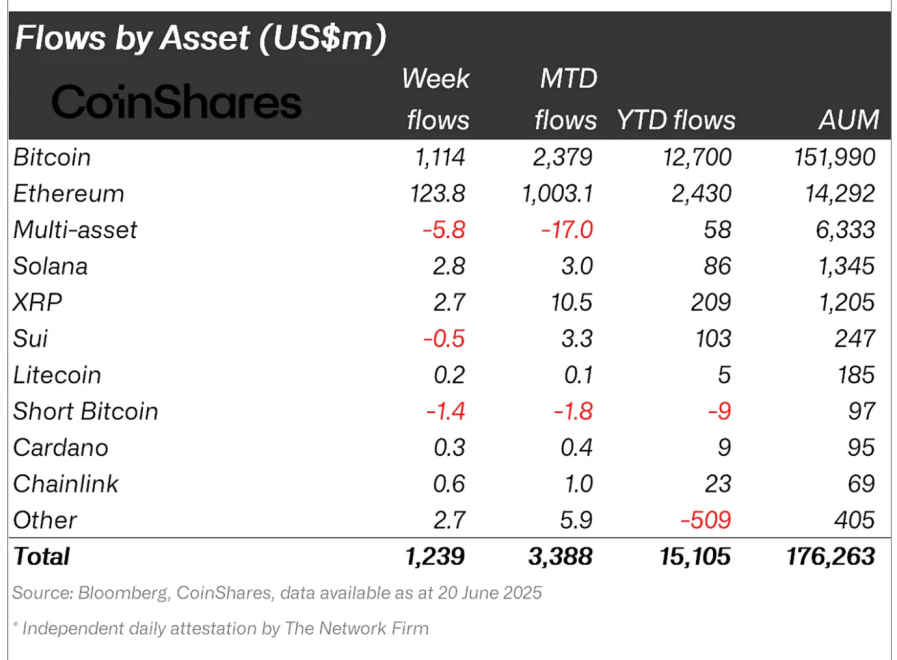

In line with the breakdown, Bitcoin-focused funding merchandise obtained $1.1 billion in web inflows for the week, marking the second straight week of great capital getting into BTC-related funds.

This occurred regardless of a broader worth correction within the asset, a sample CoinShares interprets as indicative of traders viewing the dip as a shopping for alternative. Supporting this sentiment, quick Bitcoin merchandise recorded outflows of $1.4 million, suggesting a lower in bearish positioning.

Ethereum additionally maintained its robust efficiency, with inflows of $124 million marking the ninth consecutive week of optimistic sentiment for the asset. Cumulatively, this has introduced inflows over the nine-week stretch to $2.2 billion, its longest sustained run of institutional shopping for since mid-2021.

Ethereum’s influx streak comes amid heightened curiosity within the community’s staking ecosystem and optimism surrounding future protocol upgrades.

Past the 2 main digital property, modest inflows have been additionally recorded in different altcoins. Solana funds noticed $2.78 million in inflows, whereas XRP-based merchandise attracted $2.69 million.

Although smaller in magnitude, these figures level to continued curiosity in diversified publicity past Bitcoin and Ethereum, significantly in property with robust infrastructure use circumstances.

Regional Developments Mirror Diverging World Sentiment

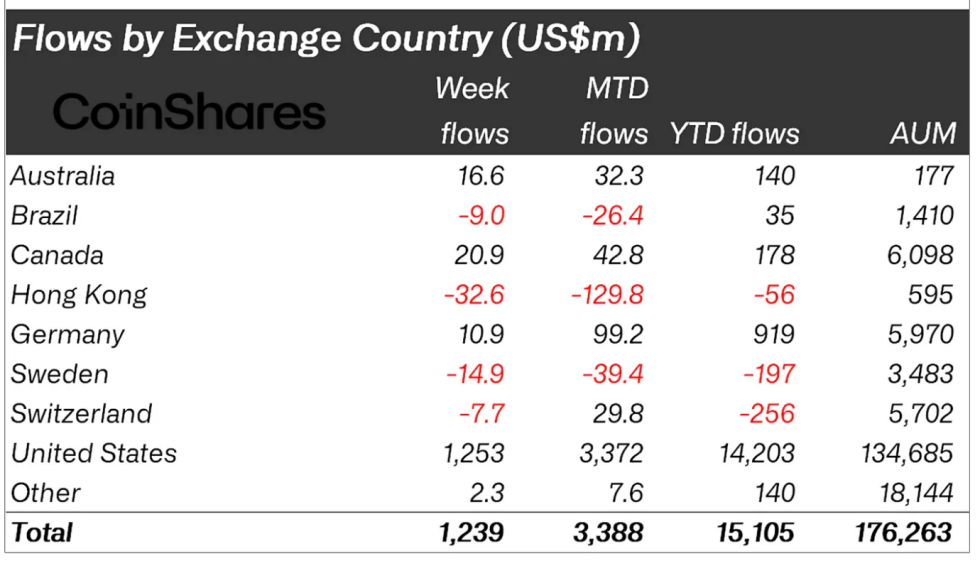

On a geographic foundation, the US market as soon as once more led in quantity, with $1.25 billion of the overall influx attributed to American traders. Canada and Germany additionally recorded web inflows, with $20.9 million and $10.9 million respectively.

In distinction, Hong Kong and Switzerland skilled outflows of $32.6 million and $7.7 million, highlighting a level of regional divergence in sentiment and positioning.

CoinShares Head of Analysis James Butterfill commented that whereas US inflows stay dominant, the week’s slowdown within the latter half might mirror broader market hesitance tied to holidays and geopolitical occasions.

Regardless of this, the mixture YTD determine of $15.1 billion displays rising institutional consolation with digital asset funding autos. The continued inflows come amid evolving regulatory discussions throughout main markets, together with potential approvals for brand spanking new digital asset merchandise and tax incentives for traders.

Featured picture created with DALL-E, Chart kind TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our workforce of prime expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.