- HYPE is up 300% since April, with Hyperliquid’s DEX transferring $420M each day and $1.75B TVL

- FDV of ~$38B may appear loopy, however robust tokenomics and market share soften the blow

- Centralization stays the largest caveat—velocity is nice, however resilience issues long run

One thing’s cookin’. Since bottoming out again in April, HYPE—the native token of Hyperliquid—has exploded greater than 300%. That’s proper, triple digits. It even clocked a recent all-time excessive this week earlier than cooling off only a bit. Not unhealthy for a protocol that’s, nicely, nonetheless flying underneath the radar for many of crypto Twitter.

However right here’s the kicker: the blockchain beneath? It’s stealthily grow to be one in every of DeFi’s high canines. No fluff—$1.75 billion in whole worth locked places Hyperliquid eighth amongst all chains, per DefiLlama. Its flagship DEX, smooth and quick as hell, is transferring over $420 million a day. That’s sixth place amongst decentralized exchanges. Oh, and Nasdaq-listed Lion Group? Yeah, they simply made HYPE their foremost treasury asset—allocating $600 million. Wild.

So… is that this the actual deal, or simply the newest rocket fueled by hypothesis?

What’s Below the Hood of Hyperliquid?

Constructed by a few Harvard grads—Jeff Yan and Iliensinc—Hyperliquid launched in 2023 and not using a dime of VC money. That alone’s fairly uncommon in immediately’s panorama. Their mission? Mix the self-custody and transparency of a DEX with the type of velocity you’d count on from a slick CEX.

They usually’ve sorta executed it. The person expertise is snappy—one-click trades, seamless deposits from 30+ chains, help for spot, margin, and perps. Fairly frictionless. They even sidestep token bridges through the use of perpetual contracts pegged to token costs as a substitute of transferring the tokens themselves. It’s intelligent… but it surely additionally means you sacrifice some composability.

Beneath all of it is a customized L1, operating a HyperBFT consensus variant—assume ultra-fast Byzantine fault tolerance. It supposedly handles as much as 200,000 transactions per second. However yeah, there’s a trade-off: decentralization. Proper now, there’s solely 21 validators on the community. Examine that to Ethereum’s 14,000+. Little bit of a crimson flag for some people.

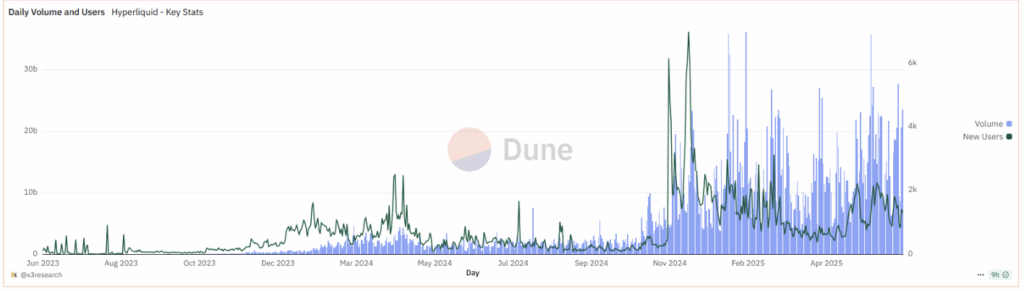

Nonetheless, it exploded in November 2024. Each day buying and selling quantity spiked from $2B to $20B nearly in a single day. Right this moment? Over 500,000 customers are energetic on the factor.

Let’s Speak HYPE—The Token, Not Simply the Buzz

Now for the cash stuff. HYPE launched through airdrop final November—31% of its 1 billion token provide was handed out to early customers. It grew to become the biggest airdrop in crypto historical past, with its market cap hitting $11B only a month later. Quick ahead, and 334 million tokens at the moment are value $12.4B, giving it a completely diluted valuation (FDV) of round $38B. That’s… loads.

HYPE’s utility? It’s the fuel, the governance, the staking token. You possibly can validate with it, stake it, vote with it. However does holding it actually give long-term worth?

Some aren’t satisfied. Moonrock Capital’s Simon Dedic, for one, straight up stated: “Love the undertaking. Unimaginable execution. However who’s shopping for at $50B FDV? Like significantly?” Truthful query.

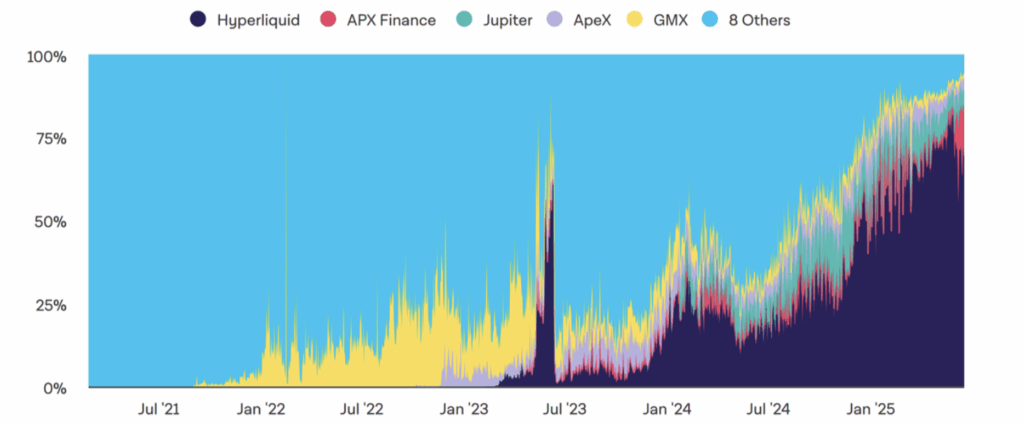

However others argue the valuation hole is overstated. Hyperliquid owns 70% of decentralized perpetual buying and selling proper now however nonetheless solely takes 10% of Binance’s whole perps quantity. That hole? May very well be a giant alternative—particularly if U.S. laws get friendlier.

Additionally value noting: HYPE’s tokenomics are tremendous tight. The platform reinvests practically all of its charge income—97%—again into HYPE by buybacks. Solely 34% of tokens are circulating. Staff tokens are locked ‘til 2027-28. And no VC overhead means nobody’s dumping simply to hit ROI targets.

So yeah, FDV is excessive… however perhaps not absurd, relying on the way you view long-term adoption.

Massive Cash’s Watching—However Centralization Lurks

Per analysts like Ansem, immediately’s consumers are in all probability late-stage VCs who missed the airdrop boat, TradFi guys operating P/E fashions on crypto (lol), and whales rotating out of ETH and SOL into what they assume is likely to be the following massive buying and selling layer.

That may very well be bullish.

Nonetheless, there’s a philosophical dilemma brewing. Traders have at all times flocked to centralized stuff as a result of it’s simpler. However historical past’s proven—FTX, Celsius, decide your poison—that decentralization isn’t only a flex. It’s insurance coverage in opposition to disaster. Hyperliquid’s validator set is tiny. That gained’t matter… till it abruptly actually does.