- Bitcoin funding merchandise noticed one other $1.1B in inflows, with year-to-date flows hitting $12.7B — largely from U.S. establishments.

- Value motion is going through stiff resistance between $110K–$112K whereas bearish RSI alerts and a double prime type on the weekly chart.

- If BTC fails to carry $100K, a dip towards $96K is feasible, particularly with brief liquidations piling up and analyst sentiment turning cautious.

Even with the market feeling shaky and whispers of capitulation spreading quick, huge gamers haven’t backed off Bitcoin. Truly, it’s fairly the alternative — institutional demand has stayed robust, possibly stronger than ever.

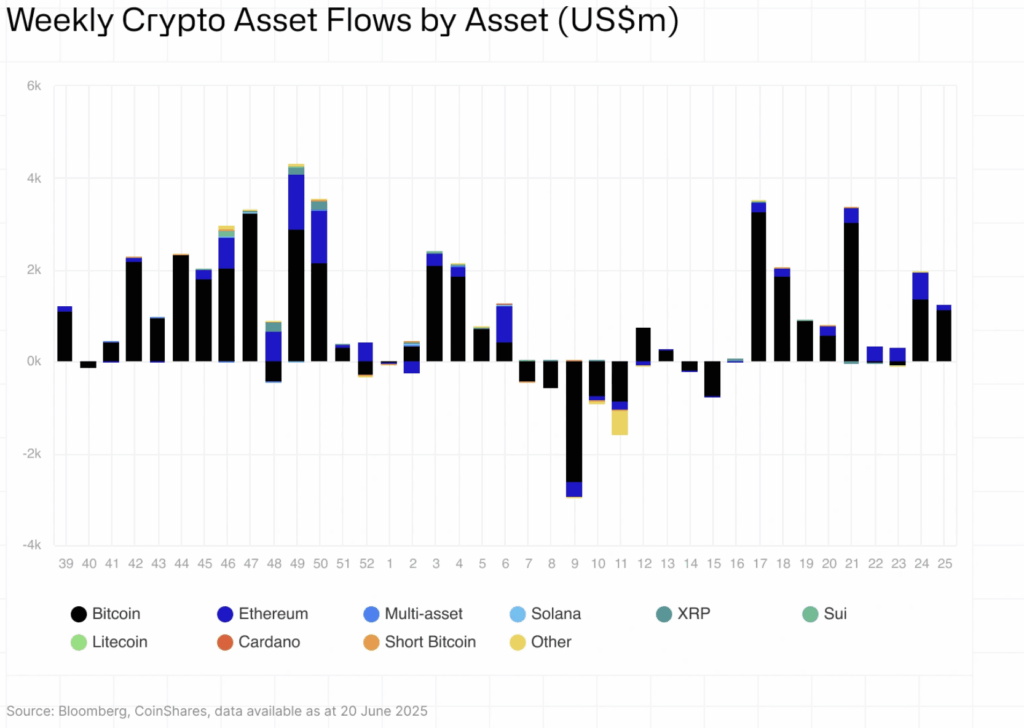

Information from CoinShares reveals BTC funding merchandise pulled in one other $1.1 billion final week. That’s the second week in a row of recent inflows. Altogether, the month-to-month whole sits round $2.38 billion, and year-to-date inflows are actually hovering close to a large $12.7 billion. Most of this money is coming from the U.S., which clocked in a web $1.25B. On the flip facet, Hong Kong and Switzerland noticed outflows of $32.6M and $7.7M, respectively. Not big, however nonetheless value noting.

Can BTC Break Resistance or Nah?

Bitcoin managed an honest bounce — up slightly over 3% — and is now buying and selling close to $104,100 as of Monday, June 24. That’s within the coronary heart of the North American session. Nonetheless, it’s staring down some robust resistance forward, with the $110K–$112K zone wanting like a wall it hasn’t cracked but.

Zooming out to the weekly chart, BTC’s organising what seems like a attainable double prime sample. And to make issues worse, the RSI is exhibiting some bearish divergence. That’s often not an excellent combo when you’re hoping for a breakout.

Liquidations Mount as Analysts Flip Cautious

In keeping with Coinglass, greater than $12 billion value of shorts have been liquidated — a fairly clear signal that the leveraged market’s in chaos mode. If you happen to’re studying between the strains, that type of unwinding suggests BTC may nonetheless have extra draw back forward earlier than issues stabilize.

Benjamin Cowen, a well-followed crypto analyst, not too long ago shared a grim take: he sees the entire crypto house (Bitcoin included) dipping into decrease lows over the following few months. His name? A neighborhood backside forming someday in August or September 2025. Not precisely cheerful.

What If BTC Drops Beneath $100K?

From a chart perspective, the $100K mark is wanting like a line within the sand. If BTC closes beneath that stage constantly this week, there’s a great probability it slides additional — possibly right down to the $96K assist vary. At that time, all eyes could be on whether or not consumers step in or if the promote stress simply snowballs.

The publish Establishments Hold Shopping for Bitcoin — However Can It Break Out? first appeared on BlockNews.