Technique has made one more Bitcoin buy, this one being introduced as world tensions weigh heavy on the cryptocurrency market.

Technique Has Added One other 245 BTC To Its Stack

In a brand new publish on X, Technique co-founder and chairman Michael Saylor has shared a submitting made with the US Securities and Alternate Fee (SEC) for a brand new Bitcoin buy.

With this $26 million acquisition, Technique has added one other 245 BTC to its holdings. That is the fourth purchase that the corporate has made this month, though it’s the smallest of the bunch. The final buy, introduced on June sixteenth, was a very large one involving a sum surpassing $1 billion.

Following the shopping for spree in June to this point, the entire reserve of Technique now sits at 592,345 BTC. The agency put collectively this stack for $41.87 billion, however at the moment it’s price a whopping $61 billion, implying a major revenue of just about 46%.

Based on the SEC submitting, the corporate made the most recent buy between June sixteenth and twenty second. Thus, it appears the corporate determined to purchase extra, regardless of tensions rising between Israel and Iran through the interval.

Bitcoin Market Has Been Struck With Volatility After Conflict Fears

The previous day or so has been a wild time for the cryptocurrency market, induced by escalating tensions within the center east following US strikes on three Iranian nuclear amenities.

Beneath is a chart that reveals how Bitcoin’s latest efficiency has seemed.

Seems to be like the value of the coin has gone via a rollercoaster | Supply: BTCUSDT on TradingView

As is seen within the graph, the Bitcoin value plummeted arduous all the best way down towards the $98,000 stage as panic promoting ensued, however earlier than lengthy, the coin discovered a rebound. Now, the asset’s again at $102,800, which is about the identical stage as earlier than the crash.

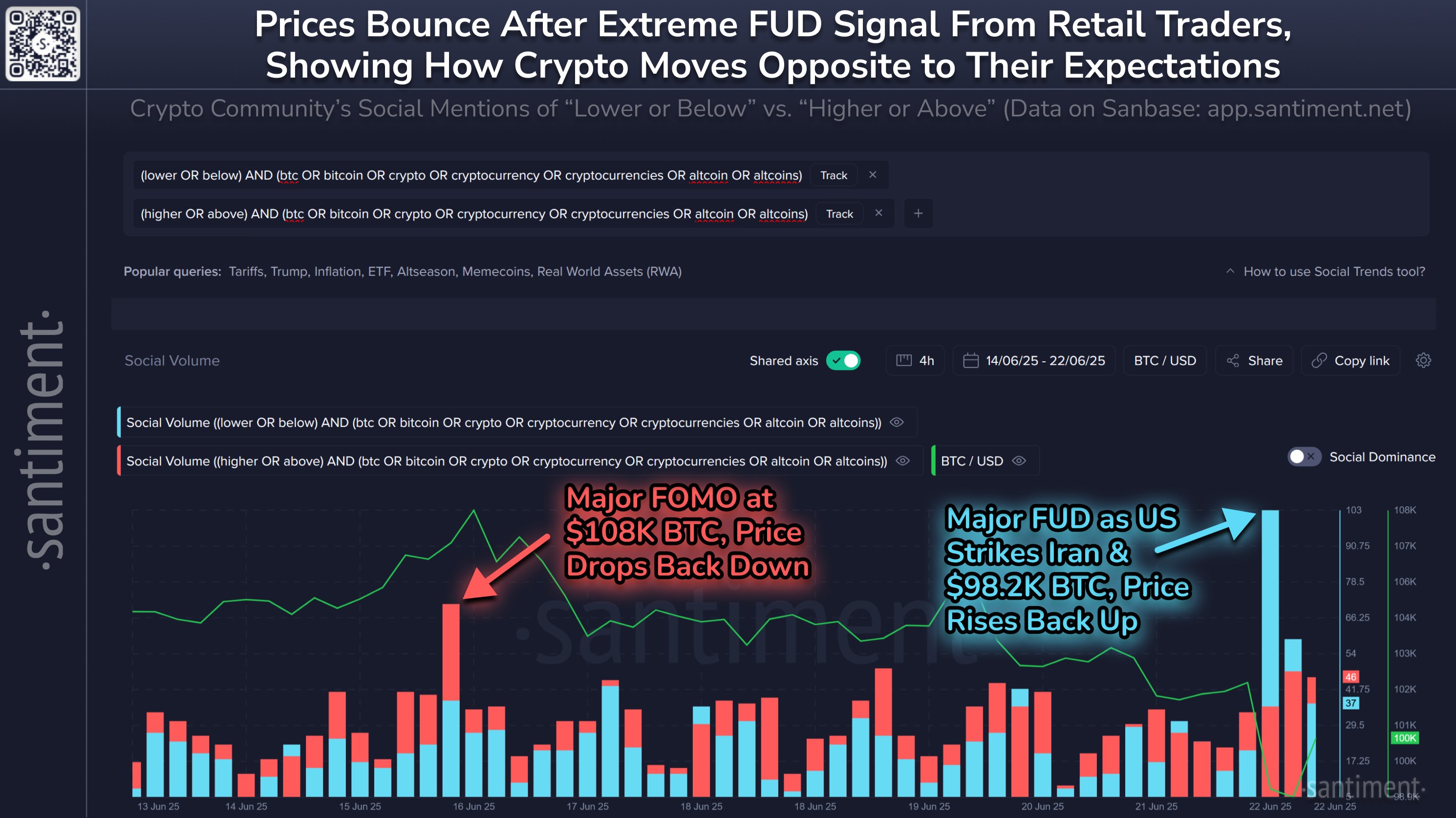

Based on information from the analytics agency Santiment, the value bounce has adopted the identical standard sample of retail investor sentiment performing as a contrarian sign.

The pattern within the social quantity of bearish and bullish calls on social media | Supply: Santiment on X

Within the chart, Santiment has connected the info of the Social Quantity, a metric that measures the distinctive variety of posts making mentions of a given time period or matter on the key social media platforms. The analytics agency has utilized key phrases associated to cryptocurrency and Bitcoin to the metric.

Moreover, it has additionally utilized two separate filters: one equivalent to bearish calls (‘decrease’ or ‘under’) and one other to bullish calls (‘greater’ or ‘above’). From the graph, it’s obvious that the previous kind of posts blew up following the US strikes, indicating FUD exploded among the many retail traders.

Usually, Bitcoin and different digital belongings have a tendency to maneuver in a path that goes in opposition to the expectations of the group and that’s certainly what appears to have occurred this time as effectively.

Featured picture from Dall-E, Santiment.internet, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our crew of prime expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.