- The Fed eliminated “reputational threat” from financial institution supervision guidelines, easing a serious barrier for crypto adoption

- XRP rallied 6% on the information, because of its robust banking ties and real-world use circumstances

- The shift alerts a friendlier U.S. regulatory local weather that would gasoline deeper blockchain-bank integration

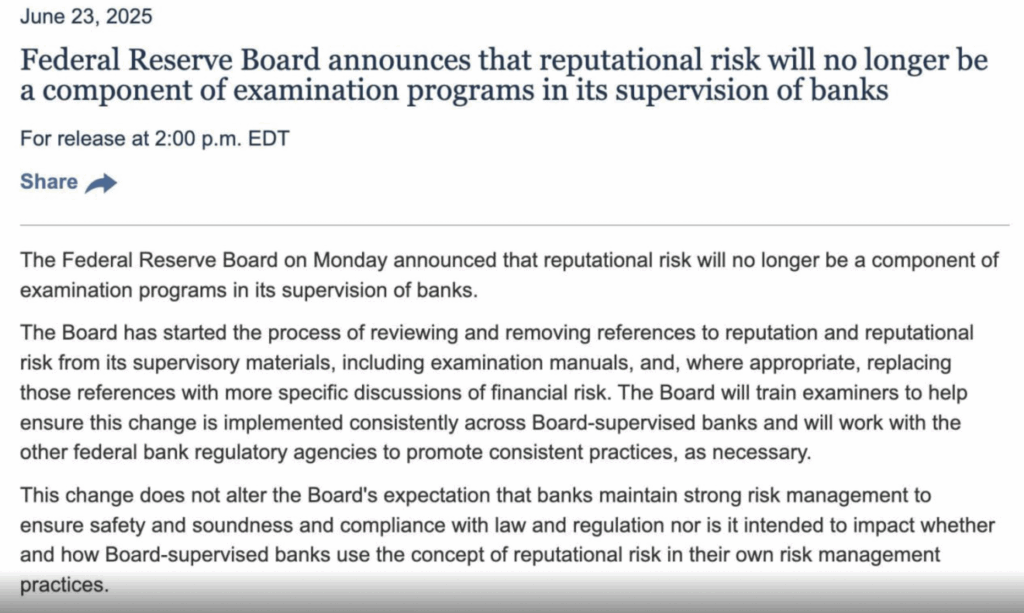

In a shock transfer that’s acquired the crypto crowd buzzing, the Federal Reserve simply made a coverage pivot that’s being seen as a large win for the business. On June 23, the Fed stated it’ll not consider “reputational threat” when supervising banks — and similar to that, the temper throughout the markets shifted. XRP jumped round 6% on the information, now sitting at about $2.14. Not too shabby, contemplating the place issues had been only a week in the past.

For people watching carefully, this shift sounds small, but it surely’s not. “Reputational threat” has lengthy been that fuzzy excuse used to maintain banks away from crypto. With out it, doorways may lastly crack open for blockchain corporations which have been boxed out for years.

Crypto Twitter’s Acquired Ideas (Of Course)

Proper after the Fed’s replace dropped, crypto heads on X began buzzing. Amonyx (@amonbuy) referred to as it a enormous secondfor crypto-friendly banks, posting a screenshot of the Fed’s launch. The important thing bit? As a substitute of judging banks based mostly on what individuals may suppose (aka reputational drama), regulators will now focus extra narrowly on monetary dangers.

That’s large. As a result of for ages, “reputational considerations” had been the go-to excuse to disclaim banking providers to crypto firms — even the legit ones. Now, with that off the desk, it might imply method much less resistance for establishments trying to work with digital asset platforms.

Why XRP’s Driving the Wave

Let’s speak XRP. It’s not random that XRP reacted so quick to this coverage change. In contrast to meme tokens or NFT collectibles, XRP’s core use case entails banks — cross-border settlements, remittances, monetary rails… you title it. However U.S. banks have largely saved their distance, and that “reputational threat” clause was one of many the explanation why.

Now that the Fed’s dropped that language? Properly, it’s sort of a inexperienced mild. It doesn’t imply banks will all pile in tomorrow, but it surely clears an enormous hurdle. XRP — and firms working with it — may lastly have a shot at deeper monetary integration within the States.

A Actual Shift within the Regulatory Winds?

Now, don’t get it twisted. The Fed nonetheless expects banks to watch out — threat administration, authorized compliance, all that great things nonetheless applies. However the vibe is completely different now. The tone feels much less anti-crypto, extra open to innovation, and that issues loads on this sport.

XRP people are hoping this alerts a brand new chapter, one the place regulators cease treating crypto like radioactive waste. And with the earlier administration’s harsh stance fading into the rearview mirror, this newest replace appears to be like like a part of a broader rethinking of how digital belongings match into conventional finance.