- Avalanche bounced 9.26% after a brutal downtrend however nonetheless reveals bearish indicators.

- On-chain exercise is up 204%, but buying and selling quantity stays low, hinting at fragile momentum.

- With most holders underwater, any rally might face heavy resistance from exit-hungry sellers.

Avalanche (AVAX) has been by a tough patch recently—no sugarcoating that. Since June 11, it’s dropped like a rock, shedding about 26% in slightly below two weeks. However hey, there’s been a little bit of a bounce. On Monday, the coin posted a 9.26% rally, giving holders a minimum of one thing to smile about… for now.

What’s fascinating is the conduct of good cash. Regardless of the downtrend, these seasoned buyers are nonetheless holding their AVAX baggage. In the meantime, retail merchants—much less affected person and doubtless extra spooked—have began cashing out. Spinoff merchants are additionally piling into quick positions, betting there’s extra ache forward.

On-Chain Indicators: Uptick or Fakeout?

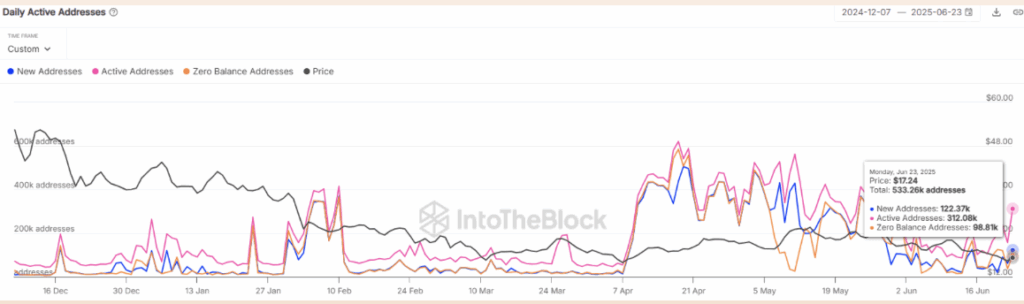

Trying on the chain knowledge, exercise is unquestionably selecting up. Nothing near April’s growth, however nonetheless—it’s on track. The variety of lively addresses has jumped massive time, up 204% in simply seven days. That’s not nothing.

If this continues, demand for AVAX would possibly rise too, which might assist value restoration efforts. However that’s an enormous if. The pattern is promising, positive, however let’s not get forward of ourselves—value motion is hinting at a bullish reversal, however nothing’s confirmed but.

AVAX Chart Paints a Cautious Image

Zooming into the each day chart, AVAX appears to be caught in a spread between $16 and $22.9. Proper now, it’s bouncing off that decrease certain—a stage that held up again in March and April too. If the bulls keep in cost, we would see a push to the $19.5 mid-range. That’s the hopeful situation.

However right here’s the catch: momentum isn’t fairly on their aspect. The Superior Oscillator? Nonetheless bearish. OBV? Under its Might low. Translation? Sellers nonetheless have the higher hand. If buying and selling quantity doesn’t decide up quickly, that $19.5 resistance might slap AVAX proper again down once more.

And let’s not overlook the massive image. Again in December 2024, AVAX was chilling round $54. Now? It’s at $18.1. That’s a brutal 66% haircut.

Bagholders Nonetheless Ready to Break Even

In keeping with IntoTheBlock’s metrics, almost 66% of AVAX holders are underwater, whereas about 27% are simply barely breaking even. That’s lots of people who’d most likely promote the second value rallies sufficient to provide them an exit.

Even when AVAX does claw its manner up, count on a lot of resistance—psychological and literal. Till Bitcoin dominance drops and cash begins flowing again into altcoins, Avalanche holders could be in for a sluggish, uneven highway.