- EIP-7782 goals to chop Ethereum block time from 12s to 6s, doubling affirmation pace.

- Quicker slots might imply smoother DeFi trades, decrease gasoline volatility, and stronger ETH demand.

- It’s a behind-the-scenes change with huge front-end influence—one that would form DeFi’s future.

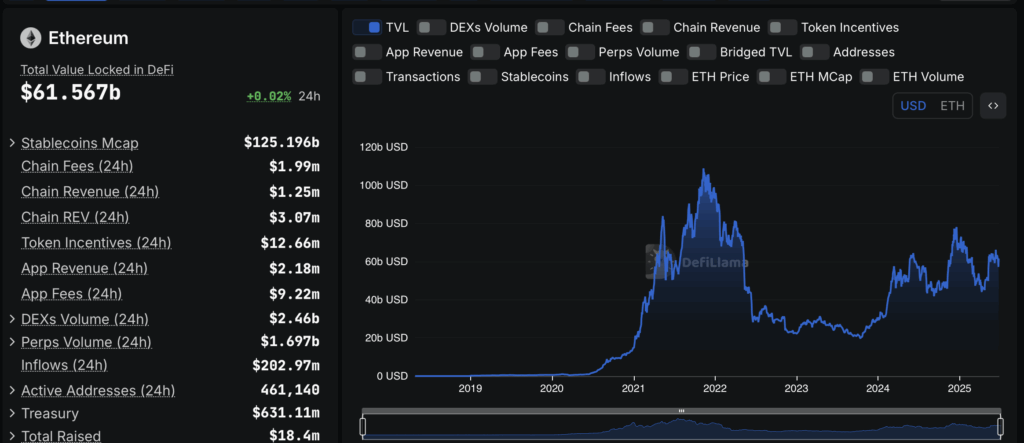

Ethereum isn’t nearly worth charts or headlines—it’s the spine of decentralized finance. With over $60 billion locked in its DeFi ecosystem, the chain’s actual power lies in its utility. And now, devs are stepping issues up. A brand new proposal, EIP-7782, goals to chop Ethereum’s slot time in half—from 12 seconds down to only 6. Sounds small, proper? However the results? Doubtlessly enormous.

With the current Pectra improve already within the rearview and this subsequent one on the desk, 2025 may be the yr Ethereum lastly will get its long-overdue pace increase. However let’s be sincere: Is that this only a flashy tech improve, or might it truly change how folks use the chain

Quicker Blocks, Tighter Community—What’s Really Altering?

Proper now, Ethereum proposes a brand new block each 12 seconds. If the proposal passes, that shrinks to six seconds flat. Identical gasoline restrict, identical transaction capability—however twice as many blocks per hour. Which means stuff simply strikes sooner. No enhance in throughput, however affirmation instances? Approach higher.

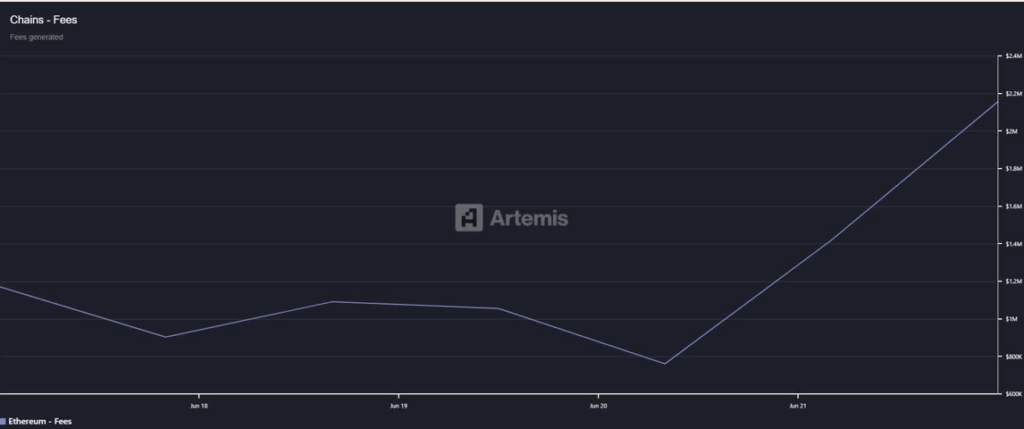

Why does that matter? As a result of charges might get extra predictable. Proper now, when issues get busy, you may toss in additional gasoline simply to get your transaction by. But when blocks come extra usually, you’re much less prone to overpay. Extra blocks = smoother movement.

Some devs are calling this modification Ethereum’s “greatest rollup but”—not as a result of it provides flashy options, however as a result of it makes the entire engine run tighter. And truthfully, that type of quiet improve may be precisely what DeFi wants.

Actual DeFi Beneficial properties: Not Only a Pace Bump Repair

Let’s discuss real-world DeFi. You’re swapping tokens, staking ETH, or pulling yield from some liquidity pool—you need pace. Proper now, each motion on-chain has to attend about 12 seconds for affirmation. In calm markets, tremendous. However when volatility spikes? That delay can price you.

Reducing it to six seconds means DeFi reacts sooner. Swaps on Uniswap change into smoother. Lending charges regulate faster. The entire expertise simply feels much less… sluggish. Plus, higher execution attracts in additional quantity, which feeds liquidity, which boosts returns. You see the place that is going.

Extra exercise means extra stakers. Extra stakers = extra demand for ETH. It’s like a suggestions loop, however one that really advantages customers.

This Isn’t Simply Tech—It’s a Energy Transfer

It’s straightforward to dismiss this slot-time stuff as a backend element. However zoom out. Ethereum is the bedrock of DeFi. Any change on the protocol degree ripples throughout your entire stack. Quicker blocks = decrease charges, sharper worth monitoring, and extra responsive dApps.

Ethereum isn’t chasing hype right here. It’s digging into the infrastructure, making it leaner and extra environment friendly. That’s not nearly UX—it’s about giving customers and devs a motive to remain.

2025 may simply be Ethereum’s greatest development yr but—not due to worth pumps, however as a result of the chain itself is lastly rising into the spine it was all the time meant to be.