Chinese language state-backed brokerage Guotai Junan Worldwide has secured regulatory approval to supply cryptocurrency buying and selling providers in Hong Kong.

The information arrives simply because the Hong Kong authorities unveiled its complete LEAP framework. The brand new blueprint advances stablecoin licensing, real-world asset tokenization, and digital asset market infrastructure.

Guotai Junan’s Crypto License Marks Main Win for Hong Kong’s Digital Asset Technique

On Wednesday, Guotai Junan introduced that the Hong Kong Securities and Futures Fee (SFC) has upgraded its Kind 1 license. It was beforehand restricted to conventional securities dealing, with the improve allowing cryptocurrency buying and selling.

The brokerage mentioned it should function by an SFC-licensed crypto platform, permitting shoppers to commerce digital belongings compliantly.

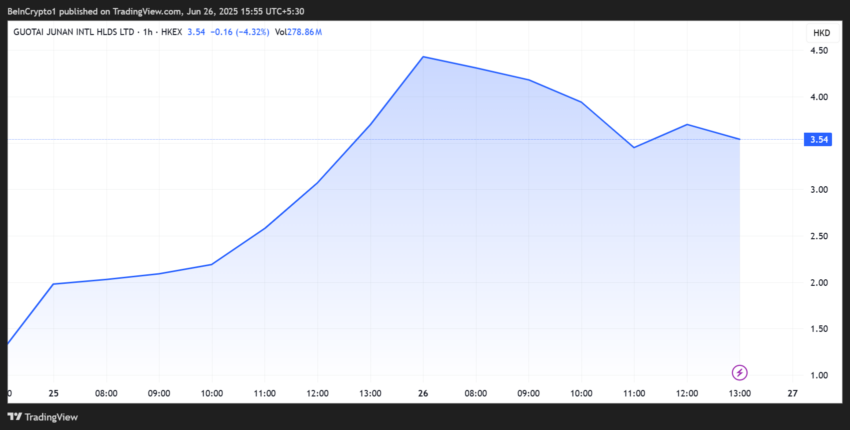

The market responded with enthusiasm. Guotai Junan’s shares surged practically 470%. It rose from HK$1.24 ($0.16) to HK$7.02 ($0.91) intraday on Wednesday. The inventory is traded at HK$3.54 ($0.46) as of this writing.

Regardless of the slight pullback, the inventory stays above its pre-approval highs. This displays investor optimism over the agency’s foray into digital belongings.

Guotai Junan turns into one of many first conventional Chinese language brokerages to obtain regulatory approval for crypto buying and selling in Hong Kong, amid rising curiosity from different mainland establishments.

Guotai Junan’s regulatory approval is a strategic win for Hong Kong. It reinforces its ambition to develop into a worldwide digital finance hub. The brokerage, managed by a Shanghai state-owned enterprise, went public in Hong Kong in 2010.

Subsequently, the approval lends mainstream credibility to town’s crypto push. In line with the state-owned Securities Instances, China Retailers Securities and Huatai Worldwide are additionally pursuing license upgrades to enter the crypto house.

Hong Kong Rolls Out LEAP Framework: All the pieces You Must Know

The announcement coincides with Hong Kong’s launch of its up to date digital asset coverage framework, often called LEAP (Authorized readability, Ecosystem growth, Software focus, and Folks growth).

The coverage, unveiled Thursday by the Monetary Providers and the Treasury Bureau (FSTB) and different key regulators, builds on town’s 2022 digital asset roadmap and descriptions particular initiatives to additional combine crypto into mainstream finance.

Beneath the LEAP framework:

- A brand new licensing regime for stablecoin issuers will launch on August 1, enabling regulated issuing and circulating fiat-backed stablecoins.

- The federal government will often subject tokenized authorities bonds and promote tokenized ETFs, clarifying stamp obligation therapy to help secondary market buying and selling.

- Broader tokenization efforts are deliberate throughout sectors, together with treasured metals and renewable power belongings like photo voltaic panels.

- Hong Kong’s monetary authorities additionally revealed plans to allow crypto derivatives buying and selling for skilled buyers, constructing on current approvals for spot crypto ETFs, futures merchandise, and staking providers.

Monetary Secretary Paul Chan mentioned the brand new framework goals to display the sensible use of tokenization and construct a flourishing digital belongings ecosystem that may combine the actual financial system with social life.

Whereas mainland China maintains a strict ban on crypto buying and selling, Hong Kong operates underneath a definite authorized and regulatory regime. It affords a regulatory sandbox for experimentation and institutional adoption.

As extra Chinese language brokerages search to enter the house, with LEAP laying the groundwork for tokenized belongings and stablecoin circulation, Hong Kong is rapidly shaping as much as be Asia’s most dynamic crypto and Web3 launchpad.

Disclaimer

In adherence to the Belief Mission pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nevertheless, readers are suggested to confirm info independently and seek the advice of with knowledgeable earlier than making any selections based mostly on this content material. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.