- Coinbase inventory closed at $375.07, hitting a brand new all-time excessive with a 40% achieve prior to now month.

- Circle’s USDC revenue-sharing deal funneled over 60% of its revenue to Coinbase, bolstering COIN’s efficiency.

- S&P 500 inclusion and analyst upgrades have fueled investor optimism and institutional inflows.

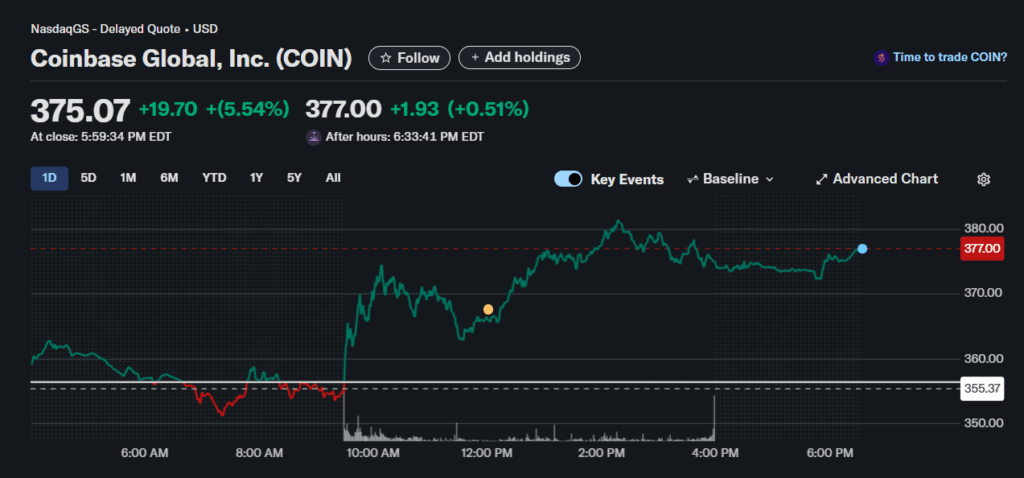

Coinbase World (COIN) simply wrapped up Thursday’s buying and selling with a bang, closing at $375.07 per share—a degree it hasn’t seen since its April 2021 debut. That’s a 5.5% leap for the day, simply clearing its earlier document shut of $357.39 set again in November 2021. Its market cap? Now sitting at a hefty $89 billion.

The inventory’s been on fireplace these days, notching a 24% achieve over the previous 5 buying and selling classes and up 40% during the last month. Plenty of this momentum has been fueled by the breakout success of Circle Web Monetary (CRCL), which listed on June 4 at $31 and has since skyrocketed greater than 500%, closing Thursday at $213.63.

Circle’s Huge Payday Is Coinbase’s Windfall

Now right here’s the kicker—Circle, the corporate behind the second-largest stablecoin USDC, gave over 60% of its reserve earnings in 2024 to Coinbase. That’s due to a revenue-sharing settlement the place Coinbase will get 50% of all remaining curiosity revenue from USDC reserves.

Although USDC nonetheless trails USDT in dominance, it holds a hefty $61.45 billion in circulating provide. That’s a giant chunk of the stablecoin market—and it’s become a quiet however highly effective money stream for Coinbase. The monetary synergy right here is robust and buyers are clearly taking discover.

S&P 500 Itemizing Provides Extra Fireplace to COIN’s Rally

Coinbase’s inclusion within the S&P 500 index, efficient Could 19, added one other layer of legitimacy and publicity. It’s the primary ever crypto-native firm to be added to the benchmark index, making it extra interesting to institutional buyers and fund managers.

Analysts are bullish, to say the least. Bernstein lately raised its value goal for COIN to $510 and dubbed it the “Amazon of crypto monetary providers.” That’s an enormous vote of confidence—and to date, the value motion appears to be backing it up.