The cryptocurrency market is abuzz with information that GameStop has raised an extra $450 million by means of a convertible bond providing. This capital is probably going for use to amass extra Bitcoin (BTC).

Along with GameStop, different public firms, corresponding to Metaplanet, H100 Group AB, Nano Labs, and others, are making strikes to incorporate Bitcoin on their steadiness sheets.

In keeping with SEC filings, with this newest bond issuance, GameStop has elevated the full funds raised from its mid-June 2025 providing to $2.7 billion. The zero-interest bonds, maturing in 2032, are convertible into shares at a worth 32.5% larger than the common on June 12.

This might create important alternatives for GameStop to diversify its property, together with Bitcoin. This transfer comes as an in depth competitor within the BTC accumulation race, ProCap, lately claimed that they’ve surpassed GameStop in BTC holdings.

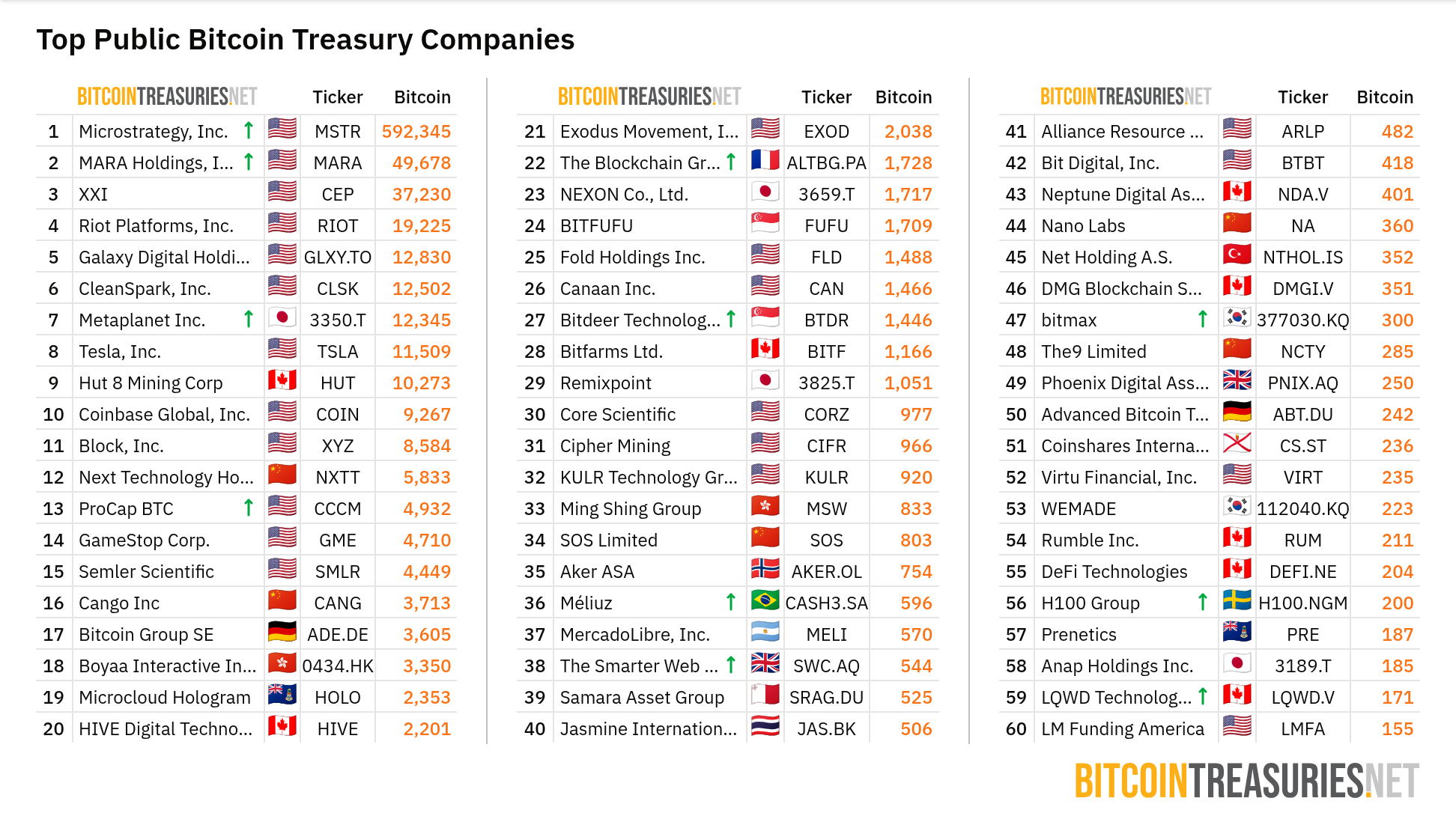

As of now, information from BitcoinTreasuries exhibits GameStop holding roughly 4,710 BTC, rating 14th. Asia’s “Technique”, Metaplanet, has the seventh place with 12,345 BTC after lately buying an extra 1,234 BTC at a mean worth of $107,557.

“Supercycle wouldn’t be a supercycle with out GameStop” An X consumer acknowledged.

Bitcoin because the Way forward for Company Treasuries

Along with GameStop, Metaplanet, and ProCap, many different public firms are intensifying their efforts to amass and maintain BTC.

Mega Matrix, a US-listed firm, lately introduced the acquisition of 12 BTC. H100 Group AB elevated its holdings to 200.21 BTC. Sixty Six Capital added 18.2 BTC and plans to lift extra capital to purchase further quantities. In the meantime, Unitronix, a real-world asset (RWA) tokenization firm, dedicated to investing $2 million in Bitcoin.

Nano Labs raised 600 BTC by means of a $500 million issuance. KaJ Labs invested $160 million in Bitcoin to help AI infrastructure.

Technique‘s participation has sparked a wave of Bitcoin funding amongst different firms. Information from BitcoinTreasuries signifies that Technique presently holds probably the most BTC, 592,345 BTC, adopted by MARA Holdings with 49,678 BTC. The involvement of those main firms demonstrates that this mannequin can improve shareholder worth.

Nevertheless, worth volatility dangers and SEC rules may impression their plans. With the July 2025 CPI set to be introduced quickly, GameStop’s and different firms’ choices might be pivotal in shaping the way forward for Bitcoin in company treasuries.

Disclaimer

All the data contained on our web site is revealed in good religion and for normal data functions solely. Any motion the reader takes upon the data discovered on our web site is strictly at their very own threat.