The GENIUS Act will allow tech firms to problem stablecoins that functionally blur the boundary between private and non-private cash.

However Winston Ma, adjunct regulation professor at New York College, argues that non-public stablecoins can’t operate as true forex with out sovereign enforcement. Yuriy Brisov, a lawyer at Digital & Analogue Companions, contends that privately issued currencies can function reliable options to conventional financial methods.

To know the authorized implications of the GENIUS Act and the way it matches into the worldwide stablecoin panorama, Journal spoke with Brisov in Europe, Ma within the US and Joshua Chu, co-chair of the Hong Kong Web3 Affiliation.

The invoice handed the Senate on June 18 and now heads to the Home of Representatives, which has its personal STABLE proposal additionally aiming to set guidelines for stablecoins.

The dialog has been edited for readability and size.

Journal: What’s been the sensation on the bottom because the GENIUS Act handed the Senate?

Chu: I don’t suppose we must be too shocked by this growth, given the wave of regulatory actions we’ve been seeing. Hong Kong has been speeding to introduce its personal Stablecoin Ordinance, MiCA is already in impact in Europe, and now the US is following that development.

Brisov: I informed you two months in the past that it could cross the Senate as a result of it was already evident that the momentum had shifted. The STABLE proposal was deeply unpopular. GENIUS, alternatively, was extensively mentioned and struck a greater stability.

Journal: Why was there much less assist for STABLE?

Brisov: As a result of it primarily proposed turning stablecoins into part of the banking system. Solely banks or monetary establishments with charters might problem them. GENIUS expands the scope of who can problem stablecoins. It opens the door for tech firms to turn out to be issuers as properly.

Journal: Does that imply we would quickly see stablecoins issued by Massive Tech?

Ma: If the GENIUS Act turns into regulation, it might open the door for firms like Meta to problem their very own token or construct fee mechanisms inside their ecosystems.

The problem is becoming platforms of that scale right into a regulatory framework initially designed with extra conventional monetary establishments in thoughts. Underneath GENIUS, state-level regulators are the first authority, whereas the Workplace of the Comptroller of the Foreign money (OCC) performs a secondary function.

Yuriy: Simply to make clear: In GENIUS, there’s a two-tier regulatory pathway. An issuer can select to go straight to the federal degree from the outset and apply for a license or constitution from the Federal Reserve. They don’t have to start on the state degree like underneath the STABLE framework.

Additionally, in case you’re issuing over $10 billion value of stablecoins, you’re robotically pushed into federal oversight no matter your choice. That’s a significant distinction between the 2 proposals.

Ma: Precisely. So, within the case of large world platforms, it in all probability makes extra sense for them to go straight to the federal framework anyway, given their measurement and attain. An organization like Meta working underneath GENIUS might find yourself issuing one thing that, in scale and performance, resembles a central financial institution digital forex (CBDC).

It’s fascinating as a result of whereas the US system would nonetheless be fragmented with a number of issuers, Meta’s stablecoin might hypothetically have the sort of uniformity and large transaction quantity that makes it look extra like a sovereign digital forex.

In China, the digital yuan is a sovereign undertaking backed by a single centralized justice and regulatory framework. Nevertheless, within the US, we would find yourself with one thing that capabilities equally, not by means of state issuance, however by means of large company ecosystems.

Journal: How does the GENIUS Act examine to legal guidelines in Europe and Asia?

Brisov: In some ways, GENIUS is America’s reply to MiCA. MiCA clearly backs euro-pegged stablecoins and helps European firms and banks. And we’ve seen the outcomes. After MiCA, the euro and euro-pegged stablecoins began gaining floor.

Learn additionally

Options

68% of Runes are within the pink — Are they actually an improve for Bitcoin?

Options

The difficulty with automated market makers

GENIUS is a part of the US response. US lawmakers and the administration acknowledge that sensible regulation offers a aggressive benefit. It’s about making certain the US greenback and dollar-pegged stablecoins stay dominant in world commerce.

Journal: What are the potential downsides of the GENIUS Act?

Brisov: Traditionally, the US has separated industrial enterprises and banking establishments. That precept is a cornerstone of not simply the American financial system however its broader political and authorized system. GENIUS blurs that line, permitting firms like Amazon or Meta to probably problem their very own cash and turn out to be self-sufficient monetary ecosystems.

In Europe, MiCA additionally doesn’t outright ban Massive Tech from issuing stablecoins, nevertheless it does make it a lot tougher. There’s additionally the difficulty of quantity caps. Underneath MiCA, in case you’re a international stablecoin issuer, your most day by day quantity should keep underneath 1 million transactions or 200 million euros.

In case you exceed that, your stablecoin is taken into account “vital” and comes underneath the supervision of the European Banking Authority (EBA) and the European Securities and Markets Authority (ESMA). They’ll resolve learn how to regulate you shifting ahead.

Journal: What do you concentrate on the timing of China’s central financial institution governor’s speech on the digital yuan, delivered the identical day the GENIUS Act handed?

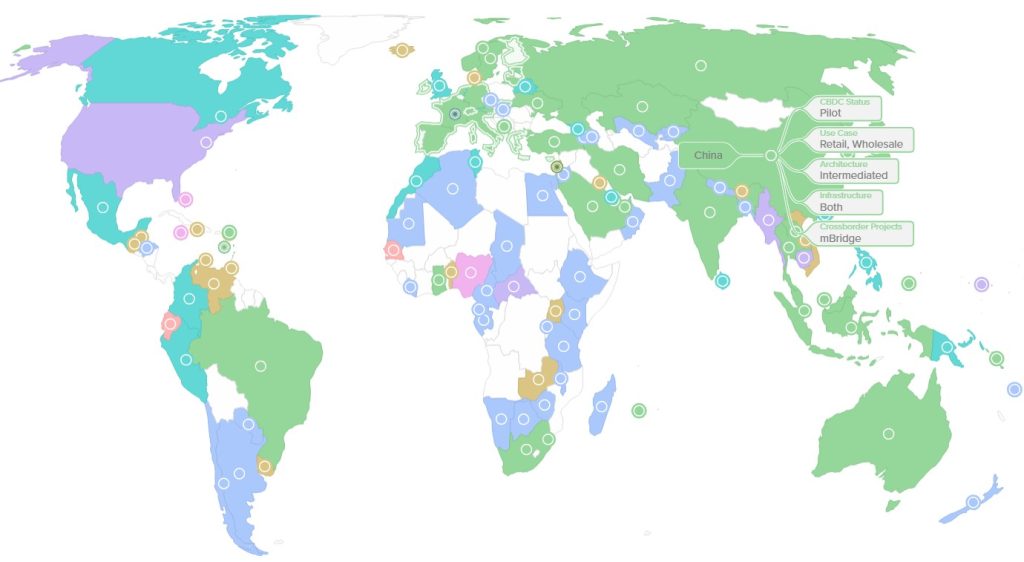

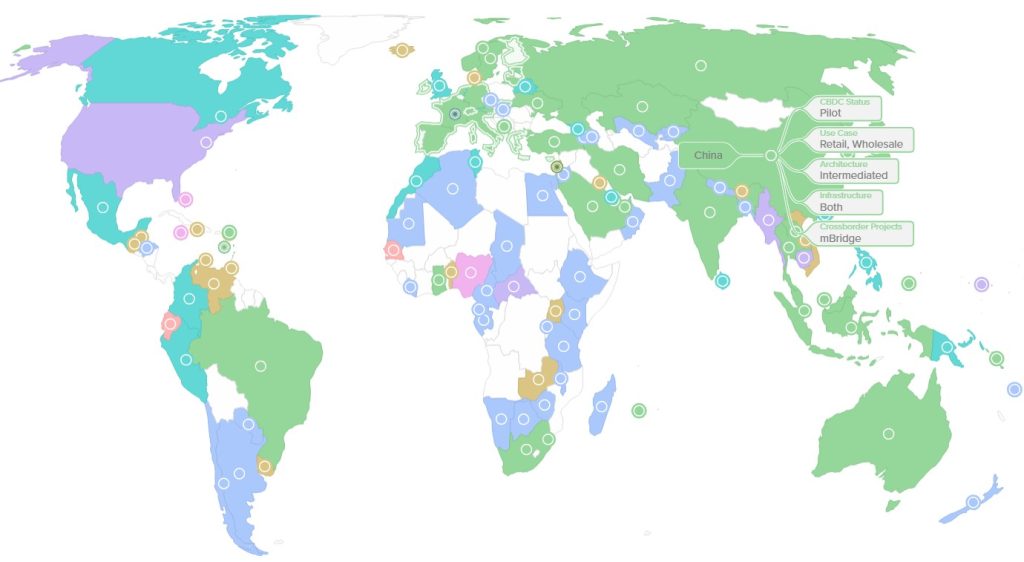

Ma: This wasn’t coincidental. What’s fascinating is how the Chinese language central financial institution makes use of the time period “CBDC stablecoin” as a single idea. In different phrases, in China’s financial system, the CBDC is the stablecoin model of the renminbi.

The digital yuan is by far essentially the most extensively examined CBDC on the earth. So, now we’re seeing this rising financial competitors globally: The US depends on a mixture of non-public sector stablecoins, whereas China is leaning on a sovereign digital forex mannequin.

Journal: Can stablecoins actually operate as currencies with out sovereign backing?

Ma: If you wish to name one thing a forex, it wants sovereign backing — not simply to market it, however to implement it. In that sense, China’s mannequin has its strengths.

Think about having 100 totally different stablecoin issuers. Meaning customers would wish 100 separate fee interfaces. That’s an enormous barrier. Even in China, the place there’s only one interface for the CBDC, it’s been a problem.

Past simply the power to course of funds, retailers have to be prepared or required to just accept these funds. For instance, in my ebook “China’s Cellular Financial system,” I talk about a case the place a service provider refused to just accept money, and the shopper sued. The Chinese language central financial institution dominated that money have to be accepted as a result of it was issued by the state.

In order for you a stablecoin to operate as a forex, there needs to be an authority backing it, saying, “It’s essential to settle for this.” With out that energy, it’s not actually a forex — it’s simply an non-compulsory fee methodology.

Yuriy: To supply one other perspective, fiat forex is issued by the federal government. However for many of human historical past, cash was privately issued. Even within the US, till 1913, totally different banks printed their very own forex. The Federal Reserve’s monopoly on issuing {dollars} didn’t actually solidify till the Thirties-Nineteen Seventies.

What we’re seeing now could be a disaster of centralized methods — the very problem that led to the creation of Bitcoin.

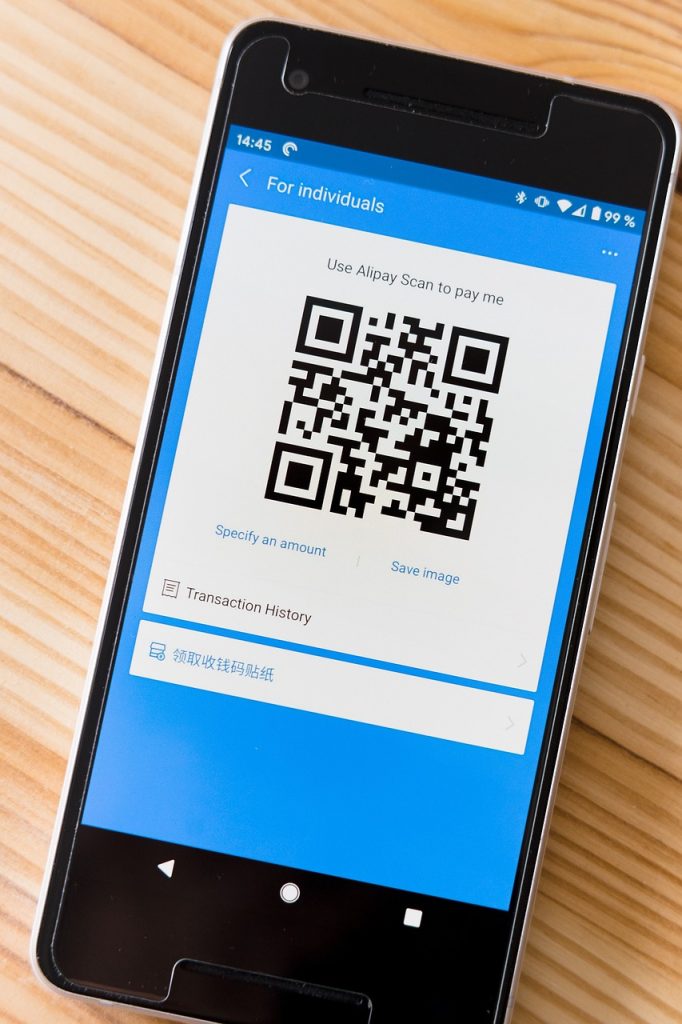

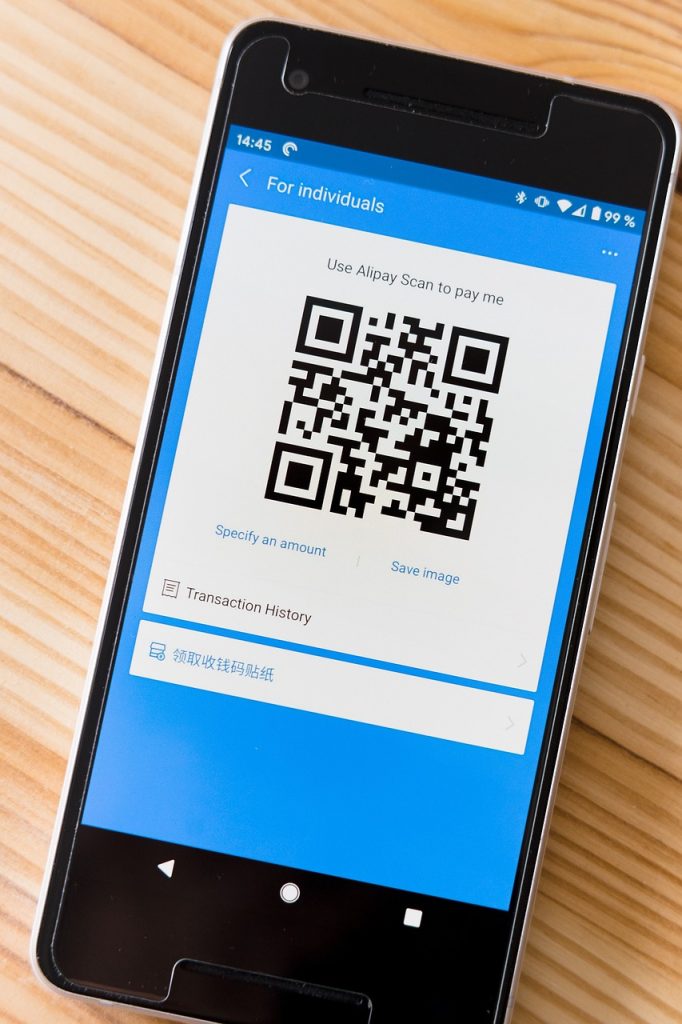

Ma: However Bitcoin is extra of a retailer of worth, not a sensible forex. Folks don’t usually use it for day-to-day funds. There’s nonetheless the difficulty of person interfaces. You want infrastructure to make funds work at storefronts.

Yuriy: That infrastructure now exists. Retailers settle for 15-20 totally different cryptocurrencies by means of a single point-of-sale interface. The crypto is robotically transformed into {dollars} or euros. The service provider by no means even touches the crypto — they only obtain fiat.

Layer-2 options make this technically straightforward. So, I don’t see that as a significant barrier anymore.

Learn additionally

Options

Make Ethereum really feel like Ethereum once more: Primarily based rollups defined

Options

1 in 6 new Base memecoins are scams, 91% have vulnerabilities

Chu: In Hong Kong, courts have acknowledged cryptocurrencies as property, permitting authorized treatments for theft or fraud. Nevertheless, this recognition doesn’t equate to authorized tender standing or confer intrinsic worth akin to fiat forex. Underneath Hong Kong regulation, solely sure banknotes issued by approved banks are acknowledged as authorized tender.

To place it in perspective, whereas the holder of a “Chuck E. Cheese” token could have authorized property rights over the tokens they possess, this doesn’t assure any worth if Chuck E. Cheese went out of enterprise.

That stated, CBDCs are basically totally different from each stablecoins and cryptocurrencies. Not like cryptocurrencies akin to Bitcoin or Ether, that are decentralized and function with out central authority, CBDCs are digital types of a rustic’s fiat forex issued and absolutely regulated by the central financial institution. They carry the identical authorized tender standing as bodily money and are backed by the federal government’s full religion and credit score, making certain stability and acceptance throughout the financial system.

Stablecoins, alternatively, are privately issued digital tokens that try to take care of a hard and fast worth by pegging to belongings like fiat currencies, however they lack sovereign backing and are topic to market and issuer dangers.

Hong Kong’s just lately enacted Stablecoin Ordinance explicitly excludes CBDCs from its regulatory scope. This distinction is critical, because it underscores the federal government’s recognition that CBDCs and stablecoins are basically totally different digital belongings requiring separate regulatory approaches.

Subscribe

Essentially the most partaking reads in blockchain. Delivered as soon as a

week.

Yohan Yun

Yohan Yun is a multimedia journalist masking blockchain since 2017. He has contributed to crypto media outlet Forkast as an editor and has lined Asian tech tales as an assistant reporter for Bloomberg BNA and Forbes. He spends his free time cooking, and experimenting with new recipes.