The $90 million hack of Iran’s largest crypto trade, Nobitex, made world headlines. However newly surfaced blockchain knowledge reveals the breach uncovered one thing larger.

A forensic report by blockchain intelligence agency World Ledger discovered that months earlier than the June 18 assault, Nobitex was systematically transferring consumer funds utilizing methods generally related to cash laundering.

Was Iran’s Nobitex Change Laundering Person Funds Earlier than the Hack?

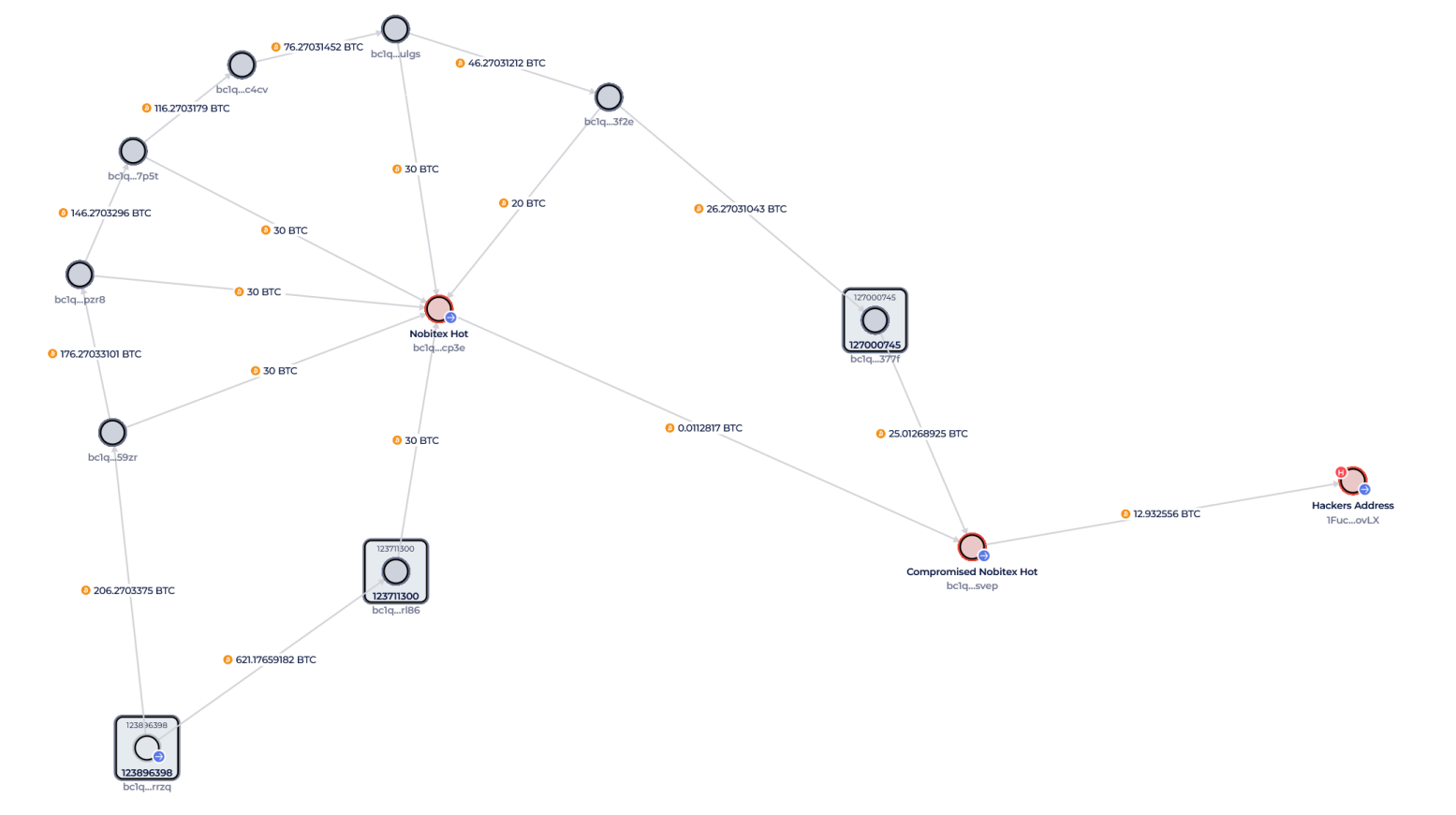

On-chain knowledge reveals that Nobitex employed a technique referred to as peelchaining. That is when massive quantities of Bitcoin are cut up into smaller chunks and routed by means of short-lived wallets.

The approach makes fund tracing troublesome and is commonly used to obscure the origins of cash. In Nobitex’s case, analysts discovered a sample of BTC being cycled in constant 30-coin chunks.

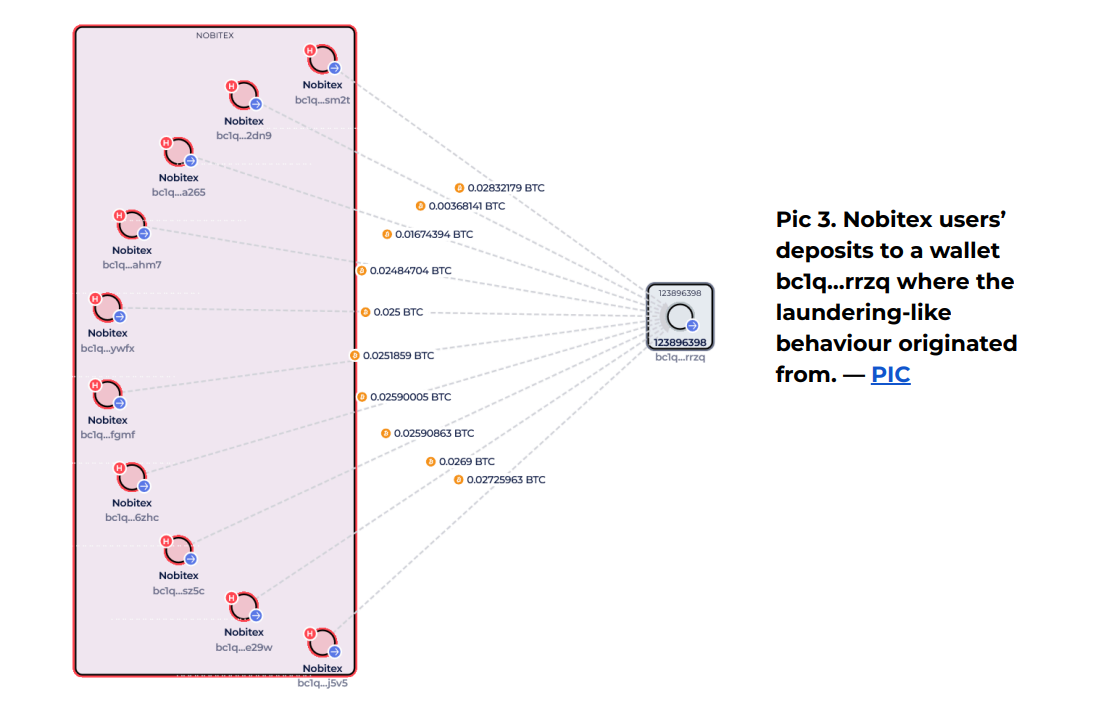

World Ledger additionally discovered that Nobitex used momentary deposit and withdrawal addresses—a habits often called chip-off transactions. These one-use addresses funnel BTC into new wallets, disguising liquidity trails.

The “Rescue Pockets” Wasn’t New

After the hack, Nobitex claimed it moved remaining funds as a security measure. On-chain exercise did present a 1,801 BTC sweep (value ~$187.5 million) right into a newly created pockets.

However this pockets wasn’t new. Blockchain knowledge traces its historic use again to October 2024. The pockets had lengthy been amassing chipped-off funds.

This “rescue pockets” obtained a number of 20–30 BTC transfers that adopted the identical laundering-like patterns, even earlier than the hack occurred.

Put up-Hack Exercise Exhibits Continued Management

Hours after the breach, Nobitex moved funds from its uncovered sizzling pockets to a different inner deal with. This full-balance sweep indicated Nobitex retained operational management.

On June 19, investigators noticed 1,783 BTC transferred once more to a brand new vacation spot pockets. This matched Nobitex’s public declare of securing its property—however now with added context.

The flows counsel that relatively than reacting to the hack, Nobitex was merely following its pre-existing cash laundering playbook.

The professional-Israel hacking group Gonjeshke Darande revealed recordsdata exposing Nobitex’s inner pockets construction.

The hack could have shocked customers, however blockchain knowledge reveals that Nobitex had already been transferring funds this manner for months.

Previous wallets linked to the trade have been commonly sending Bitcoin to new wallets. From there, the funds have been damaged into smaller quantities and moved many times—usually in chunks of 20 or 30 BTC.

This methodology makes it tougher to trace the place the cash finally ends up. It’s much like how some folks cover their tracks when transferring funds by means of crypto.

What’s necessary is that this wasn’t one thing Nobitex began after the hack. That they had been doing it lengthy earlier than, and so they stored doing it after—virtually prefer it was customary process.

One pockets specifically—bc1q…rrzq—reveals up many times. It obtained a lot of consumer deposits and seems to be the place to begin for a lot of of those hard-to-trace fund actions.

In brief, the hack didn’t trigger Nobitex to vary the way it dealt with funds. It merely introduced ongoing behind-the-scenes exercise into the general public eye.

Disclaimer

In adherence to the Belief Mission pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nevertheless, readers are suggested to confirm info independently and seek the advice of with an expert earlier than making any selections based mostly on this content material. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.