Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

This week, Bitcoin (BTC) has recovered from its latest drop beneath the $100,000 degree and is trying to show the essential $108,000 resistance into assist for the fourth time. As we method the second half of 2025, a market watcher has shared his forecast for BTC.

Associated Studying

Bitcoin Sees Transitional Interval

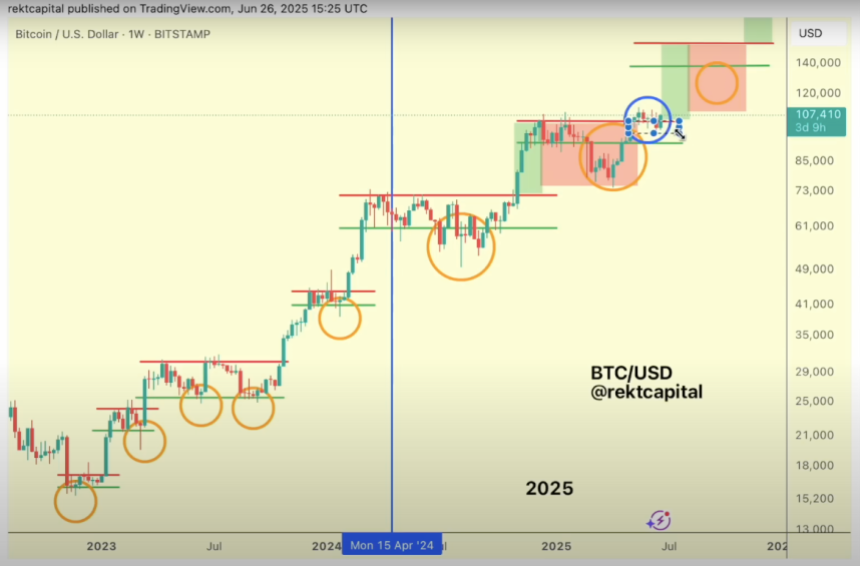

On Thursday, analyst Rekt Capital shared a roadmap for BTC for the remainder of the yr. He famous that this cycle has been “actually a cycle of re-accumulation ranges,” explaining that these have shaped all through the cycle for the reason that finish of 2022 and advanced for the reason that Bitcoin Halving final yr.

Within the pre-having interval, BTC registered transient value deviations with draw back wicks beneath the re-accumulation vary lows within the weekly chart. In the meantime, the post-halving interval has seen Bitcoin deviations happen with multi-week clusters of full-bodied candles beneath the vary lows.

As an example, after its first value discovery uptrend, which lasted round seven weeks, BTC moved inside its re-accumulation vary for about ten weeks. Then, it transitioned into the primary Value Discovery Correction, recording a nine-week draw back deviation beneath the vary lows earlier than breaking out and rallying previous the vary highs towards a brand new ATH final month.

Its previous performances urged that BTC was able to enter its second Value Discovery Uptrend. However as Rekt Capital detailed, a transitional interval has occurred for the primary time, with value consolidating across the re-accumulation vary excessive space.

In line with the analyst, that is “maybe the primary time that we’re seeing a deviation happen beneath the vary excessive,” making this space an important degree to transition into a brand new uptrend.

We by no means actually needed to pull again considerably, perhaps, till that closing corrective interval, which might final a number of months, however every re-accumulation vary would see fairly a little bit of upside, and that upside can be very fast and no actual post-breakout retesting, no actual pausing. What we’re seeing right here is one thing very, very totally different.

Weekly Shut Key For BTC’s Future

Primarily based on its new transition interval, the important thing degree for Bitcoin to reclaim within the weekly timeframe is the $104,400 assist, which it held for almost seven weeks earlier than the latest pullbacks. This degree was misplaced after BTC closed final week beneath it and “mustn’t grow to be a resistance degree.”

To the analyst, it’s key that this week’s shut solidifies the worth restoration as it will place the cryptocurrency for a retest and affirmation of $104,400 as assist and proceed the construct the bottom round this space to transition into the following multi-week Value Discovery Uptrend.

Rekt Capital added that the timeline for BTC’s subsequent uptrend will rely upon the size of the brand new transitional interval. Nonetheless, he believes that it’ll take “a bit longer” to interrupt out.

Associated Studying

Moreover, he urged that what comes after the upcoming uptrend will even rely upon how lengthy it takes, because it may result in an prolonged cycle or a prolongation of this part, which may push the cycle peak into deeper levels of 2025.

Nonetheless, the analyst affirmed that it’s essential that the following corrective interval, which may see Bitcoin drop between 25% to 33%, is brief to probably take pleasure in a 3rd Value Discovery Uptrend earlier than the bear market.

As of this writing, BTC is buying and selling at $107,555, a 3.2% improve within the weekly timeframe.

Featured Picture from Unsplash.com, Chart from TradingView.com