- COIN inventory hit a brand new 52-week excessive at $369.25, nearing its document 2021 shut, with good points of 133% since April pushed by Bitcoin’s rally and robust income development.

- Q1 income jumped 24.2% year-over-year to $2.03B, led by a 36.3% rise in subscription and providers revenue, particularly from stablecoins.

- Coinbase’s partnership with Circle and its prime spot within the VanEck MVDAPP index reinforce its main place within the crypto equities house.

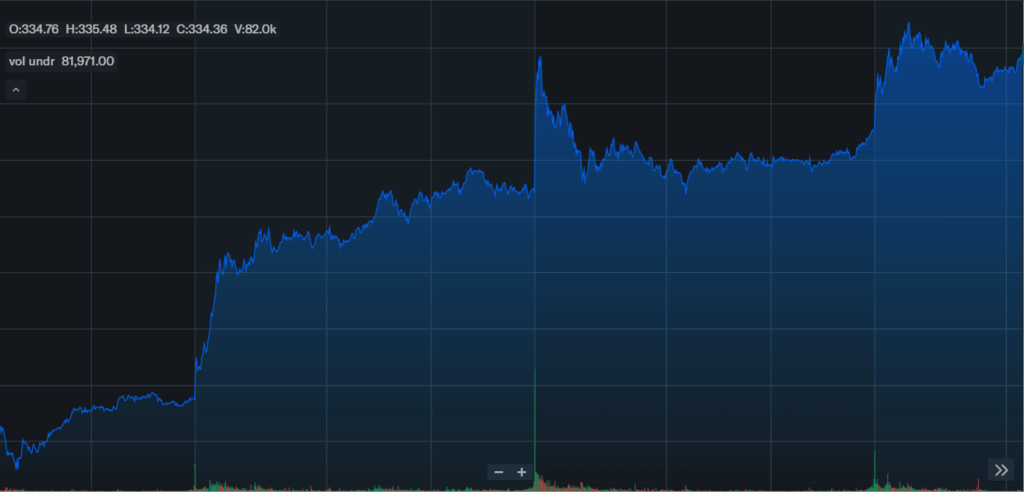

Coinbase inventory (COIN) continued its robust ascent on Wednesday, climbing as a lot as 7.1% in early buying and selling to hit $369.25—its highest worth prior to now 52 weeks. Whereas it later pulled again barely to commerce close to $352, the transfer locations it inside 2% of its all-time document shut from November 2021, which stood at $357.39. The surge displays renewed momentum throughout the crypto business, fueled by Bitcoin’s rally and improved sentiment in digital belongings.

Momentum Fueled by Bitcoin and Trade Tailwinds

COIN has gained an eye-popping 133% since its April backside, which adopted a market-wide dip triggered by President Trump’s shock “Liberation Day” tariffs. The inventory has additionally added over 42% in 2025 alone, using the wave of surging Bitcoin costs, pro-crypto regulatory indicators within the U.S., and rising service-based revenues. In Q1, Coinbase posted a 24.2% year-over-year income bump to $2.03 billion, with subscription and providers revenue leaping 36.3% to $698.1 million—thanks principally to its increasing stablecoin enterprise.

Partnership With Circle Provides Gas to the Rally

Coinbase can be gaining traction from its ongoing partnership with Circle Web Group, the issuer of the USDC stablecoin. Circle’s current IPO was a blockbuster, debuting at $31 and capturing as much as over $200 per share. Coinbase, which holds an fairness stake in Circle, is a significant participant within the USDC ecosystem, which has helped reinforce investor confidence. Although Circle briefly took the highest spot in VanEck’s MVDAPP index, which tracks prime crypto shares, Coinbase has since reclaimed its place as the biggest element.

What It Means for Buyers

With a market cap nearing $90 billion, Coinbase is now firmly established as essentially the most priceless crypto-native public firm. Its upward trajectory displays not simply optimism about crypto, but additionally its strengthening fundamentals and strategic partnerships. Nevertheless, continued success might depend upon the tempo of Bitcoin’s development, evolving rules, and the way properly Coinbase can preserve service income momentum amid rising competitors.