The thought of the colloquial “American Dream” is perhaps due for an improve after BeInCrypto reported housing credit within the US contemplating Bitcoin-backed mortgages.

Whereas homeownership has lengthy outlined monetary success within the US, a rising motion led by crypto heavyweights says that even proudly owning 0.1 Bitcoin (BTC) would possibly quickly surpass that milestone.

Binance’s CZ Says 0.1 BTC Might One Day Outvalue a Home

Changpeng Zhao (CZ), founder and former CEO of the Binance trade, steered that proudly owning simply 0.1 BTC, value $10,679 as of this writing, might at some point be value greater than a home within the US.

“The present American Dream is to personal a house. The long run American Dream can be to personal 0.1 BTC, which can be greater than the worth of a home within the US,” the Binance govt shared in a submit.

CZ was reacting to a submit by William J. Pulte, a US housing coverage official and crypto advocate, who introduced crypto inclusion as an asset for a mortgage software.

In accordance with CZ, that is nice to see, with Bitcoin now counting as an asset when making use of for a mortgage within the US.

Pulte is the director of the US Federal Housing Finance Company (FHFA), which oversees main entities corresponding to Fannie Mae, Freddie Mac, and the Federal House Mortgage Banks.

The choice marks a elementary shift in US monetary coverage. Enacting this coverage, notably concerning Bitcoin, enhances the pioneer crypto’s recognition amongst high-net-worth buyers. Extra intently, it legitimizes crypto as a monetary asset in federal housing coverage.

“Once I purchased a home final 12 months, I supplied a portfolio abstract from DeBank as proof of funds. No financial institution would settle for such a doc however realtors will settle for the doc for money gives,” one consumer revealed.

This aligns with a broader pattern of digital belongings gaining mainstream legitimacy in monetary infrastructure, together with Bitcoin ETFs (exchange-traded funds) and Ethereum counterparts.

Notably, Pulte additionally revealed regulatory momentum, ordering executives at Fannie Mae and Freddie Mae to supply regulatory adjustments. After a “productive assembly,” Pulte confirmed the addition of crypto to US mortgage qualification.

In the meantime, like CZ, MicroStrategy (now Technique) govt chair Michael Saylor sees the transfer as Bitcoin’s foray into the American Dream.

Saylor has lengthy seen Bitcoin as a long-term retailer of worth. This newest improvement cements that imaginative and prescient, tying Bitcoin to the foundational points of middle-class life corresponding to homeownership.

In a latest US Crypto Information publication, BeInCrypto reported Saylor providing MicroStrategy’s Bitcoin Credit score framework to calculate credit score danger utilizing BTC worth volatility and mortgage period, amongst different components.

Bitwise’s Jeff Park Explains The Rise of the “Wholecoiner”

Elsewhere, Jeff Park says the American Dream is being redefined for youthful generations. In accordance with the portfolio supervisor at Bitwise, changing into a “wholecoiner” (proudly owning 1 full BTC) is changing suburban homeownership as an emblem of monetary independence for Millennials and Gen Z.

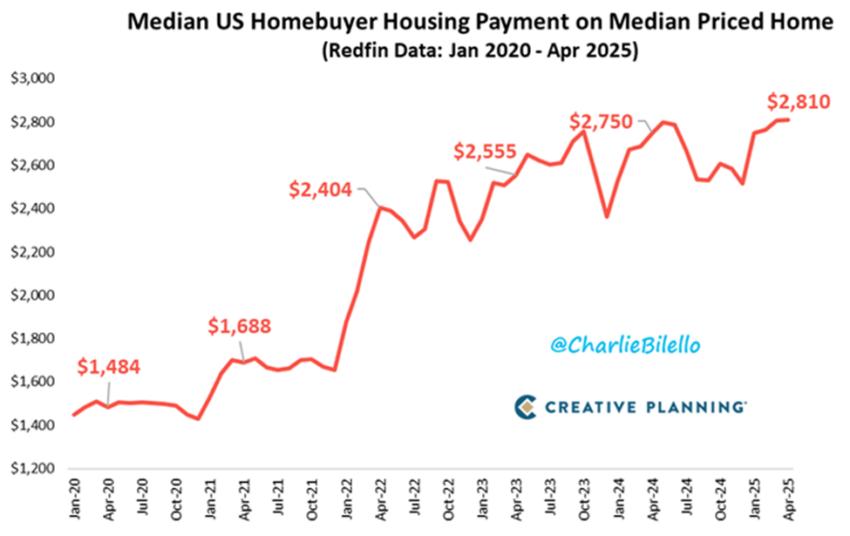

With US residence costs hovering, weighing closely on youthful Individuals, the dream of proudly owning property is slipping away.

Equally, scholar debt is a problem, with experiences suggesting excessive unemployment charges even for college students graduating from top-of-the-line establishments.

In the meantime, Bitcoin, buying and selling at $106,796 as of this writing, represents another grounded in shortage, autonomy, and international entry. A report from Jumper Be taught echoes this sentiment.

“Proudly owning one Bitcoin is seen as a milestone akin to homeownership in earlier generations, anchored to not land however to sound cash and digital autonomy,” learn an excerpt within the weblog.

The coverage shift displays a broader cultural transformation. As digital natives prioritize flexibility, decentralization, and sovereignty, Bitcoin goes past being simply an asset and progressively changing into a way of life anchor.

As Saylor, CZ, and Pulte, amongst others, converge round this narrative, Bitcoin turns into a benchmark of aspiration. The fashionable American Dream might quickly be measured in satoshis, not sq. footage.

Disclaimer

In adherence to the Belief Undertaking tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nonetheless, readers are suggested to confirm information independently and seek the advice of with an expert earlier than making any choices based mostly on this content material. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.