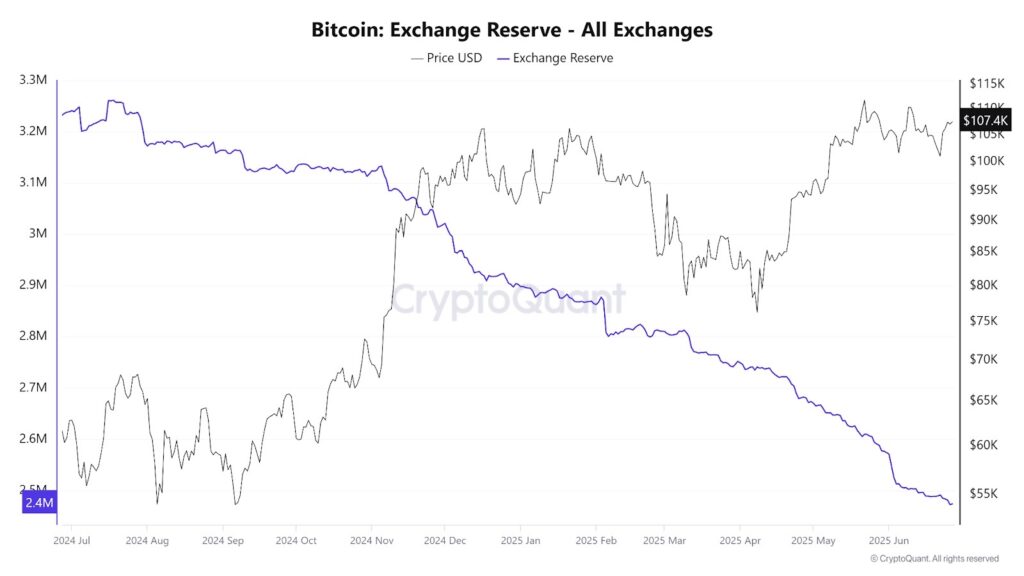

On June 26, CNBC highlighted a notable shift in Bitcoin’s on-chain dynamics: buyers holding Bitcoin for at the least 155 days are easing up on their HODL methods and beginning to promote. This alteration from the sometimes affected person group comes as spot Bitcoin ETFs proceed to draw capital at an unprecedented tempo.

This publication is sponsored. CryptoDnes doesn’t endorse and isn’t liable for the content material, accuracy, high quality, promoting, merchandise, or different supplies on this web page.

Why does this matter? When whales determine to appreciate beneficial properties, they will considerably affect market sentiment and even counteract the impression of institutional inflows. With this tug-of-war between profit-taking and contemporary demand, merchants are asking: what’s the neatest play? Welcome to your information to one of the best crypto to purchase now.

Bitcoin Possession Shifts as Whales Promote, Forcing Dealer Adaptation

Bitcoin ETFs proceed to attract sturdy curiosity, marking 12 straight days of contemporary inflows. Traders added $548 million throughout 5 main funds yesterday, with BlackRock’s IBIT main the best way, pulling in $340 million. Constancy’s FBTC and Ark’s ARKB adopted intently, with $115 million and $70 million, respectively.

Regardless of regular institutional demand, Bitcoin’s value stays surprisingly sluggish, sparking debate and elevating considerations about custody practices. The inflow of funds shouldn’t be pushing the worth greater as anticipated, triggering hypothesis throughout the market.

Huge ETF shopping for, totaling $4 billion this month, contrasts sharply with Bitcoin’s modest 3% acquire. The important thing issue seems to be the presence of main sellers, with knowledge from CryptoQuant indicating that ‘whales,’ possible Chinese language miners, are offloading their holdings, offsetting the ETF purchases.

This shift in market dynamics reveals a big pattern: giant holders (with 1,000+ BTC) are promoting, whereas institutional ETFs and firms are shopping for. Retail buyers with beneath 1 BTC are additionally promoting, although their actions now have much less impression. Merchants might start turning to extra advanced choices or Bitcoin inventory proxies in response to this altering market panorama.

Bitcoin Worth Evaluation

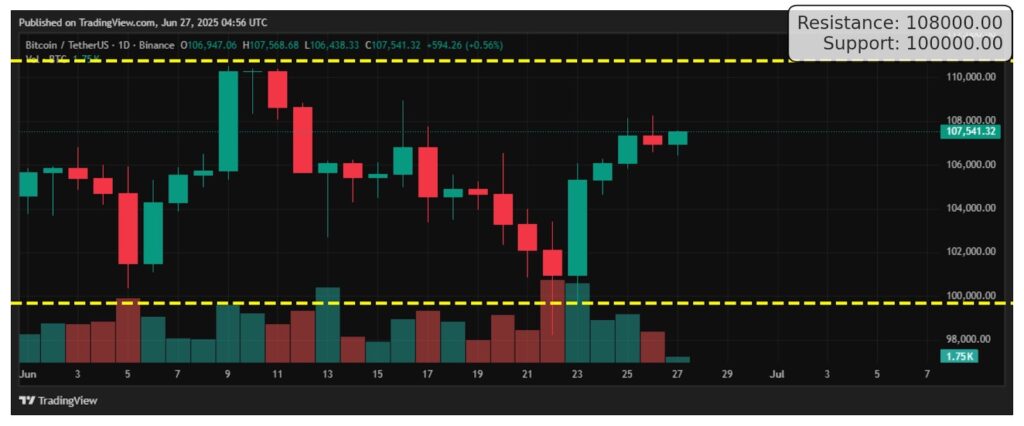

The Bitcoin every day chart reveals two key ranges: resistance at $108,000 and assist at $100,000. The worth is at present stalling close to the $108K resistance, which aligns with highs from earlier in June, suggesting that sellers are stepping in round this stage. Then again, the $100K assist zone has beforehand acted as a security web, with patrons stepping in to defend the worth, as seen in the course of the sharp bounce on June 23.

After bouncing strongly off the $100K assist, BTC has progressively climbed again up. The sequence of inexperienced candles and rising quantity recommend bullish momentum. Nevertheless, the repeated rejection close to the $108K resistance raises warning. If Bitcoin can break by means of this stage with sturdy quantity, it may sign a bullish breakout. In any other case, we might even see consolidation or a pullback towards the assist stage.

This sample resembles a rounded base or cup-like formation, the place the worth drops, recovers, and exams earlier highs, usually indicating accumulation earlier than a possible breakout.

Block Range, a crypto analyst on X, stories that Bitcoin is at present range-bound between $106K and $108K, with heavy liquidations going down.

$BTC full evaluation

– nonetheless in vary and $108k is stage to flip

– Dominance is excessive, wants to interrupt down beneath 64% for alts for any acquire

– Heatmap, totally loaded with longs from $106.4k and shorts from $108.6kAbstract: vary sure 106k-108k, lots of liquidations. $BTC ATH… pic.twitter.com/nYIAJvsDwH

— Block_Diversity v.8 ™️ (@i_bot404) June 26, 2025

Finest Crypto to Purchase Now

As long-term holders trim positions and ETFs maintain their foot on the gasoline, the market is splitting into two camps: strategic accumulation versus profit-taking. This divide units the stage for focused alternatives in tokens that thrive on each institutional momentum and on-chain fundamentals. Let’s minimize by means of the noise and nil in on one of the best crypto to purchase now.

Bitcoin Hyper

Using the ETF wave, Bitcoin Hyper makes use of yield-generating methods on Bitcoin positions. As establishments enter and whales exit, the token’s compounding mechanism may benefit from each inflows and spot-funding arbitrage.

Bitcoin Hyper has shortly gained consideration as a groundbreaking crypto venture, introducing main improvements to the area. As the primary Layer-2 answer for Bitcoin, it goals to overtake the community and tackle its key limitations.

By dashing up transactions and lowering charges, Bitcoin Hyper affords a extra environment friendly different for on a regular basis purchases. Its answer connects to Bitcoin’s predominant chain by way of a decentralized bridge, combining Bitcoin’s safety with Solana’s quick transaction speeds.

Utilizing the SVM, Bitcoin Hyper ensures a seamless expertise, permitting customers to lock BTC, mint wrapped tokens, and luxuriate in sooner, low-cost transactions. Zero-knowledge proofs keep safety and integrity whereas enabling excessive throughput.

After customers are completed, they will burn wrapped tokens and get better native BTC by way of the trustless bridge. HYPER token is on the heart of this method, facilitating transactions, staking, governance, and community incentives.

Bitcoin Hyper seeks to unlock progressive use circumstances for Bitcoin, equivalent to lending, buying and selling, and good contracts, with out compromising the decentralization and safety which are the founding ideas of the Bitcoin community.

BTC Bull

When whales money out, volatility will increase, and BTC Bull is designed to capitalize on that motion. Its momentum-driven construction makes it an excellent alternative for merchants seeking to acquire amplified publicity to Bitcoin’s fluctuations.

BTC Bull has raised $7.3 million in its presale, positioning itself as a primary token for Bitcoin maximalists who imagine Bitcoin can exchange fiat. Holders are additionally rewarded as Bitcoin hits key milestones.

When Bitcoin hits $125k, $175k, and $225k, BTCBULL tokens shall be burned. At $150k and $200k, Bitcoin airdrops will set off, and at $250k, a BTCBULL airdrop will distribute 10% of the tokens to the neighborhood.

The token’s mascot, a soldier-clad bull, symbolizes the resilience required in investing. Past milestone rewards, customers may stake their BTCBULL tokens for added advantages.

To take part and earn rewards, customers want a decentralized (DeFi) pockets, with the group recommending Finest Pockets, a non-KYC possibility accessible on iOS and Android.

Finest Pockets Token

As custody questions swirl, Finest Pockets Token affords on-chain governance and enhanced security measures. This crypto bridges institutional belief and retail usability, positioning it to profit when giant holders and newcomers alike demand safer storage options.

Finest Pockets Token launched in 2024 and has already raised over $13.5 million in its presale. With a rising function set and enticing early incentives, it’s shortly turning into a well-liked alternative amongst merchants.

Aimed toward each crypto professionals and newcomers, Finest Pockets is a non-custodial cell pockets constructed for ease of use. It helps over 60 blockchains, permitting customers to handle a variety of property in a single place.

On the core of Finest Pockets is Multi-Celebration Computation (MPC) know-how, which ensures top-tier safety with out the necessity for a protracted seed phrase. It’s like a vault that requires a number of keys to open, providing sturdy safety.

Being a non-custodial pockets, Finest Pockets supplies customers with full management of their personal keys and cryptocurrencies, with the end result that it’s a good possibility for privacy-focused customers. The appliance has been engineered to make the customers masters of their funds.

One of many highlights is the “Upcoming Tokens” tab, during which customers can discover promising preliminary initiatives earlier than they launch. Finest Pockets’s BEST token serves because the pivot of the ecosystem, fueling charges, governance, and particular perks.

BEST token holders get decreased transaction prices, elevated staking advantages, and precedence entry to verified token gross sales. Additionally a part of the plan is a staking aggregator for improved yields and upcoming Finest Card for spending cryptocurrencies with cashback rewards.

ClayBro, a outstanding determine within the crypto YouTube neighborhood, forecasts that 2026 might be a significant 12 months for Finest Pockets.

Conclusion

The tug-of-war between profit-taking long-term holders and regular ETF inflows highlights a turning level in Bitcoin’s maturation. Whereas whales are cashing in, institutional demand stays sturdy, and this twin pressure may maintain markets risky but stuffed with selective alternatives.

Traders who concentrate on tokens that provide each yield methods and safe custody stand to profit because the panorama evolves. Keep attentive to how these dynamics reshape on-chain flows and fund allocations, as timing is essential in risky markets. And bear in mind: one of the best crypto to purchase now.

This publication is sponsored. CryptoDnes doesn’t endorse and isn’t liable for the content material, accuracy, high quality, promoting, merchandise or different supplies on this web page. Readers ought to do their very own analysis earlier than taking any motion associated to cryptocurrencies. CryptoDnes shall not be liable, instantly or not directly, for any injury or loss precipitated or alleged to be attributable to or in reference to use of or reliance on any content material, items or companies talked about.