- Whale-sized BTC inflows into Binance sign rising alternate exercise and strengthen BNB fundamentals

- On-chain information helps rising institutional presence and liquidity on Binance

- Analysts recommend BNB may get away of its present vary and shoot previous $900 if momentum continues

BNB appears to be gearing up for one more leg up—at the least, that’s what the info is whispering. As exercise heats up on Binance, the alternate’s native token is beginning to attract some critical consideration. And it’s not simply retail merchants leaping in; on-chain indicators present rising institutional motion and whale-sized BTC transfers which may simply be setting the stage for a bullish breakout.

One of many clearest indicators? A gentle circulate of Bitcoin into Binance, which isn’t nearly BTC itself—it’s a touch that the alternate is buzzing. With extra BTC floating into the platform, buying and selling ramps up, and naturally, BNB’s utility as a fee-reducing token places it proper within the highlight.

BTC Inflows Gasoline BNB Momentum

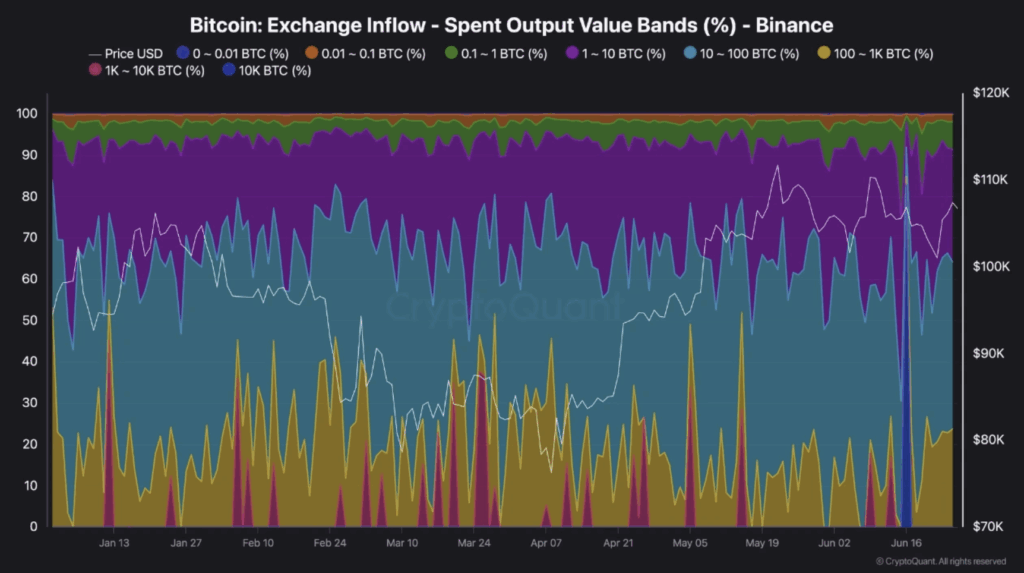

So right here’s the news: latest on-chain charts are displaying a spike in BTC inflows to Binance, particularly from large gamers. Whale-level transactions (assume 10,000 BTC and up) made up a whopping 83% of complete inflows on June sixteenth. That’s not your common crypto crowd.

Why does this matter for BNB? Nicely, extra quantity on Binance often means extra merchants utilizing BNB for reductions, funds, and staking. It’s like a series response. Extra BTC in → extra exercise → extra BNB utility → value stress upward. And contemplating that BSC transactions and pockets counts have been ticking up too, the entire ecosystem’s trying fairly alive proper now.

Binance Liquidity Wanting Sturdy

When capital pours into an alternate, liquidity will get a lift. And liquidity, of us, is like oxygen for merchants—it smooths out value motion, tightens spreads, and makes everybody slightly happier. Binance is clearly respiration simply high quality in the meanwhile.

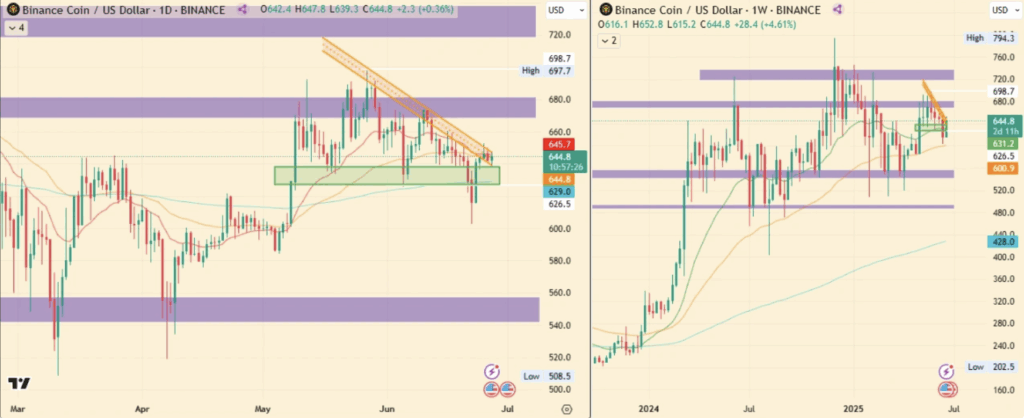

With elevated alternate flows, BNB isn’t simply using the wave—it’s serving to steer the ship. And this enhancing backdrop is what some analysts are eyeing after they toss out large targets. Some say $700’s the subsequent milestone, however others are already peeking previous that quantity, pointing to a $900 breakout zone if the appropriate catalysts kick in.

The $900 Query: Simply Hype or Actual Risk?

Let’s rewind for a second. BNB jumped from $202 to just about $800 final yr—spectacular, proper? However 2025 began slightly tough, with costs falling again to $510. That pullback would possibly’ve cooled some enthusiasm, however momentum has slowly been constructing once more. By the tip of Might, BNB hit $698 after which… went sideways for many of June.

Nonetheless, a breakout from this consolidation sample—particularly with the Maxwell arduous fork approaching June 30—might be the gasoline BNB wants. Analyst AltCryptoGems even talked about BNB’s long-term pattern pointing towards value discovery mode. And if that basically occurs? Yeah, we would simply see these $900 predictions come true.