- ETH surged from $2,111 to $2,515 in 2 weeks, pushing above key resistance ranges

- Constructive funding charges and a potential quick squeeze sign heavy hypothesis

- A spike in Binance inflows suggests huge gamers could also be getting ready for main strikes or exits

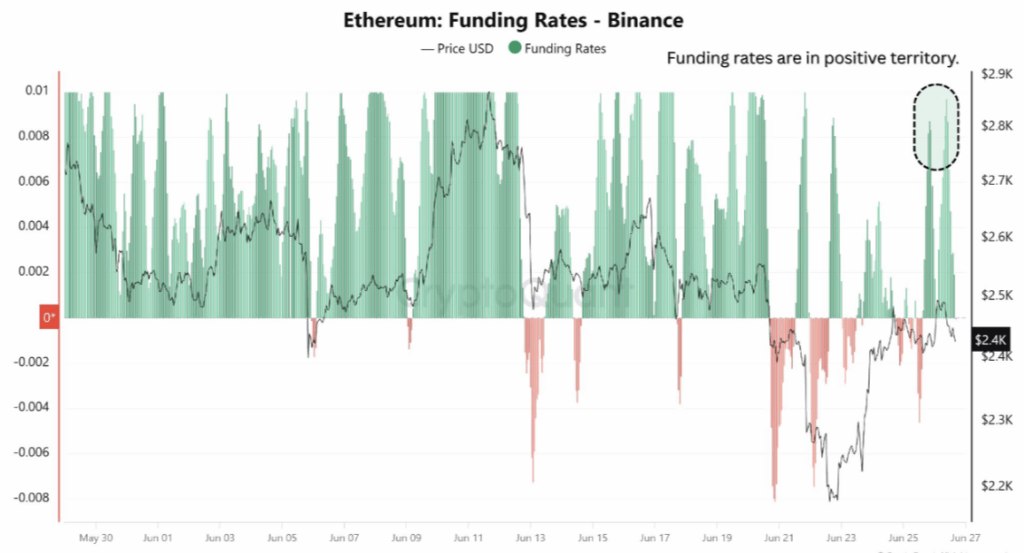

Ethereum’s been turning heads once more. Over the previous couple weeks, ETH has jumped from $2,111 to round $2,515, bringing that elusive $3,000 goal again into focus. It’s not simply worth motion that’s making waves—beneath the hood, market dynamics are shifting in an enormous method. Funding charges have flipped optimistic, Binance inflows are spiking, and a brief squeeze may’ve helped spark this rally. Feels just like the bulls are waking up—once more.

A Nearer Look: Funding Charges and Liquidation Traps

Based on analyst Amr Taha over at CryptoQuant, ETH’s breakout wasn’t some fluke—it had layers. The sudden flip from adverse to optimistic funding charges indicators that merchants are piling into lengthy positions, anticipating extra upside. However—right here’s the kicker—an excessive amount of bullish leverage can backfire. The truth is, CoinGlass knowledge reveals 68% of latest liquidations got here from lengthy positions. That’s a warning flag. If longs get too comfortable, a pointy drop might catch a variety of people off guard.

The latest retest of the $2,500 space? That zone is the place a earlier quick squeeze lit a fireplace underneath ETH. Shorts had been compelled to shut, shopping for again ETH in a panic—traditional squeeze mechanics. It’s the type of setup that may create explosive strikes, but in addition sudden snapbacks if momentum fades.

Binance Inflows and the Whale Shuffle

One other oddity: a hefty 177,000 ETH landed on Binance over simply three days. That type of on-chain transfer is often tied to main gamers reshuffling positions—typically it means promoting, typically it’s simply prepping for liquidity strikes. Both method, it provides rigidity. Huge ETH deposits on exchanges don’t occur by chance.

Taha says any such exercise—coupled with the worth flip above $2,500—suggests excessive speculative curiosity. However it’s not all sunshine. These are the sorts of indicators that may precede each additional surges or quick corrections.

What’s Subsequent? $2,800 or One other Dip?

On the technical facet, ETH simply fashioned a golden cross on the every day chart, a sample that’s often seen as a bullish omen. That’s bought some merchants whispering about $4,000 once more. However others, like analyst Crypto Wave, are a bit extra grounded. He thinks there’s nonetheless an actual likelihood ETH drops to the $1,700–$1,950 vary if it may possibly’t maintain momentum.

In the meanwhile, ETH is hovering round $2,429, down barely previously 24 hours. So we’re at a type of tipping factors—both a breakout towards $2,800 and past, or a pullback that exams dealer conviction.