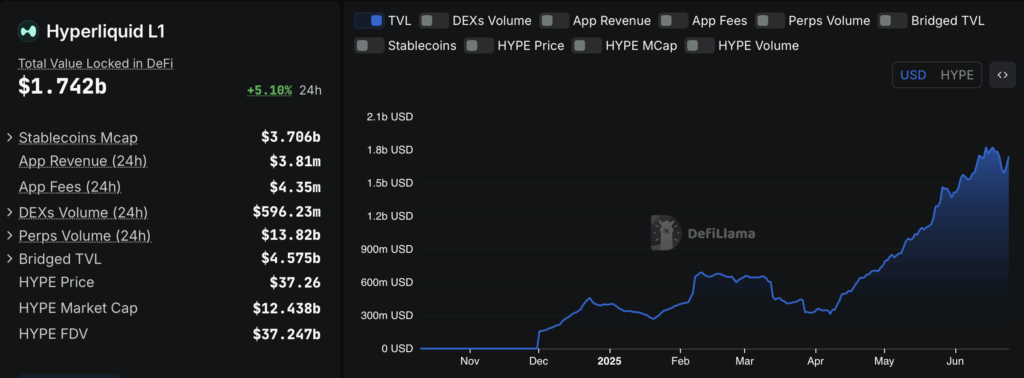

- Hyperliquid’s TVL jumped 80% since April, hitting $1.73B—signaling robust consumer adoption

- Value discovered a stable help zone close to $35, with merchants eyeing a possible breakout above $40

- If momentum holds, HYPE may check its all-time excessive and push towards the $50 mark

Hyperliquid’s making noise once more—quietly at first, however merchants are selecting up on the alerts. The token not too long ago cracked $36, and extra importantly, it’s carved out a stable help zone round $34. That may not sound like fireworks, nevertheless it’s received people feeling assured. It’s all occurring in sync with a broader DeFi revival, the place TVL throughout the house has surged 80% over the past three months. That’s not only a bounce—it’s a wave.

The renewed urge for food for decentralized finance has spilled over into property like Hyperliquid, which is driving that tailwind straight into heart stage. It’s not simply speculators both—on-chain metrics present significant exercise from customers staking and depositing. Principally, this isn’t simply hype—it’s sticky.

80% TVL Leap Places Hyperliquid on the DeFi Map

Since April, the whole worth locked (TVL) in Hyperliquid’s protocol ballooned from about $353 million to $1.73 billion, in accordance with DeFiLlama. That’s a wild 80% leap in simply three months. You don’t get that type of traction with out individuals actually believing in what the mission’s doing.

This type of TVL development normally factors to rising adoption and belief. Stakers are locking up funds, protocols are getting used, and the token’s utility begins exhibiting by means of worth motion. And yep, it’s all feeding again into investor sentiment—like a loop that’s beginning to construct momentum.

Holding the $35 Line—Might $50 Be Subsequent?

In the meanwhile, Hyperliquid is hovering round $36.01. It’s dipped about 1.9% within the final 24 hours, nevertheless it’s nonetheless up almost 5% over the week. The large quantity to observe? That $35.34 help degree. To this point, it’s held up, and if it continues to take action, analysts are eyeing a run towards the $40 mark.

If the bulls keep in cost, breaking previous $40 may unlock a dash towards $45.91—and presumably even $50 if quantity backs the transfer. On the flip facet, if the $35 degree offers method, issues may flip quick. However proper now, momentum’s trying fairly first rate.