Bitcoin is up 9% since final Sunday, displaying renewed energy because it approaches key resistance ranges. After weeks of uneven value motion and uncertainty, momentum is constructing throughout the crypto market. Merchants and analysts alike are carefully watching Bitcoin’s subsequent transfer, with many calling for a possible breakout above the all-time excessive. With bullish sentiment rising and liquidity returning to threat property, a decisive transfer might be imminent.

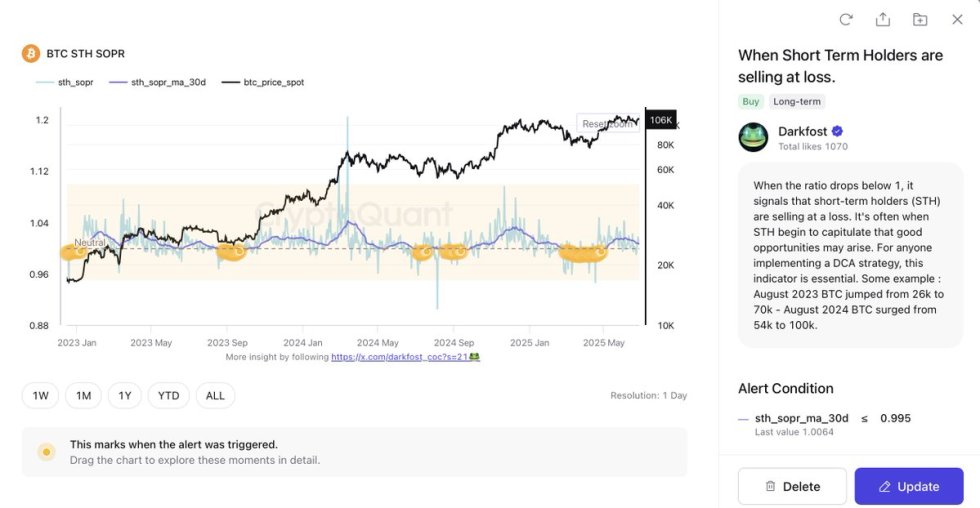

Supporting this outlook is a key on-chain sign highlighted by high analyst Darkfost. In keeping with his insights, the short-term holder (STH) realized value ratio lately dropped beneath 0.995—a stage that traditionally indicators STHs are capitulating and promoting at a loss. This habits usually emerges throughout native bottoms, typically presenting high-reward alternatives for long-term buyers. It’s these moments of weak spot that incessantly precede sturdy recoveries and upward tendencies.

As Bitcoin pushes increased, the broader market stays optimistic {that a} confirmed breakout might shift momentum throughout the altcoin sector as nicely. For now, the main focus stays on whether or not BTC can maintain present beneficial properties and break by resistance decisively. With sturdy fundamentals, rising institutional curiosity, and supportive on-chain information, Bitcoin’s subsequent main transfer could also be simply across the nook.

Bitcoin Faces Essential Take a look at As Market Awaits Subsequent Transfer

Bitcoin is as soon as once more at an important juncture, hovering between its all-time excessive of $112,000 and key assist at $105,000. Bulls are working to interrupt above resistance and spark the subsequent leg increased, whereas bears purpose to tug the worth beneath assist and shift momentum of their favor. This standoff has created a unstable and indecisive setting, with value swinging between these ranges for days. To this point, neither aspect has been in a position to set up dominance, leaving merchants on edge as the subsequent main transfer begins to take form.

Including to the broader market optimism is the US inventory market, which has simply reached a brand new all-time excessive. Many analysts see this as a number one indicator for crypto, suggesting that Bitcoin and altcoins might be subsequent in line to observe the rally. Liquidity situations are enhancing, and threat urge for food is returning, setting the stage for a possible breakout if Bitcoin can overcome resistance.

Darkfost lately shared a key on-chain sign supporting this outlook. In keeping with his evaluation, the Brief-Time period Holder Spent Output Revenue Ratio (STH SOPR) has dropped beneath 0.995. Traditionally, this stage signifies that short-term holders are capitulating and promoting at a loss—a habits typically seen at native bottoms. When STHs exit in concern, it tends to clear the way in which for stronger fingers to build up, laying the groundwork for the subsequent leg up.

With bullish macro indicators and on-chain metrics aligning, Bitcoin’s present vary might quickly give method to a serious transfer. Whether or not that breakout occurs above $112K—or a breakdown beneath $105K—will decide the tone of the subsequent chapter on this market cycle. For now, all eyes stay on Bitcoin.

BTC Value Motion: Testing Key Resistance

Bitcoin is at the moment buying and selling at $107,321, consolidating slightly below the important $109,300 resistance stage. This zone has acted as a ceiling for over a month, with a number of failed makes an attempt to interrupt above. The most recent restoration from the $103,600 assist has been sturdy, with BTC reclaiming all key transferring averages—50 SMA ($105,774), 100 SMA ($105,866), and staying nicely above the 200 SMA ($97,046)—displaying a shift in short-term momentum towards the bulls.

The 12-hour chart shows a transparent sample of upper lows, indicating that consumers are stepping in with growing confidence. Nevertheless, the dearth of quantity throughout this newest push suggests hesitation, as merchants await a confirmed breakout earlier than totally committing. For Bitcoin to realize vital upside traction, it should shut a number of candles above $109,300, turning resistance into assist.

If bulls fail to interrupt above resistance quickly, the $105,000–$103,600 zone turns into the important space to carry. A breakdown beneath this vary might open the door for a deeper retracement towards the 200 SMA round $97,000. Till then, BTC stays in a neutral-to-bullish posture, with the market watching carefully for a decisive transfer that would form the subsequent leg of this cycle.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our workforce of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.