- Bonk bounced from $0.000013 to $0.00001480 as consumers surged again into the market.

- Derivatives knowledge reveals a bullish tilt, with Open Curiosity and quantity rising sharply.

- Momentum is powerful, however overbought indicators trace at both breakout or reversal forward.

Bonk (BONK) stunned a couple of of us by climbing off its latest ground round $0.000013 and tagging $0.00001480 earlier than easing off barely to $0.00001446. Nothing wild by itself—however paired with the surge in quantity (up a whopping 98.33% to $160.5 million), it’s onerous to not elevate an eyebrow.

So, is that this only a technical hiccup? Or perhaps… one thing greater brewing beneath?

Patrons Step Again Into the Ring

After getting knocked round by heavy promoting, Bonk’s consumers weren’t down for lengthy. Information from Coinalyze confirmed a robust return of demand—309 billion in purchase quantity in comparison with 182 billion bought on June 29. That left a wholesome Purchase-Promote Delta of +127 billion. Not refined. That form of imbalance screams renewed curiosity, perhaps even FOMO from dip-buyers.

In the meantime, Netflow turned adverse, clocking in at -765K. Meaning extra BONK was leaving exchanges than getting into—traditional signal of accumulation. It doesn’t assure a rally, but it surely certain doesn’t harm.

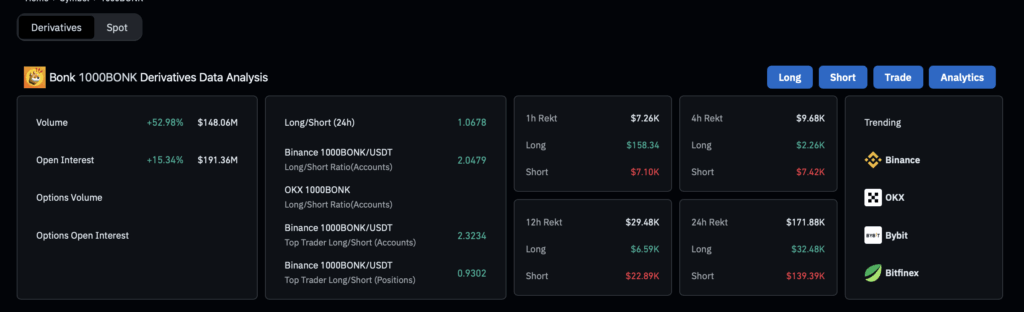

Derivatives Are Heating Up, Too

The futures market wasn’t asleep both. BONK’s Open Curiosity spiked 6.68% to $11.65 million, with buying and selling quantity in derivatives leaping 59.45% to $32.34 million. That form of enhance means one factor—merchants are exhibiting up. And based mostly on the Lengthy/Brief Ratio of 1.124, they’re largely betting on upside.

Whenever you pair rising Open Curiosity with a tilt towards longs, it normally indicators rising confidence. Not at all times a breakout… however positively individuals taking positions anticipating motion.

Momentum Builds—However So Do the Dangers

On the technical aspect, indicators are lighting up. The Stochastic RSI simply rocketed to 89, which is deep in overbought territory. That’s not inherently dangerous—robust traits have a tendency to remain overbought—but it surely additionally raises the potential for a fast pullback.

And with the Relative Vigor Index at -0.0332 however pointing up, it reveals that bullish vitality is there, however not screamingly robust but. If bulls push only a bit tougher, reclaiming the $0.000015 stage isn’t out of attain. However… hesitation or fatigue would possibly imply a fallback to $0.000013. Merchants might want to keep alert.