Cathie Wooden’s Ark Make investments has scaled again its publicity to Coinbase, promoting over $52 million in firm shares over two consecutive days final week.

The choice got here as Coinbase inventory soared to a brand new all-time excessive, pushed by bullish sentiment and rising institutional curiosity in crypto-linked equities.

Coinbase Leads S&P in June however Ark Make investments Reduces Publicity

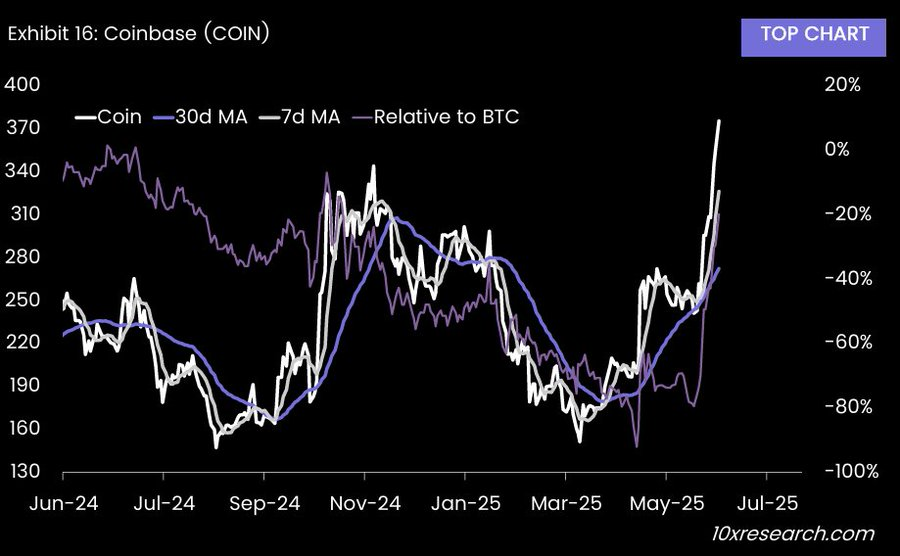

Buying and selling information signifies that Ark offered roughly $12.5 million price of Coinbase shares on June 26, adopted by a bigger $40 million sale the following day. The inventory rallied throughout that interval, reaching an intraday excessive of $382 earlier than closing the week at $353.

General, Coinbase has climbed 32% prior to now month and is up over 42% year-to-date. This makes it the best-performing inventory within the S&P 500 for June.

Market analysts attribute this rally to a number of elements akin to improved regulatory readability and continued product enlargement.

A significant increase got here final week when the US Senate handed the GENIUS stablecoin invoice, which is now awaiting a vote within the Home.

If enacted, the invoice might deliver long-awaited tips for the digital asset sector, doubtlessly lifting investor confidence in crypto-focused companies.

Past favorable regulation, Coinbase’s rising momentum can also be being fueled by upcoming product choices.

Analysts at 10x Analysis highlighted the platform’s plans to launch US-regulated perpetual futures for Bitcoin and Ethereum on July 21. Additionally they pointed to Coinbase’s robust ties with Circle and the rising use of USDC as catalysts for continued development.

Furthermore, Coinbase CEO Brian Armstrong additionally lately touted the agency’s institutional energy in an replace on the social media platform X.

He famous that eight of the highest ten publicly traded Bitcoin companies use Coinbase Prime. Moreover, $140 billion price of crypto is held in US-based ETFs, with Coinbase custody liable for 81% of that determine.

Nevertheless, regardless of the robust momentum, some analysts urge warning. 10x Analysis warned that present valuation ranges may be stretched within the quick time period.

“Our regression mannequin signifies that Coinbase is overvalued….regardless of the robust uptrend,” the analysts said.

Nonetheless, investor sentiment stays largely optimistic, particularly as Coinbase continues to form the dialog round crypto coverage in Washington.

TIME lately named the alternate certainly one of its 100 Most Influential Firms of 2025. The agency cited its advocacy for clearer guidelines within the digital asset sector and famous its continued enlargement plans.

“If industry-friendly payments are handed, Coinbase stands to turn into a fair larger hub for US crypto exercise,” the report said.

Disclaimer

In adherence to the Belief Challenge tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nevertheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any choices primarily based on this content material. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.