- A $1,010 XRP is mathematically doable—however realistically far-fetched except XRPL turns into the worldwide monetary rails.

- Collateral fashions give XRP extra achievable targets between $10 and $100, assuming XRPL helps sensible contracts.

- Primarily based on actual utilization and the NVT mannequin, XRP might rise to between $83 and $276 with excessive transaction volumes.

So right here’s the concept floating round: if the XRP Ledger (XRPL) ever grabbed simply 10% of the worldwide derivatives market, XRP’s worth might completely take off. We’re speaking—nicely, let’s simply say, numbers most people wouldn’t consider at first look.

Proper now, XRP’s been chillin’ across the $2 mark for what seems like ceaselessly. $2.18, to be precise. Not a ton of motion recently, however that hasn’t stopped analysts from calling it wildly undervalued. A variety of that optimism hinges on XRP’s function in cross-border funds… and now, probably, the huge $1 quadrillion derivatives market. Sounds massive? It’s. However how would that form of cash transfer the worth? Let’s stroll by way of it.

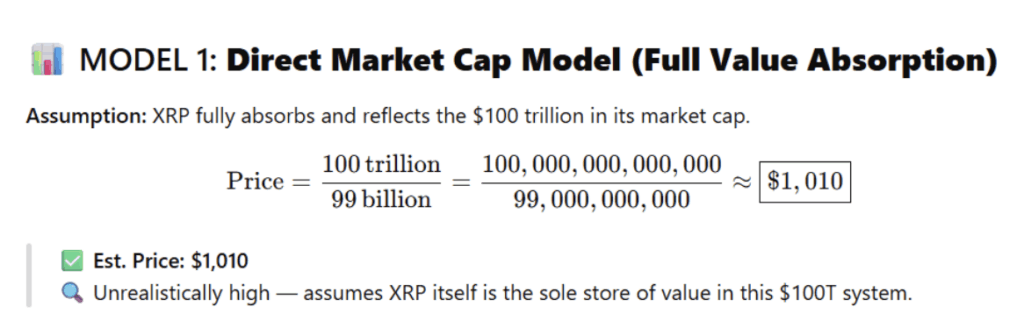

State of affairs 1: The $1,010 XRP Fantasy

Utilizing a straight-up market cap mannequin, the maths goes like this: divide $100 trillion (10% of the $1 quadrillion market) by XRP’s provide—round 99 billion tokens—and also you get a worth per coin of about $1,010. Yup, over a grand per XRP. However right here’s the factor. This assumes XRP turns into the worth for all these derivatives, which is… not how XRPL works. It’d mainly want to interchange each different system and turn into the worldwide monetary spine. Unlikely, not anytime quickly.

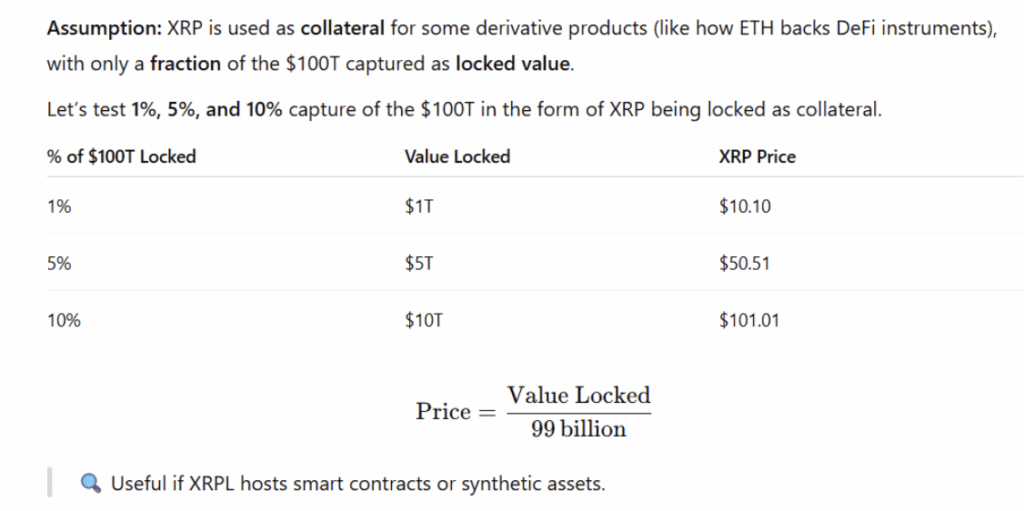

State of affairs 2: XRP as Collateral, Extra Lifelike

A way more grounded take includes utilizing XRP as collateral. Consider how Ethereum works in DeFi, proper? If XRPL supported sensible contracts and comparable setups, XRP wouldn’t must be the derivatives market—it’d simply again it. Now, if 1% of that $100 trillion (so, $1 trillion) was locked in XRP, we’d see the token hit about $10.10. If it’s 5%? That’s $50.51. At 10% locked up? Increase, we’re taking a look at $101.01 per coin. Not unhealthy, and far more plausible.

Ripple’s already enjoying with sensible contract tech, by the best way. If XRPL retains increasing its options, this path turns into much more viable.

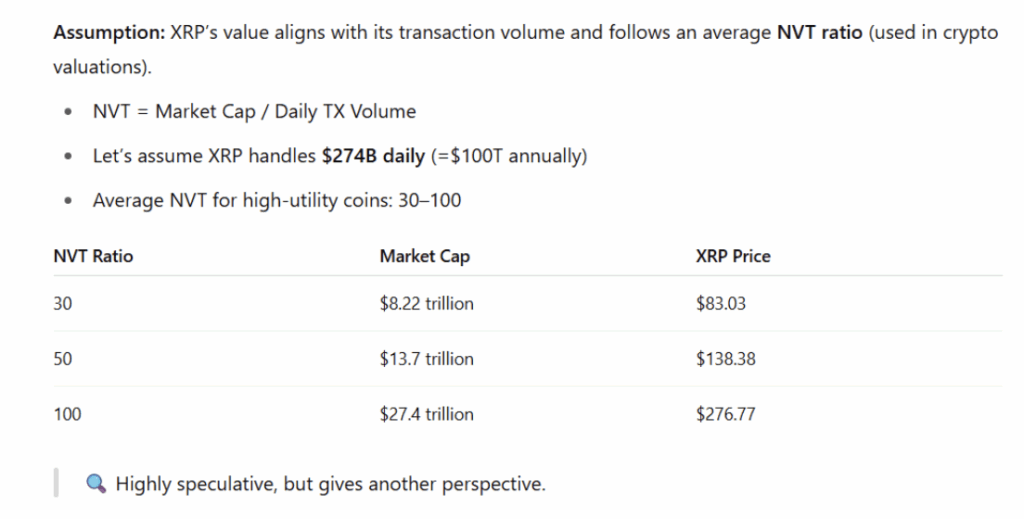

State of affairs 3: The NVT Ratio—A Transactional Take

Final mannequin? ChatGPT ran numbers utilizing the Community Worth to Transactions (NVT) ratio. That’s only a fancy means of measuring how effectively a blockchain turns utilization into worth. Let’s say XRPL processes $274 billion in day by day quantity—that provides as much as $100 trillion a yr. If XRP’s NVT ratio lands between 30 and 100, you’re taking a look at a market cap someplace between $8.2 trillion and $27.4 trillion.

What’s that imply for worth? Roughly $83 to $276 per XRP. Once more, not as eye-popping as the primary mannequin, but it surely’s nonetheless a monster return from immediately’s ranges. And it’s rooted in utilization, not fantasy.