Ethereum has entered a essential part in its transition to a stake-based mannequin, crossing a significant threshold with over 35 million ETH now locked in staking contracts.

This determine represents roughly 28.3% of Ethereum’s whole provide and is price greater than $84 billion at present market costs.

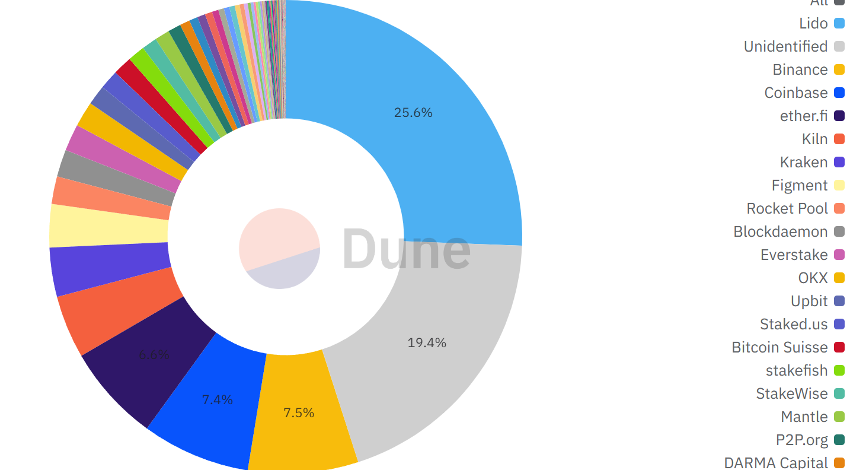

Lido, Binance, and Coinbase Dominate Ethereum Validator Energy

Blockchain analytics agency Sentora reviews that that is the best proportion of ETH ever staked. The agency acknowledged that the development accelerated in June when over 500,000 ETH had been staked inside the first half of the month.

This improve follows readability from the US Securities and Change Fee (SEC). The company’s Might steering has given institutional traders extra confidence in Ethereum’s staking prospects.

Consequently, giant traders, together with whales, have proven rising curiosity in ETH, opting to stake their holdings to realize extra publicity to the community’s long-term worth.

Regardless of the passion surrounding Ethereum’s staking progress, issues about its decentralization have emerged.

The highest three Ethereum stakers—Lido, Binance, and Coinbase—now management almost 40% of all validator balances.

Lido, a dominant liquid staking platform, holds roughly 8.7 million ETH, or 25% of all staked cash. In the meantime, the 2 main centralized exchanges, Binance and Coinbase, every handle round 7.5% of the staking market.

“A censorship or outage occasion affecting Lido, Binance, and Coinbase, would now hit >40% of latest blocks,” Sentora warned.

This focus of energy has reignited discussions about Ethereum’s decentralization mannequin. The dominance of some entities raises issues concerning the community’s future governance and liquidity.

In the meantime, the surge in staking exercise, coupled with round 19% of ETH locked in long-term holdings, is lowering the liquid provide out there for buying and selling.

Consequently, ETH’s float is approaching ranges not seen since earlier than the Merge, inflicting thinner order books and elevated market volatility. Furthermore, ETH spot markets are experiencing sharper worth swings, which is amplifying each rallies and corrections.

As well as, DeFi platforms are additionally feeling the squeeze. Sentora identified that borrowing charges for liquid staking tokens like stETH, rETH, and frxETH are rising.

Sentora famous that these tokens could really feel the pinch if their unit collateral grows scarcer. This might probably pressure the lending protocols to regulate their methods to accommodate the tightening market.

Disclaimer

In adherence to the Belief Undertaking pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nevertheless, readers are suggested to confirm information independently and seek the advice of with an expert earlier than making any choices based mostly on this content material. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.