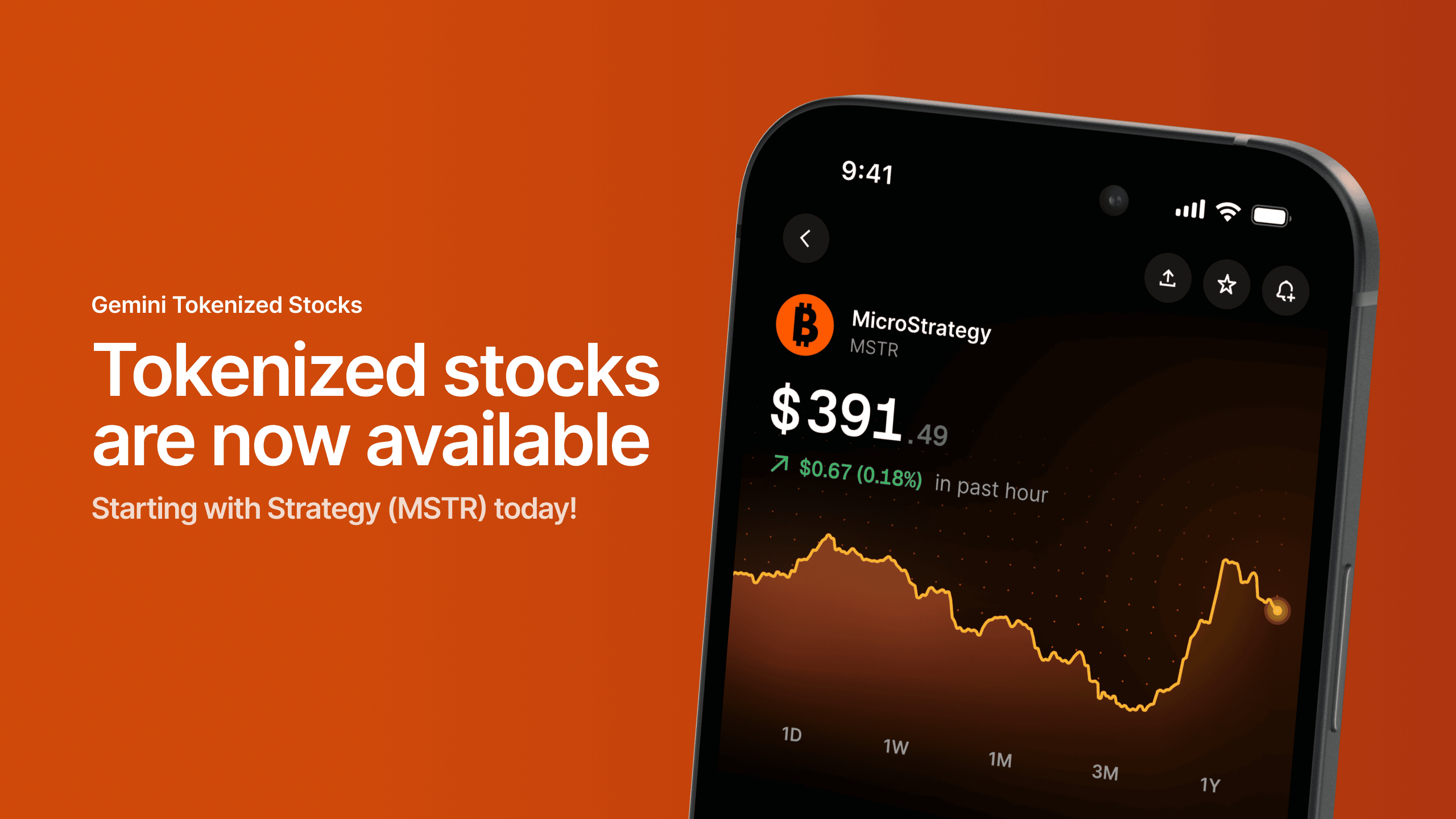

Cryptocurrency alternate Gemini has introduced the launch of tokenized MicroStrategy (MSTR) inventory for purchasers within the European Union, enabling onchain entry to probably the most outstanding Bitcoin-related equities.

The asset is now obtainable on the Arbitrum community, with help for extra blockchains on the way in which.

The providing permits international customers — anybody with a smartphone and web connection — to realize blockchain-based publicity to U.S. equities, beginning with MicroStrategy. Based on Gemini, the initiative marks a step towards merging conventional monetary property with the 24/7, decentralized infrastructure of crypto.

“That is the way forward for finance, and the longer term has arrived,” Gemini said in its official launch. “We’re beginning with MSTR and can roll out extra tokenized shares and ETFs within the coming days.”

Tokenized Shares Powered by Dinari

To convey this product to market, Gemini has partnered with Dinari, a frontrunner in tokenized U.S. securities. Dinari’s on-demand tokenization mannequin permits Gemini to supply token holders the identical financial rights because the underlying securities — together with dividends, the place permitted — together with elevated liquidity and transparency.

This new performance goals to democratize entry to U.S. equities, exporting shares of firms like MicroStrategy past conventional finance hubs and into the palms of retail customers worldwide.

International Enlargement Plans Underway

Gemini described the tokenized fairness push as a “win-win” for each the U.S. and international traders — a way of connecting the “biggest firms on planet earth” to “the folks of planet earth.” A full listing of supported jurisdictions is on the market on Gemini’s web site.

Because the platform expands, it plans to supply extra tokenized U.S. shares and ETFs, paving the way in which for broader integration between blockchain and international fairness markets.