- Bitcoin treasury companies threat coming into a “demise spiral” if BTC costs fall they usually lose MNAV premiums

- Most are equity-financed for now, softening the potential fallout from future declines

- Solely companies with daring management and powerful execution are anticipated to climate future bear markets

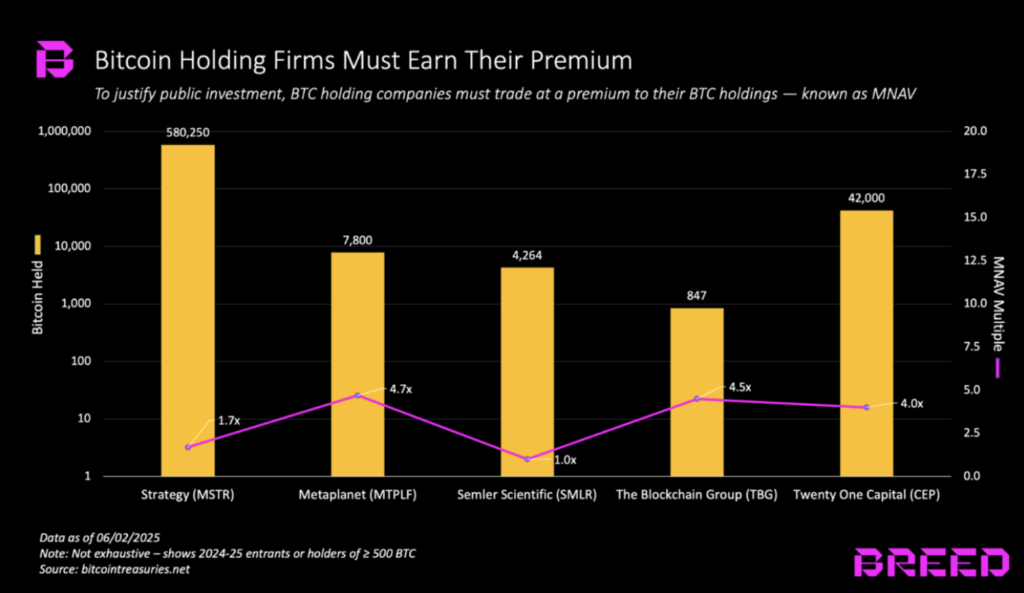

Seems, stacking Bitcoin on the stability sheet isn’t a free ticket to moon territory. In line with a brand new report from enterprise capital group Breed, most BTC treasury corporations—these companies holding Bitcoin as a core asset—is likely to be headed straight for a “demise spiral.” That’s very true for those buying and selling near their web asset worth (NAV), which mainly means their inventory value mirrors the worth of their holdings minus what they owe.

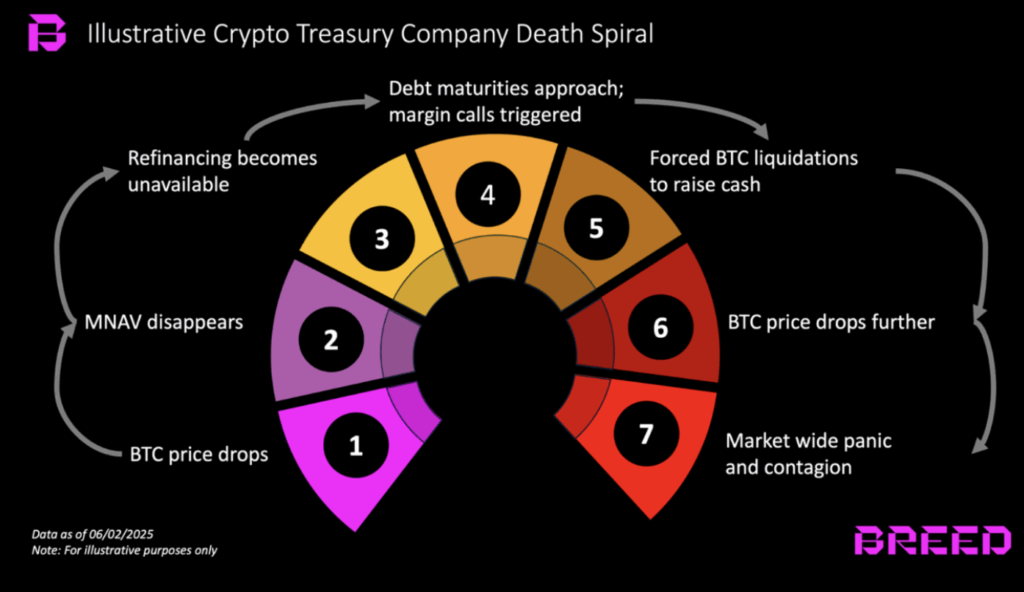

The true make-or-break issue? Their means to keep up one thing referred to as an MNAV—market cap a number of over web asset worth. With out it, properly… issues unravel quick. Breed outlines seven phases of decay, beginning when Bitcoin’s value drops, dragging MNAV down with it. All of the sudden, these corporations begin trying shaky to buyers, and entry to recent capital dries up.

When BTC Drops, the Spiral Begins

Right here’s the way it spirals: decrease MNAV makes it more durable to safe debt or elevate funds. As debt maturities shut in, companies get margin referred to as, they usually’re compelled to dump BTC into an already-weakened market. That promoting strain sinks BTC additional, and weaker companies both collapse or get scooped up by more healthy ones. The cycle may ripple out, even setting off the following bear market if issues get dangerous sufficient.

However Breed says it gained’t have an effect on everybody. Firms with visionary management, sharp execution, and intelligent methods may truly develop their Bitcoin per share by means of the chaos. These are the survivors. Everybody else? Is perhaps toast.

Fairness vs. Debt: The Cushion That Would possibly Save the Day

Right here’s the (considerably) excellent news: most of those treasury gamers aren’t playing with borrowed money—but. They’re financing BTC buys with fairness, not debt. That provides a buffer. If issues go south, there’s no margin name panic promoting. But when debt begins changing into the go-to possibility? That’s when the true mess may begin.

The authors of the report suppose equity-heavy methods will assist include any fallout, a minimum of for now. Nonetheless, that might shift rapidly if extra corporations determine to leverage up in hopes of juicing returns.

Treasury Pattern Took Off Due to Saylor

The entire concept of turning your stability sheet right into a Bitcoin vault? That actually kicked off when Michael Saylor’s firm, Technique (yep, that’s the identify), went all in again in 2020. His transfer sparked a broader wave of company Bitcoin adoption. Quick ahead to now: over 250 organizations—together with ETFs, pension funds, and even authorities outfits—are holding BTC, based on BitcoinTreasuries knowledge.

However identical to in each gold rush, just a few prospectors come out wealthy. The remaining? Nicely, they get worn out within the mud cloud.