High Tales of The Week

XRP spikes 3% after Garlinghouse says Ripple dropping SEC cross-appeal

XRP’s value jumped over 3% on Friday, simply hours after Ripple Labs CEO Brad Garlinghouse stated the corporate is dropping its cross-appeal towards the US Securities and Trade Fee (SEC) and expects the regulator to do the identical.

“Ripple is dropping our cross-appeal, and the SEC is predicted to drop their attraction, as they’ve beforehand stated,” Garlinghouse stated in an X put up on Friday. XRP, the cryptocurrency related to Ripple Labs, spiked 3.36% to $2.18 simply 5 hours after the put up, in response to CoinMarketCap knowledge.

“We’re closing this chapter as soon as and for all and specializing in what’s most essential – constructing the web of Worth. Lock in,” Garlinghouse added.

Anthony Pompliano’s crypto enterprise buys $386M in Bitcoin

Crypto entrepreneur Anthony Pompliano’s agency ProCap made its first Bitcoin buy simply days after revealing that it plans to go public later this 12 months.

The Bitcoin monetary providers agency, ProCap BTC, stated on Tuesday that it bought 3,724 Bitcoin (BTC) for $386 million. The funding is now value simply shy of $400 million at present market costs, because the asset has gained because the purchase.

The agency bought the belongings at a time-weighted common value of $103,785 per BTC. The purchase follows the ProCap’s announcement on Monday that it plans to go public by way of a merger with the blank-check firm Columbus Circle Capital to grow to be ProCap Monetary.

Coinbase claims ‘key function’ in Secret Service’s biggest-ever crypto seizure

Crypto change Coinbase says it performed a “key function” in supporting a US Secret Service investigation that resulted within the seizure of $225 million linked to crypto funding scams earlier this month.

On June 18, the Division of Justice filed to grab greater than $225 million in crypto recovered by the Secret Service that was allegedly stolen by on-line funding scammers, which Agent in Cost Shawn Bradstreet stated on the time was the most important cryptocurrency seizure within the company’s historical past.

Coinbase stated in a weblog put up on Tuesday that it joined a number of different exchanges in an “investigative dash” with the Secret Service in 2024 to establish rip-off victims, analyze chain flows and assist construct a case to grab the crypto.

Bitcoin treasury development is new altseason for crypto speculators: Adam Again

Bitcoin treasury adoption by public corporations has grow to be the brand new altcoin season for cryptocurrency speculators, Adam Again stated on Monday.

Bitcoin treasury season “is the brand new ALT SZN for speculators,” stated Again, co-founder and CEO of Blockstream and the inventor of Hashcash. “Time to dump ALTs into BTC or BTC treasuries,” he added.

Bitcoin treasury companies are shopping for BTC “on repeat to extend Bitcoin per share,” tapping into completely different funding strategies comparable to convertible notice choices to build up extra of the world’s first cryptocurrency, making them enticing for traders, Again defined.

FTX rejects 3AC’s $1.5B declare, citing ‘failed buying and selling technique’

Attorneys performing for the collapsed crypto change FTX have rebuked a $1.53 billion restoration declare from Three Arrows Capital’s (3AC) liquidators, arguing the losses resulted from a dangerous buying and selling technique that shouldn’t be paid for by collectors.

3AC liquidators initially filed a $120 million declare in FTX’s chapter case in June 2023 and expanded it to $1.53 billion in November 2024, alleging claims together with breach of contract, fiduciary responsibility and unjust enrichment.

The liquidators alleged FTX held $1.53 billion within the hedge fund’s belongings that have been liquidated to settle liabilities in 2022, contributing to 3AC’s collapse, arguing the transactions have been avoidable and FTX debtors had delayed offering the data that will have uncovered the liquidation.

Winners and Losers

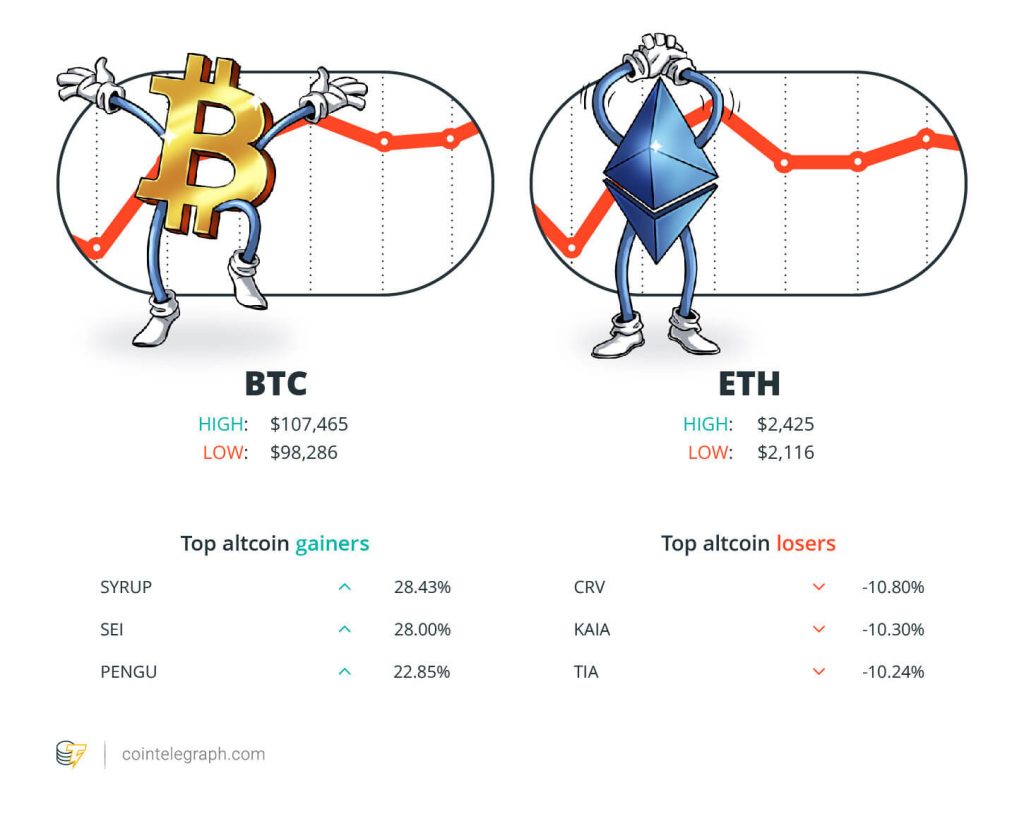

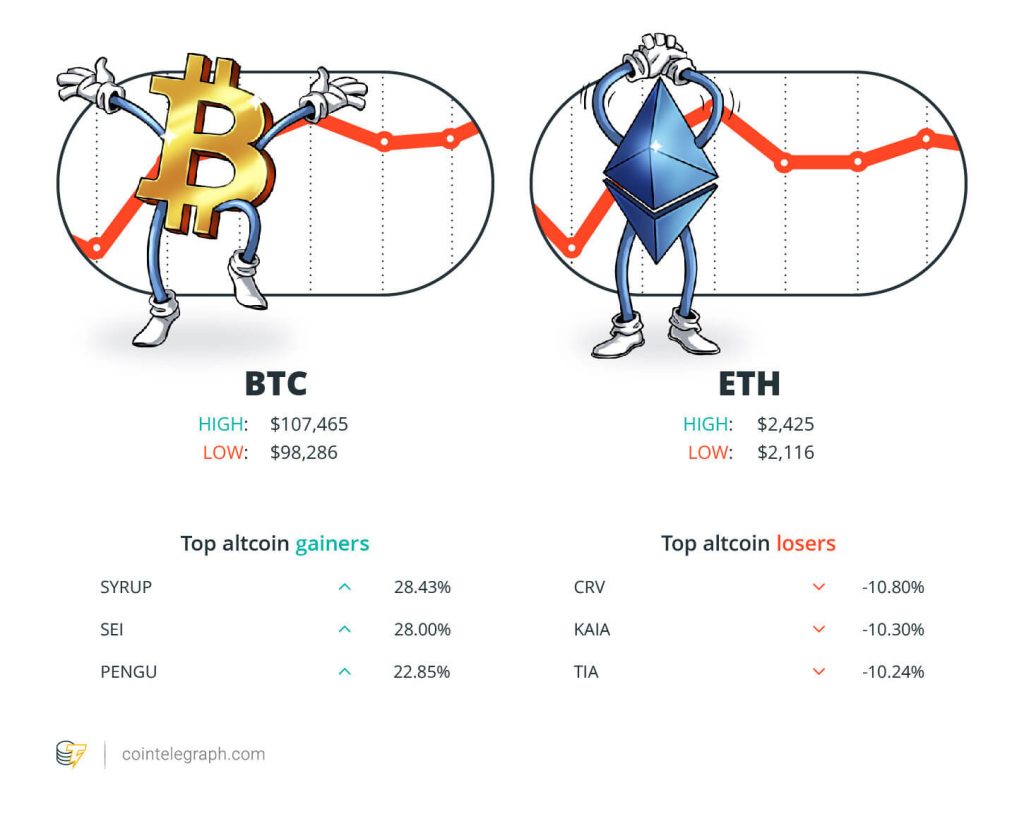

On the finish of the week, Bitcoin (BTC) is at $107,465, Ether (ETH) at $2,425 and XRP at $2.19. The entire market cap is at $3.29 trillion, in response to CoinMarketCap.

Among the many largest 100 cryptocurrencies, the highest three altcoin gainers of the week are Maple Finance (SYRUP) at 28.43%, Sei (SEI) at 28.00% and Pudgy Penguins (PENGU) at 22.85%.

The highest three altcoin losers of the week are Curve DAO Token (CRV) at 10.80%, Kaia (KAIA) at 10.30% and Celestia (TIA) at 10.24%. For more information on crypto costs, make certain to learn Cointelegraph’s market evaluation.

Most Memorable Quotations

“I consider there may be a few 91% probability of MSTR qualifying for the S&P 500 in Q2.”

Jeff Walton, monetary analyst

“Weekly view on $COIN seems to be very bullish, even whether it is due for a pullback.”

Andy Heilman, funding adviser

“We consider Bitcoin is the brand new hurdle price. For those who can’t beat it, it’s important to purchase it.”

Anthony Pompliano, crypto entrepreneur

“US inventory futures nearing all-time highs, fueled by geopolitical easing and Fed rate-cut expectations, are bolstering investor threat urge for food as Bitcoin’s current rebound elevated hypothesis of a brand new document excessive within the close to future.”

Nick Ruck, director at LVRG Analysis

“H1 2025 marks a pivotal shift in crypto hacking: escalating strategic intent from state actors and different geopolitically motivated teams.”

TRM Labs

“Stablecoins have vital shortcomings relating to selling the integrity of the financial system.”

The Financial institution for Worldwide Settlements

High Predictions of The Week

Bitcoin’s ‘bull pennant’ targets $165K as BTC change flows hit 10-year lows

Bitcoin value registered a weekly excessive of $108,200 on June 25 after a ten% rise from its native low at $98,400 three days prior. BTC has now reclaimed a key help degree as costs continued to consolidate under its $112,000 all-time excessive vary.

Learn additionally

Options

‘Normie degens’ go all in on sports activities fan crypto tokens for the rewards

Options

13 Christmas presents that Bitcoin and crypto degens will love

Can Bitcoin value rise over 50% within the subsequent few days?

Bitcoin rallied by 52% between April 8 and Might 22 to achieve an all-time excessive of $112,000. Since then, BTC value has oscillated between the all-time excessive and $100,000. The newest restoration from six-week lows under $100,000 means that the bulls are aggressively defending this degree.

“Bitcoin reclaimed the important thing help space,” stated well-liked pseudonymous crypto analyst Jelle in a Wednesday put up on X, including that the BTC is now again inside a pennant on the day by day chart.

A bull pennant is a continuation sample that happens after a big rise, adopted by a consolidation interval on the increased value finish of the vary.

High FUD of The Week

Faux IT insiders behind $1M in crypto losses throughout NFT protocols — ZachXBT

Hackers posing as legit data know-how (IT) staff who’ve infiltrated Web3 tasks have stolen roughly $1 million in crypto in the course of the previous week, in response to onchain investigator and cybersecurity analyst ZachXBT.

A number of entities have been impacted, together with Favrr, a Web3 fan-token market, non-fungible token (NFT) tasks Replicandy and ChainSaw, together with different groups the onchain sleuth didn’t identify in his Friday X put up.

The hackers exploited the minting mechanism for the NFT tasks, minting mass portions of NFTs, promoting them, and inflicting the value flooring to drop to zero whereas they extracted revenue, ZachXBT stated.

Anchorage ‘Security Matrix’ faces backlash over stablecoin delistings

Anchorage Digital is drawing criticism from not less than one stablecoin issuer after asserting plans to section out help for 3 stablecoins, citing “regulatory expectations” and inner threat evaluation.

Nick van Eck, co-founder and CEO of Agora, criticized Anchorage’s transfer to take away help for stablecoins USDC, Agora USD, and Standard USD in a Thursday X put up, claiming the choice was primarily based on “simply verifiable and identified factual inaccuracies.”

Learn additionally

Options

Crypto as a ‘public good’ within the twenty second century

Options

That is your mind on crypto: Substance abuse grows amongst crypto merchants

He stated that Anchorage did not disclose its relationship with stablecoin issuer Paxos, which may doubtlessly profit from the phasing out of tokens issued by different platforms.

‘Main bummer’ — Customers uncover Ledger is sunsetting the ‘OG’ Nano S

Customers throughout social media are dismayed after noticing Ledger, a significant supplier of {hardware} crypto wallets, introduced final month it was sunsetting help for the Nano S.

In its Spring replace on Might 30, Ledger stated it was transitioning away from the Ledger Nano S, and consequently, new functions, function submissions and app updates would not be accepted. One other discover urging customers to transition to a brand new system was printed in April.

The Nano S was launched in 2016, making some units near 10 years previous.

The pockets supplier additionally inspired customers to verify they’ve their 24-word Secret Restoration Phrase to keep up help.

High Journal Tales of The Week

GENIUS Act reopens the door for a Meta stablecoin, however will it work?

The GENIUS Act will enable Large Tech conglomerates like Meta to concern a stablecoin, however authorized consultants are debating whether or not it’ll work in observe.

North Korea crypto hackers faucet ChatGPT, Malaysia street cash siphoned: Asia Categorical

North Korean hackers sit again as ChatGPT helps them with crypto theft, crypto riches fuels Indian espionage, and extra.

Why being a Gen Z crypto founder is a ‘blessing and a curse’

From dorm-room all-nighters to multi-million greenback raises, these younger crypto founders are constructing the longer term — one “no” at time.

Subscribe

Probably the most partaking reads in blockchain. Delivered as soon as a

week.

Editorial Workers

Cointelegraph Journal writers and reporters contributed to this text.