- Sensible contract deployments and DEX quantity are rising whereas value stays flat—basic stealth accumulation indicators.

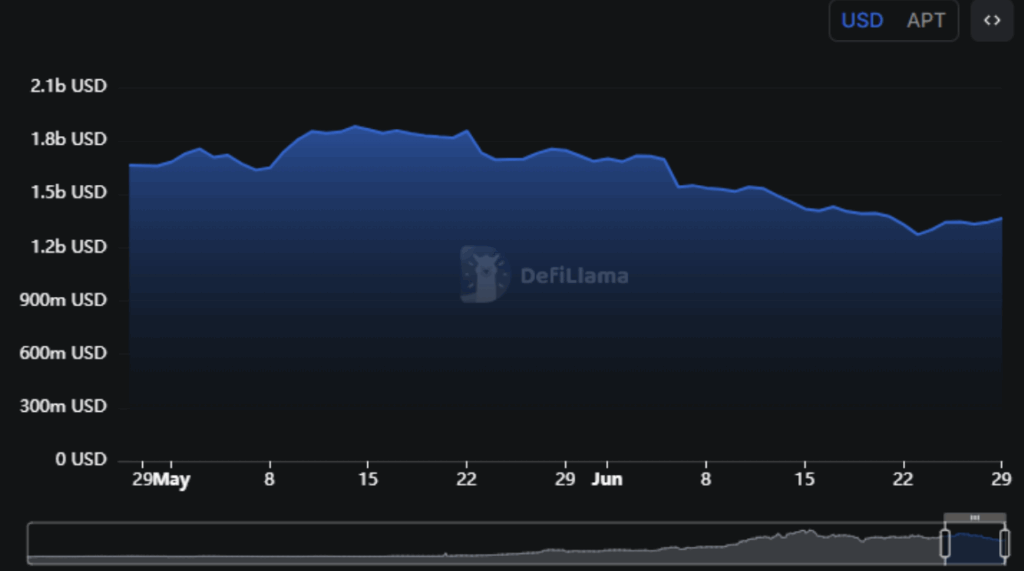

- $92M flowed into Aptos DeFi in beneath every week, lifting TVL to $1.365B.

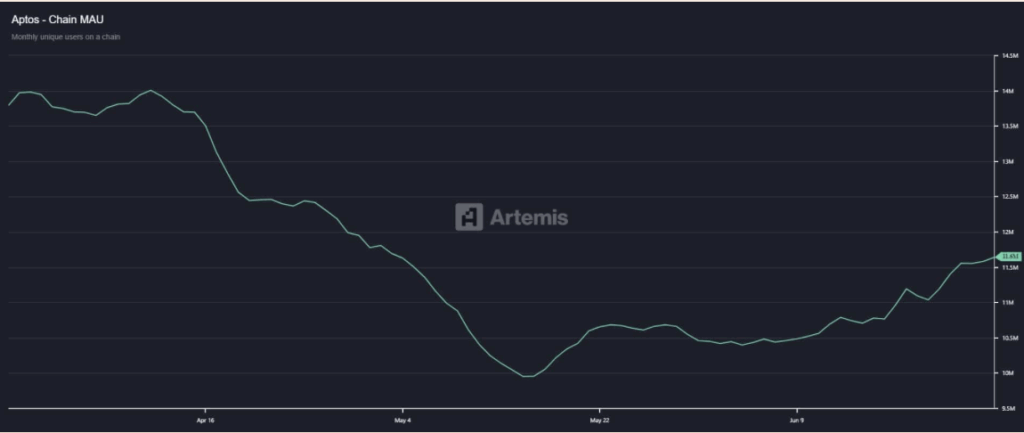

- Person exercise is again, with MAU and transactions each hitting multi-month highs—setting the stage for a possible breakout.

Aptos (APT) hasn’t precisely been thrilling to look at currently. Worth motion’s been dragging—gradual, sideways, and unable to interrupt previous the $0.48 wall. It’s the form of chart that makes you shrug and scroll on. However maintain up—there may be extra occurring right here than meets the attention.

Some behind-the-scenes indicators counsel a shift may be coming. Extra devs are constructing. Liquidity’s flowing in. And APT? It’s quietly getting busier.

Devs Are Again—Sensible Contracts Hit 30-Day Excessive

In accordance with Nansen, good contract exercise on Aptos simply spiked onerous. Previously 24 hours alone, over 1,200 contracts had been deployed—that’s the best one-day complete in a complete month. Not unhealthy for a sequence folks mentioned was quiet.

Why does this matter? As a result of when devs begin transport code once more, it often means one thing’s coming. New instruments, contemporary apps, no matter—it usually results in extra utilization. And extra utilization can imply, yep, extra demand for the token.

On-chain knowledge backs this up. There’s been a visual bump in exercise and—perhaps extra importantly—shopping for. Persons are scooping up APT once more.

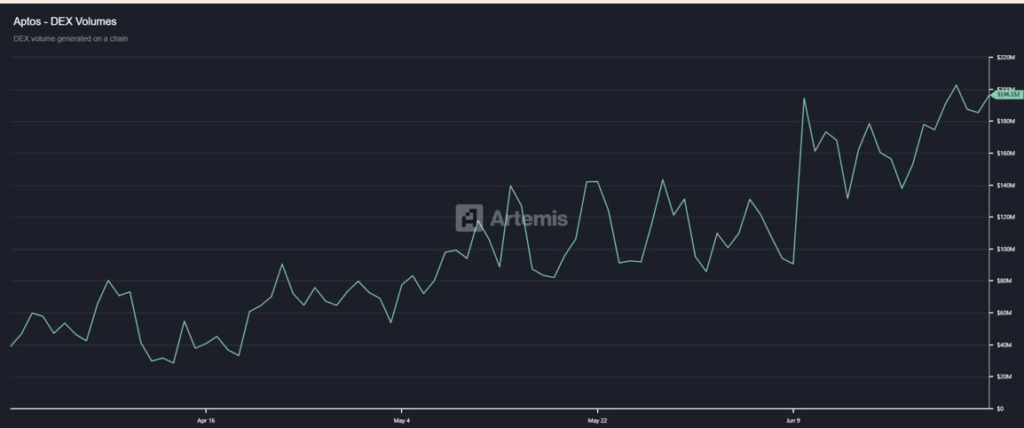

DEX Quantity Simply Missed $200M

Over on the buying and selling aspect, issues are heating up too. Artemis experiences that Decentralized Trade (DEX) quantity for APT surged to $196.1 million, simply shy of its June 24 peak of $202.6 million. That form of transfer in a gradual market? Undoubtedly not regular.

And get this—it’s occurring whereas value is flat. That’s usually what good of us name “stealth accumulation.” Principally: merchants aren’t promoting. They’re loading up whereas it’s quiet.

AMBCrypto identified comparable indicators. Rising liquidity and climbing TVL often counsel that curiosity is returning, even when value hasn’t caught up but.

Liquidity’s Flowing Again Into Aptos

Information from DeFiLlama exhibits Whole Worth Locked (TVL) on Aptos protocols jumped from $1.273B on June 23 to $1.365B by June 28. That’s a $92 million rise in lower than every week. Not large—however positively notable.

If that form of liquidity retains coming in—and DEX quantity holds up—it’s not loopy to assume APT may very well be gearing up for a breakout.

Person Development Is Again, Too

It’s not simply devs and whales. Common customers are trickling again in. Artemis knowledge confirmed Month-to-month Energetic Customers (MAU) hit 11.6 million—up from final month’s dip, and the best we’ve seen shortly.

In the meantime, Transaction Rely jumped to five.3 million, probably the most since February. That’s not simply HODLing—that’s folks utilizing the chain.

Put all of it collectively—extra customers, extra trades, extra constructing—and also you’ve acquired a community that’s quietly buzzing once more. If the development sticks, APT won’t keep caught for lengthy.