Bitcoin has been trying to interrupt above the essential $109,000 degree since final week however continues to face stiff resistance. Regardless of a number of intraday pushes, bulls have been unable to safe a decisive shut above this key zone, preserving the market in a state of suspense. Whereas BTC stays firmly above the psychological $100,000 mark, the longer it fails to reclaim $109K and transfer into worth discovery, the better the chance that bullish momentum might begin to fade.

For now, consumers are nonetheless holding sturdy, defending help ranges and preserving the uptrend construction intact. Nonetheless, with out a confirmed breakout, merchants have gotten more and more cautious. A clear transfer into new all-time highs would seemingly set off renewed capital inflows and broader market confidence, however till that occurs, Bitcoin stays at a crossroads.

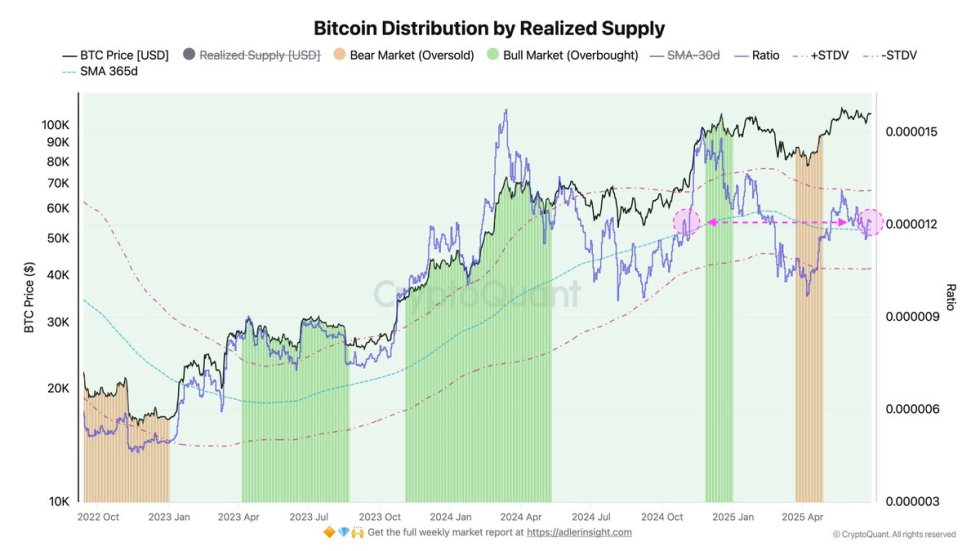

Supporting this unsure outlook is recent information from CryptoQuant, which exhibits that BTC is presently buying and selling simply above its annual Realized Value ratio degree. This implies that Bitcoin is neither considerably overbought nor oversold, putting the market in a impartial zone. Traditionally, such positioning has typically preceded main directional strikes, making the approaching days essential in figuring out whether or not BTC breaks larger or loses momentum.

Bitcoin Metrics Sign Market Neutrality

Bitcoin has been in a consolidation section since early Might, sustaining a agency place above the $100,000 degree regardless of a number of makes an attempt by bears to interrupt it. The one important dip under this psychological threshold occurred on June 22, and even then, BTC rapidly recovered inside hours. This resilience highlights the power of purchaser curiosity at six-figure ranges. Nonetheless, whereas bulls have efficiently defended help, they’ve been unable to push previous the essential $110,000 resistance, resulting in rising hypothesis {that a} correction could also be looming.

Including priceless context to this uncertainty, high analyst Axel Adler shared insights into the Bitcoin Distribution by Realized Provide metric—a instrument used to evaluate how costly BTC is relative to what buyers truly paid for it. Realized Provide calculates the overall greenback worth of all Bitcoin based mostly on the costs at which cash final moved, providing a extra grounded view of valuation.

The metric’s ratio, outlined as BTC Value / Realized Provide, features equally to the P/E ratio in equities. A excessive ratio can counsel overvaluation, whereas a low one implies potential undervaluation. At the moment, Bitcoin’s worth is simply barely above the annual ratio degree, placing it in a impartial valuation zone. Curiously, this is identical setup seen in November 2024, proper earlier than BTC surged from $74K to $107K.

This implies the market is neither overheated nor undervalued, positioning Bitcoin in a balanced zone the place main strikes might develop in both course. So long as BTC stays on this vary with out a clear breakout or breakdown, merchants ought to keep alert—this section may very well be the calm earlier than the subsequent large shift.

BTC Faces Rejection At $109K As Value Consolidates

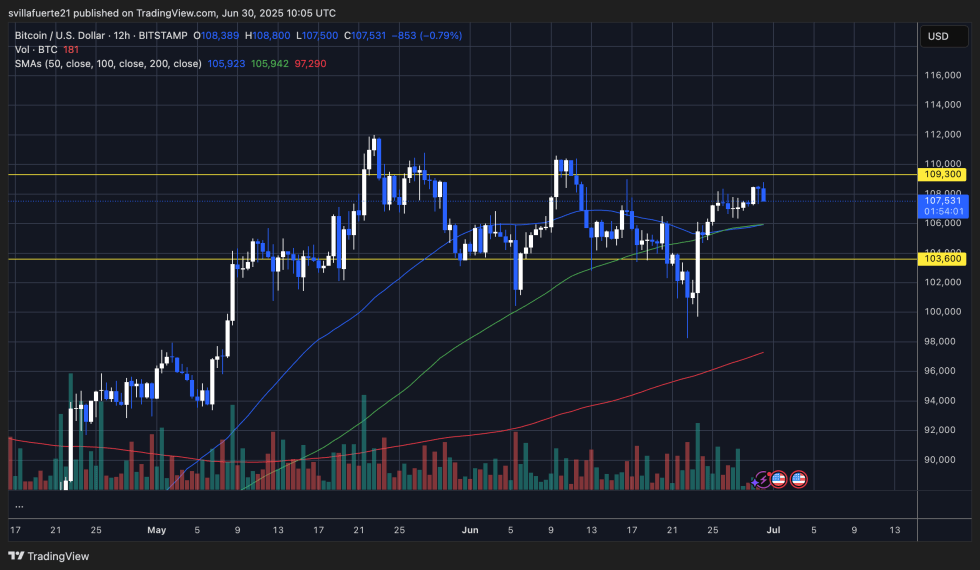

Bitcoin is presently buying and selling at $107,531 on the 12-hour chart, exhibiting indicators of consolidation slightly below the essential resistance zone at $109,300. This degree has acted as a ceiling for over a month, with a number of failed breakout makes an attempt. The newest rejection from this degree displays the continued battle between bulls and bears, as neither aspect has been capable of affirm a decisive transfer.

Regardless of the rejection, the general construction stays bullish. BTC continues to carry above all key shifting averages—50 SMA ($105,923), 100 SMA ($105,942), and 200 SMA ($97,290)—with the 50 and 100 SMAs converging as dynamic help across the $106K degree. This alignment favors bullish continuation if consumers can keep strain.

Quantity has but to indicate a convincing surge, indicating that merchants are nonetheless ready for affirmation earlier than totally committing to new positions. A powerful candle shut above $109,300 would seemingly set off upside momentum and shift BTC into worth discovery. On the flip aspect, a drop under $105,000 would put the $103,600 help in danger and open the door to a broader pullback.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our workforce of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.