- Over 210M HBAR moved in a single week—whales is likely to be accumulating whereas retail chills.

- HBAR fundamentals are strengthening, with actual use instances just like the $AUDD and dwell USDC assist.

- A rumored inexperienced ETF itemizing in late 2025 may push HBAR towards $0.50–$1.50 if momentum kicks in.

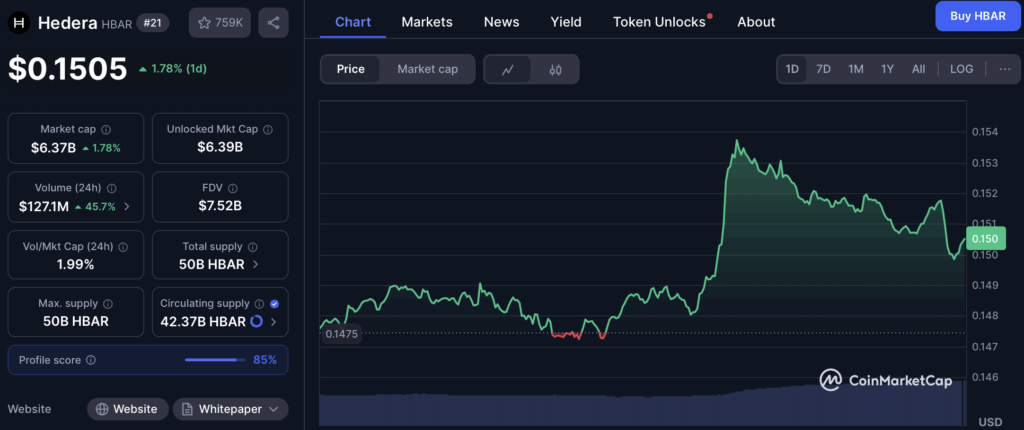

Hedera (HBAR) is beginning to buzz once more. Not loudly—however that’s kinda the purpose. Retail merchants are largely out of the image, chilling on the sidelines, whereas HBAR quietly builds momentum. Value-wise, it’s nonetheless method down from these 2021 glory days, sitting at round $0.1489. However recently? There’s been a bizarre mixture of low noise and excessive sign that’s received some folks paying consideration once more.

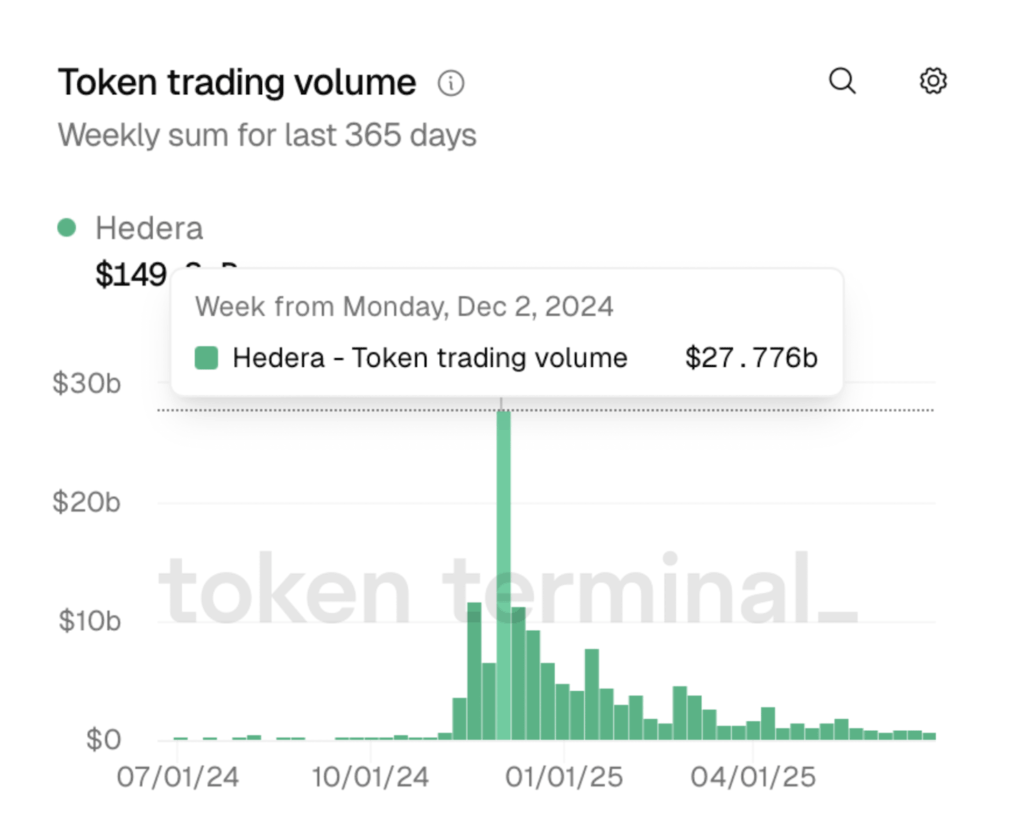

High analyst Steph_iscrypto identified one thing kinda wild—HBAR buying and selling quantity has tanked over 90% since December 2024. Sounds unhealthy on paper, however truthfully, that form of dip often means the vacationers have left. And when retail clears out? That’s typically when the whales get to work. Humorous sufficient, that’s precisely what appears to be taking place proper now.

Massive Transfers, Low Chatter—What’s Going On?

On June 28, greater than 210 million HBAR moved on-chain. That’s not chump change—roughly $16.8 million, simply flying below the radar. And that very same week? Somebody yanked 50 million HBAR off Coinbase. Chilly storage, possibly. In the meantime, one other 175 million tokens landed again right into a identified whale pockets. These aren’t retail-sized strikes. It’s giving “strategic accumulation.”

Whereas all that’s occurring, the basics are quietly stacking up. WSB Dealer Rocko reminded people that HBAR already pulled a 10x transfer earlier this yr—in simply 5 weeks. And the momentum? Nonetheless constructing, apparently.

Actual-World Stuff Truly Taking place

Then there’s the Australian Digital Greenback ($AUDD), which launched on Hedera. That’s a real-world foreign money utilizing their tech. USDC assist? Already dwell. Oh—and Hedera simply co-chaired a coverage roundtable in Washington D.C. with Chainlink and Oliver Wyman. They have been speaking digital cash, regulation, the long run—all that grown-up stuff crypto typically avoids.

And right here’s the place it will get much more fascinating: there’s buzz that HBAR may find yourself in a “inexperienced blockchain ETF” designed round low-energy, Web3 infrastructure. If that ETF drops later in 2025 like persons are anticipating… it may very well be a significant unlock for institutional capital. Quiet coin, loud implications.

What Occurs If the ETF Truly Lands?

We threw the query at GPT, and the numbers it crunched have been, properly, fairly eye-catching:

- If the ETF beneficial properties even slightly steam, HBAR may rip to $0.35–$0.50 short-term.

- If retail jumps again in and ETF quantity sticks? Could possibly be taking a look at $0.75–$1.00.

- And if it’s all techniques go—large staking, CBDC partnership, bull market vibes—then $1.50+ may not be that wild in spite of everything.

None of this can be a certain factor, in fact. That’s crypto. However the setup? Quiet accumulation, real-world use instances, under-the-radar authorities partnerships… it’s all there.

So yeah, HBAR may not be front-page information as we speak. However that might change—quick.